Ethereum Classic Price Prediction: ETC technicals hint at 15% descent

- Ethereum Classic price is on a slow uptrend that seems to be built on an unsafe foundation.

- Technicals suggest the incoming drop could knock ETC down by a minimum of 10%.

- If the bulls make a comeback, shatter the September 16 swing high at $16, it will invalidate the bearish thesis.

Ethereum Classic price saw a decent upswing after a ten-day consolidation starting on September 21. However, this ascent seems to be in jeopardy as technicals suggest an incoming pullback for ETC.

Ethereum Classic price awaits retracement

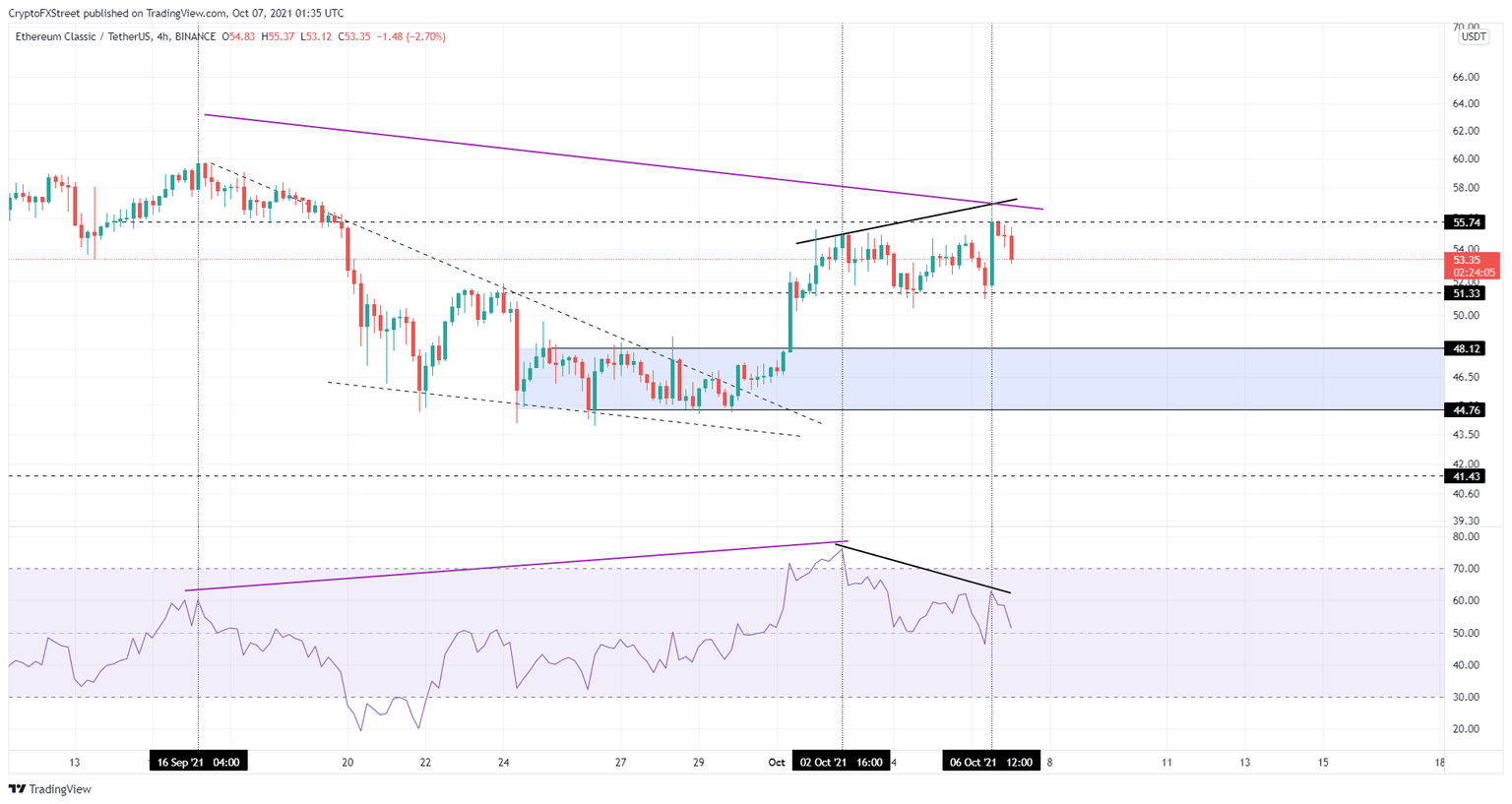

Ethereum Classic price rose 25% from September 29 to October 6 after coiling up inside a falling wedge pattern since September 6. In a way, this ascent was due to a breakout from this bullish setup.

However, ETC reached its target and started creating higher highs from October 2 to October 6 while the Relative Strength Index (RSI) formed lower lows, giving rise to a bearish divergence. This technical formation predicts the momentum will not support the recent ascent in price. Therefore, investors can expect a downswing.

Additionally, the Ethereum Classic price set up lower highs on September 16 and October 6, but the RSI formed higher highs during the same period, resulting in a hidden bearish divergence. This pattern also suggests that ETC is due for a correction.

Going forward, investors can expect the Ethereum Classic price to drop at least 10% from its current position to the support floor at $48.12. However, there is a possibility that this downswing could pierce the support area ranging from $48.12 to $44.76, extending its descent to 15%.

ETC/USDT 4-hour chart

While things seem to be bearish for the Ethereum Classic price, investors need to note that a sudden uptick in buying pressure that pushes ETC and its RSI higher could alleviate the short-term bearish outlook.

However, if Ethereum Classic price produces a 4-hour close above the September 16 swing high at $60.08, it will invalidate the bearish thesis.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.