Ethereum Classic Price Prediction: Is this the pullback we’ve been waiting for? pt.2

- Ethereum classic shows bearish uptick on the Voliume Profile Indicator hinting at a potential pullback.

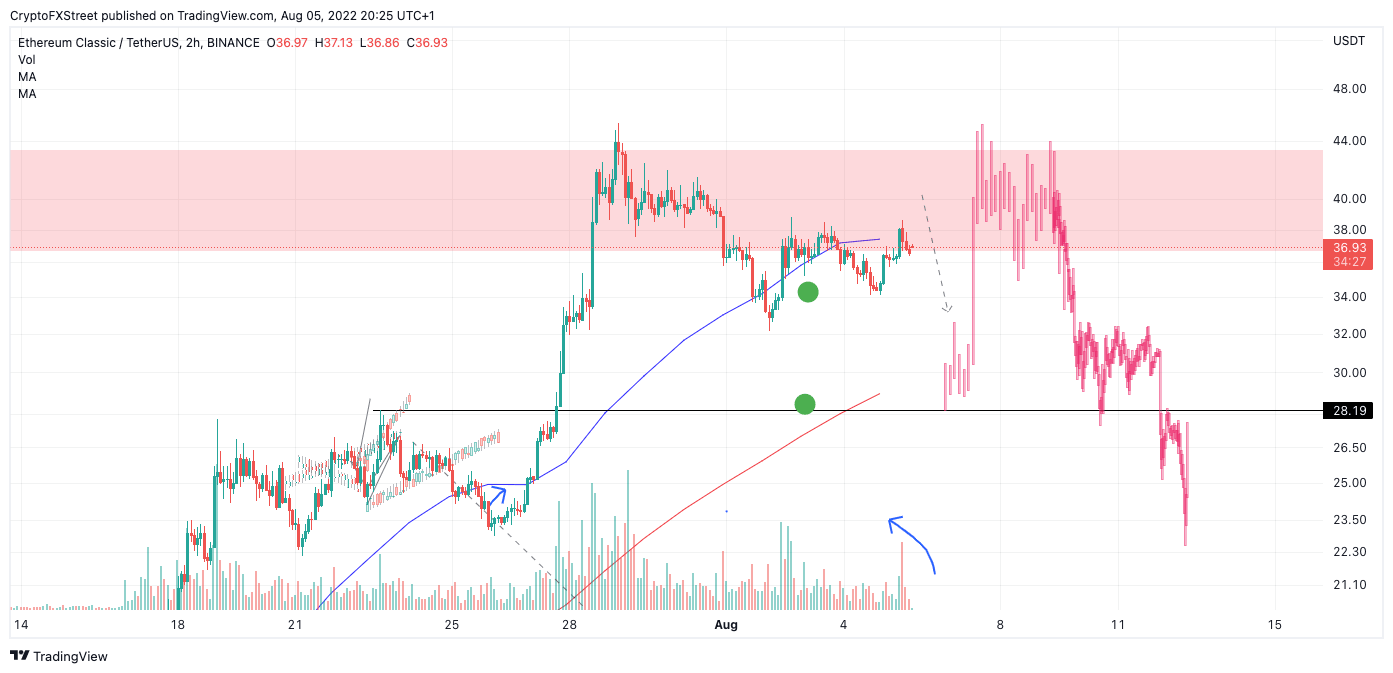

- ETC price points to one more impulse wave targeting a conservative $44. Extended targets lie in the 47 and $50 zone.

- Invalidaiton of the uptrend is a brech below $27,

Ethereum classic price points to higher targets. Still, defining an entry point as the weekend arrives will be exceptionally challenging.

Ethereum Classic price is challenging

Ethereum classic price shows reasons to believe in one more impulse wave up. Traders should be wary as they could be attempting to catch the last profitable opportunity as the technicals suggest the need for a final wave 5.

Ethereum Classic currently auctions at $36.85 as the Ethereum alternative token finds resistance at the 8-Day moving average. A potential to fall into $29 is highly probable as the volume profile indicator suggests an uptick in bearish volume on intra-hour time frames. A breach of the $30 barrier could be viewed as a potential knife catch scenario with bullish targets between $43 and $50. A 21-day moving average also lies in the safe vicinity of the potential $30 low.

ETC/USDT 2-Hour Chart

Invalidation of the bullish outlook would be a breach of $27. If the bears breach the invalidation point, they may be able to descend the price to $21, resulting in a 37% decrease from the current Ethereum Classic price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.