- Ethereum Classic price remains encased in a channel along May’s declining trend line.

- ETC 50-day simple moving average (SMA) holds price drift over the last three days.

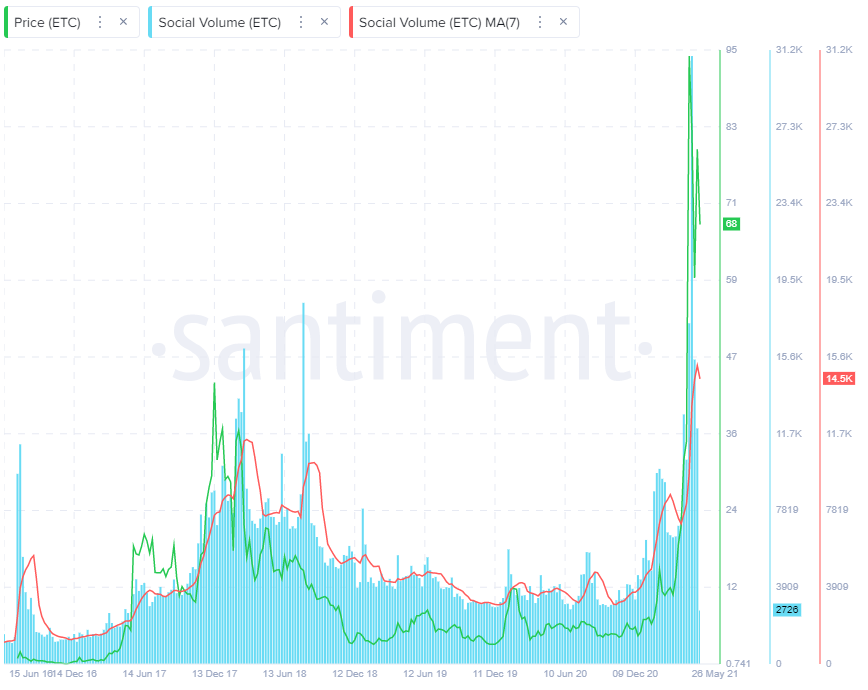

- Social volume remains elevated from a longer perspective and on a smoothed basis.

Ethereum Classic price closed last week with an inside week on the bar charts and a 27% gain after collapsing 45% the previous week. The ETC rebound did not introduce an overbought reading on any appropriate timeframe, indicating that the decline since May 26 is not the beginning of a new leg lower. Instead, it is a simple, quiet release of the price compression provoked by the series of sharp declines and rebounds the preceding days, placing the cryptocurrency in a timely position moving forward.

Ethereum Classic price steadies after an explosive month

From the May 6 high at $158.76 until the May 19 low, Ethereum price erased 75% of ETC value, including a drop of 55% at the May 19 low. The ETC volatility was an extraordinary reversal of fortune for investors. Before the correction, Ethereum Classic price had registered a 1,200% advance over the previous six weeks after breaking out from a symmetrical triangle at the beginning of April. Nevertheless, Ethereum Classic price is on pace to close May with an 85% gain.

A bullish outcome of the historic correction was removing the overbought readings on the daily and weekly Relative Strength Indexes (RSI). It positioned Ethereum Classic price to stage a meaningful rebound in a short period.

Ethereum Classic price made a statement on May 24, closing up 42%, the largest daily gain since May 2017. The sharp bounce could not overcome May’s declining trend line on a sustainable basis, and ETC fell into the current decline and within the boundaries of a descending channel.

A close above the junction of the 50 four-hour (SMA) at $69.41 and the channel’s upper trend line at $69.65 would spark a renewal of the bounce from the May 23 low, boosting Ethereum Classic price to the 200 four-hour SMA at $78.52. Once the critical moving average is disposed of, ETC will not face significant resistance until the confluence of the May 26 high at $84.08 and the 38.2% Fibonacci retracement of the May correction at $85.36.

If Ethereum Classic price extends the rally, ETC should rise to test the 50% retracement at $99.38 and the psychologically important $100.00, representing a 45% gain for the cheaper Ethereum.

Other resistance points of interest include the 61.8% retracement at $113.94, the all-time high at $158.76 and of course, the 361.8% extension of the 201-2019 correction at $161.33, offering a 140% profit for committed ETC investors.

LTC/USD 4-hour chart

A close below the channel’s lower trend line at $56.70 will sabotage the bullish narrative. Additional selling will not meet support until the 2018 high at $46.98. It would signify that Ethereum Classic price is building a more complex bottom or potentially pursuing a much deeper correction.

During the correction, there has been a sizeable contraction in social volume on a short-term basis, but from a larger perspective and on a smoothed basis, it remains at the highest level since 2016.

The Santiment social volume metric calculates the number of mentions of the coin on 1000+ crypto social media channels, including Telegram, crypto subreddits, discord groups and private traders chats.

ETC social volume

Ethereum Classic price had an incredible run in April and early May, lifting social media volume to historic highs. However, the sharp correction in May still hasn’t compressed the smoothed social volume metric (red) to past levels. It suggests that April-May’s type of price action that augments social volume will not be duplicated any time soon, so investors should be prepared for incremental rallies with extended periods of sideways price action.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.