Ethereum Classic Price Prediction: Scalpers aim lower, is the downtrend inevitable?

- Ethereum Classic price has dropped 3% on the day.

- Bears are setting up for a move toward $20.

- Invalidation of the bearish thesis would come from a break above $22.50.

Ethereum Classic price has caught a taste of bearish momentum in the market, potentially leading to a downswing. Still, the macro should be held in the back of traders' mind while they consider joining the bears.

Ethereum Classic shows room for a pullback

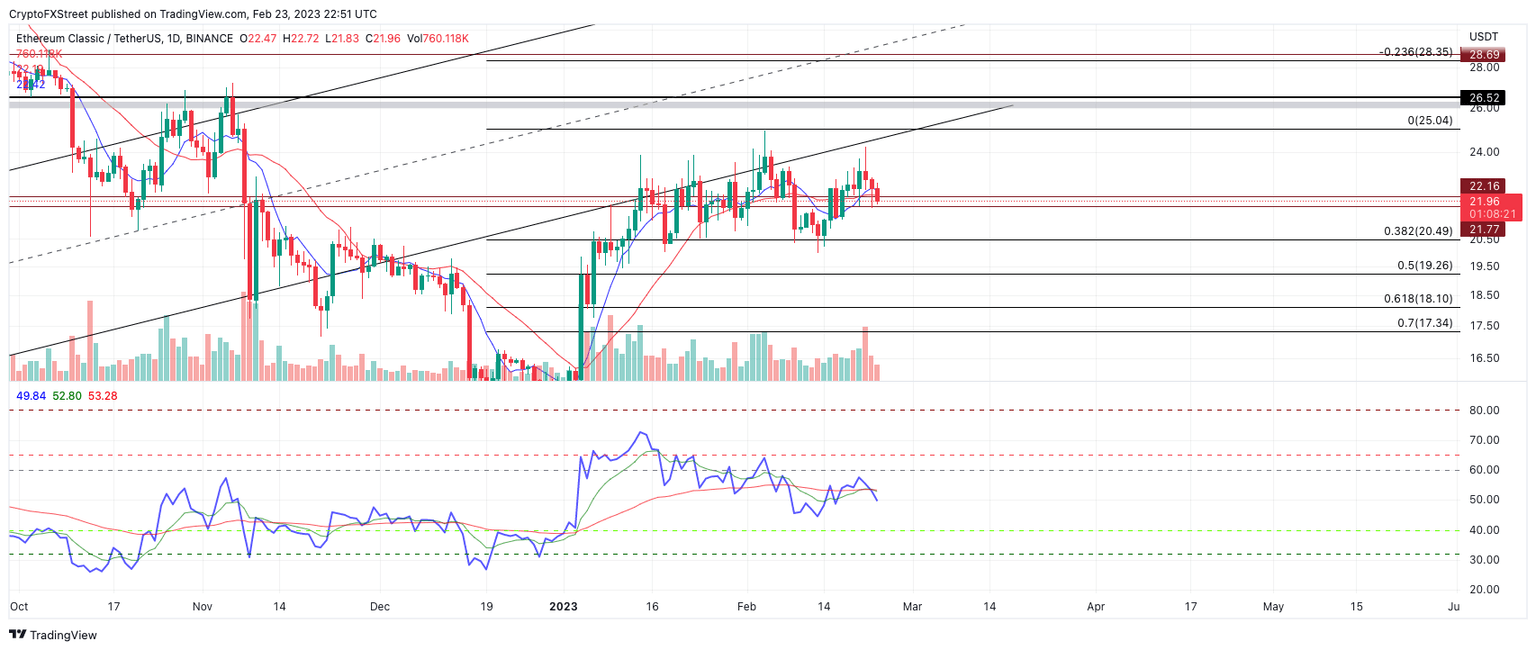

Ethereum Classic price is catching wind of a down storm as bears have produced a 3% decline on the day. At the time of writing, ETC is one hour away from producing a candlestick close beneath the 21-ay simple moving average at $22.15. If the bears succeed in producing the daily candlestick close beneath the barrier, the Ethereum Classic price would likely retest the $20.00 zone for the fourth time this winter.

Ethereum Classic price currently trades at $21.90. Still, the overall uptrend that is up 46% since January 1 has not produced a lower low, which would justifying calling an an early end to the winter rally. Thus, traders should continue to play the market for small short-term scalps while managing risk effectively.

A conservative bearish target in light of the technicals shows a potential to retest the $20 zone, creating room for a 9% downswing from ETC’s current market value.

ETC/USDT 1-Day Chart

Invalidation of the bearish thesis would come from a break above $22.50. If the breach occurs, traders can expect the winter uptrend to continue as bulls have liquidity levels near $26 that remain untagged from the 2022 Autumn sell-off.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.