Ethereum Classic Price Prediction: ETC coils up for 40% upswing

- Ethereum Classic price shows choppy action as it approaches the lower trend line of an ascending parallel channel.

- The $52.92 support floor is likely to be tagged before a 40% upswing originates.

- A decisive close below $48.41 will create a lower low, invaldiating the bullish thesis.

Ethereum Classic price has been consolidating for about nine days without a clear directional bias. However, ETC shows that it is nearing a crucial support floor on a higher time frame, and an uptrend seems likely.

Ethereum Classic price to kick-start an explosive run-up

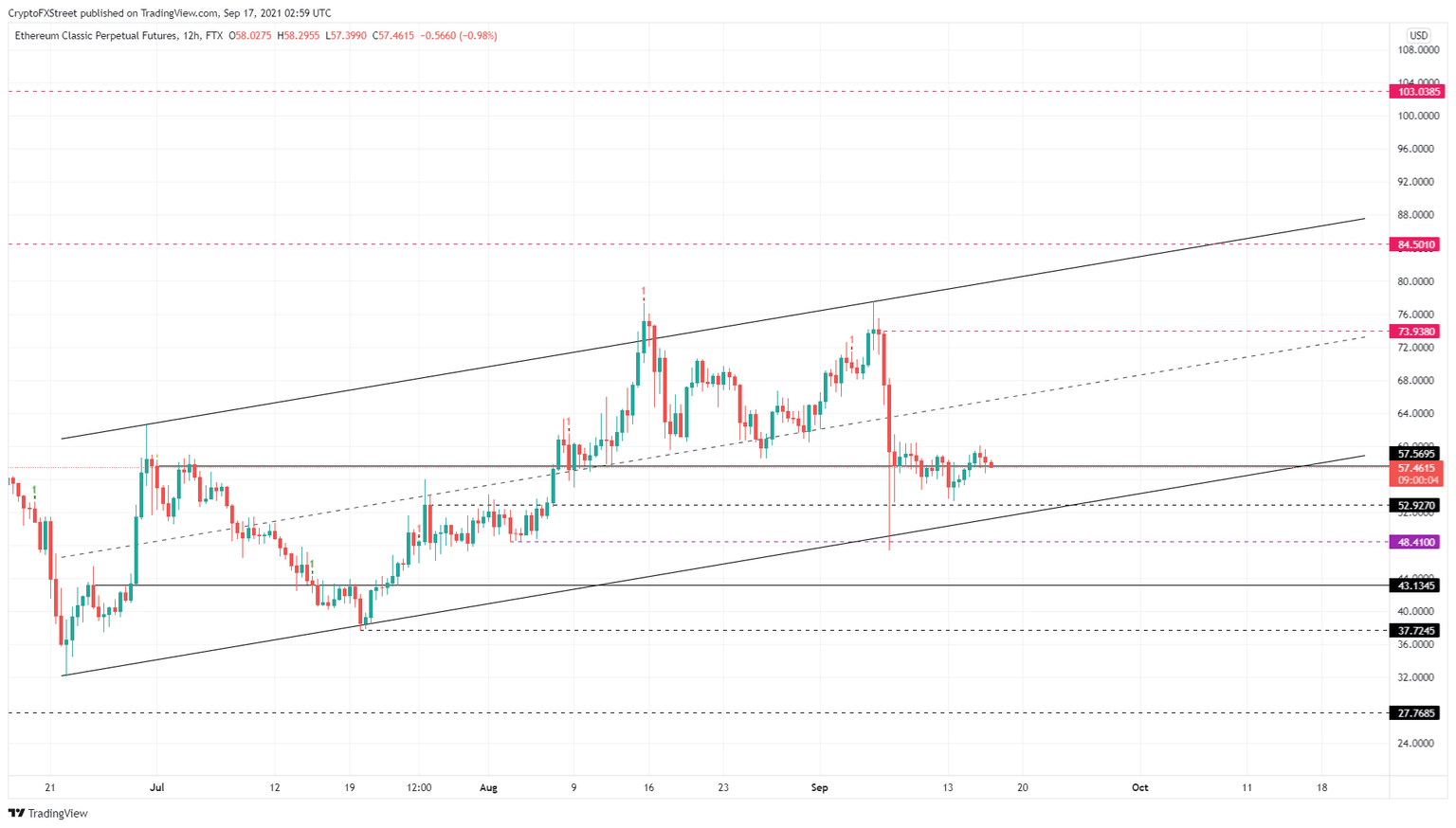

Ethereum Classic price set up three higher lows and three higher highs since June 22. Drawing trend lines connecting these swing points results in the formation of an ascending parallel channel.

The last two times ETC retested the lower trend line of the channel, it resulted in an explosive uptrend. Although the recent retest was a wick on September 7, the current consolidation could result in a proper retest of the $52.92 support floor, coinciding with the lower trend line of the channel.

Investors can expect a resurgence of buyers around this point, resulting in a massive uptrend. ETC needs to slice through the middle line of the technical formation to reach the $73.94 resistance barrier. This move would constitute a 40% ascent from the $52.92 platform.

In a bullish case, the Ethereum Classic price will likely continue the uptrend and $84.50, representing a 60% advance.

ETC/USDT 12-hour chart

While things seem to be going well for the Ethereum Classic price, a breakdown of $52.92 will question the optimism. However, a decisive 12-hour candlestick close below $48.41 will create a lower low, indicating a bearish breakdown and invalidating the bullish thesis.

In this case, ETC could likely revisit $43.13.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.