Ethereum Classic Price Prediction: ETC breakout confirmed, 30% gains await patient holders

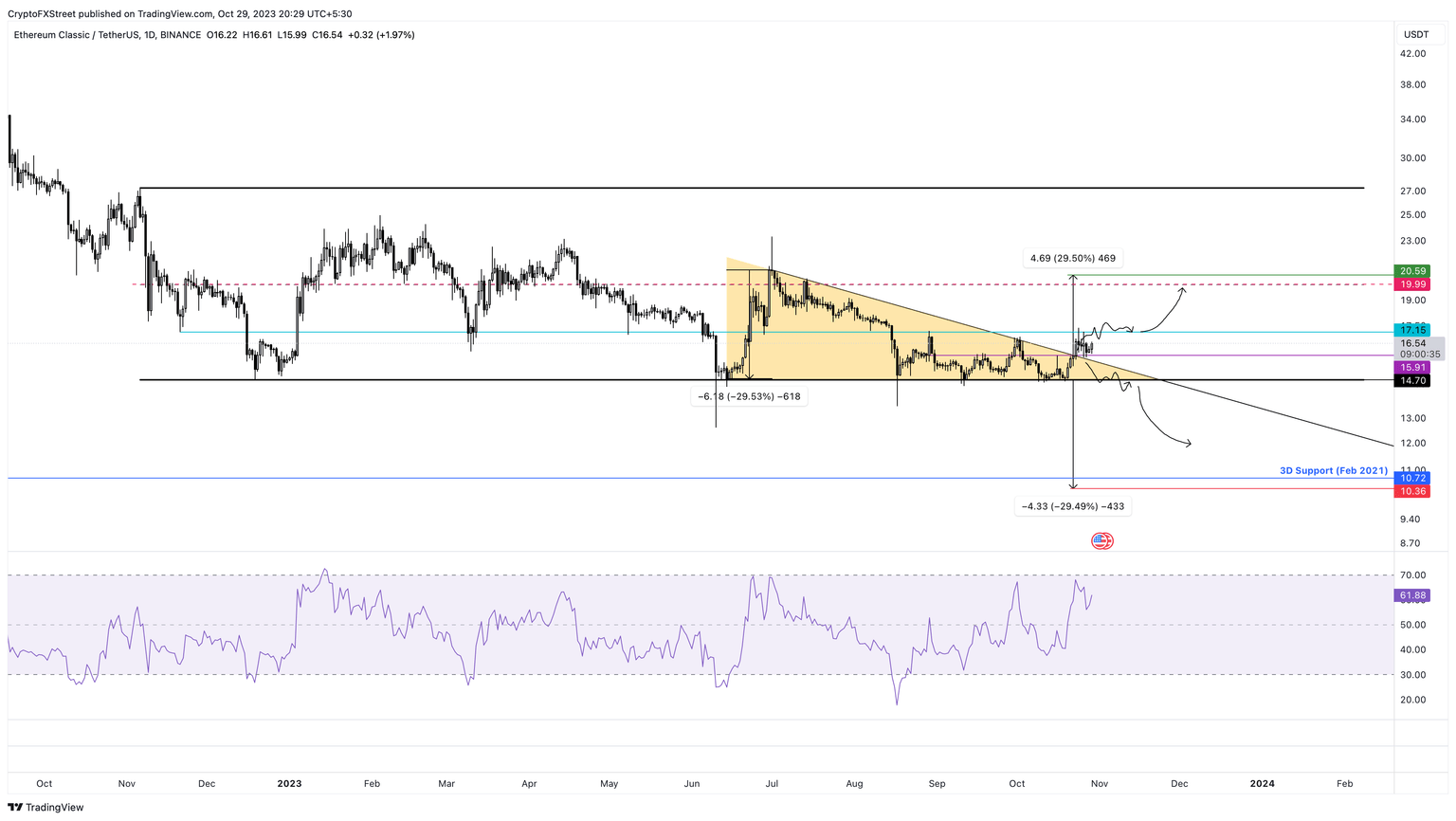

- Ethereum Classic price ranges between a high time frame range, extending from $14.70 to $27.73.

- The daily chart showcases a descending triangle setup, forecasting a near-30% move.

- Confirmation of an uptrend will arrive on the flip of the $15.91 hurdle into a support floor.

- On the contrary, a breakdown of the $14.70 support floor could trigger a 30% correction to $10.36.

Ethereum Classic (ETC) price has breached the descending triangle setup on October 23. This technical formation forecasts handsome games for patient ETC holders as the altcoin prepares before an explosive move to the upside,

Also read: Ethereum Price Prediction: ETH needs to hold these key levels to revisit $2,000

Ethereum Classic price prepares for volatility

Ethereum Classic (ETC) price has created a multi-month descending triangle setup. In particular, ETF has bounced off the $14.70 support level five times since December 2022. The last four bounces, aka swing lows, were followed by a string of lower highs. Connecting these swing points using trend lines reveals a descending triangle setup. This technical formation has a bearish bias but investors cannot ignore the possibility of an upward breakout since this rangebound movement is happening after a long duration of downtrend.

On October 23, Ethereum Classic price breached the descending triangle's hypotenuse by producing a daily candlestick close above it. This pattern forecasts a 30% upswing to $20.59, which is obtained by measuring the distance between the first swing high and the swing low to the breakout point of $15.90.

Considering the Relative Strength Index’s (RSI) position above the 50 level on the daily timeframe, the chances of the ongoing rally's continuation are high. With these points in mind Ethereum Classic price needs to overcome the $17.15 and $19.99 hurdles to reach the theoretical target of $20.59. From its current position of $16.53, this move would constitute a near 2 5%-gain.

Read more: Ethereum classic is looking for more gains

ETC/USDT 1-day chart

While the bullish outlook makes logical sense, investors need to note that this weekend rally could come undone at the start of a fresh week. In such a case, if the Ethereum Classic price produces a daily candlestick close below the $14.70 support floor, it will confirm a bearish breakout. In such a case, the measurement rule forecast a 30% correction to $10.36. But the descend might face exhaustion around $10.72, which is the three-day support last seen in February 2021.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.