Ethereum Classic Price Prediction: ETC buyers target $70

- Ethereum Classic price is currently lagging the broader cryptocurrency market, presenting an opportunity for traders.

- Kump Twist ahead indicates a zone where bulls may propel Ethereum Classic higher.

- Downside pressure remains and must be invalidated to confirm any bullish continuation move.

Ethereum Classic price has made substantial gains over the past nine trade days, increasing by almost 25%. However, an understandable and expected pause in bullish momentum could entice more buyers to enter the market if Ethereum Classic maintains its current value area.

Ethereum Classic price takes a pause: buyers and sellers await cues for direction

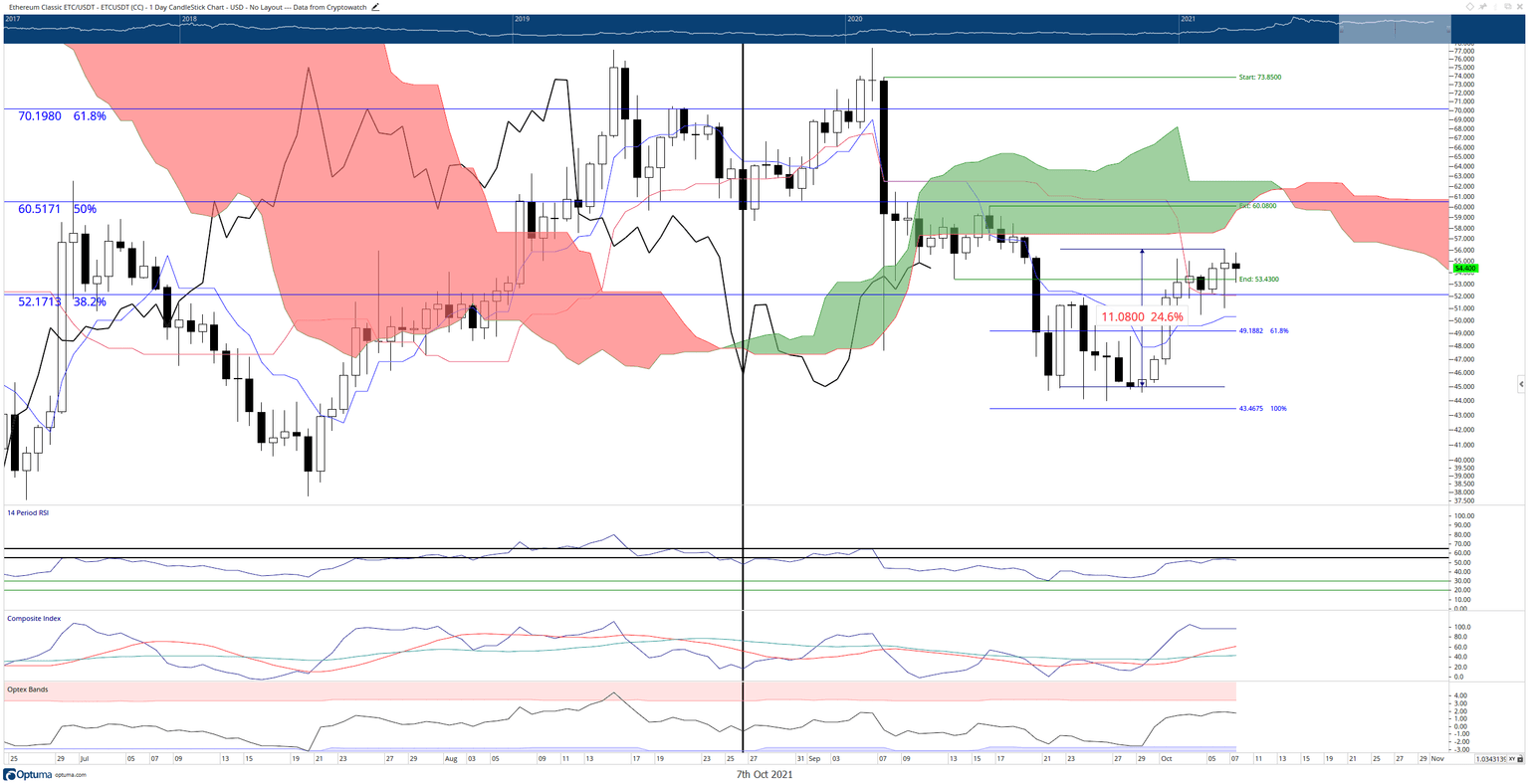

Ethereum Classic price is up against a significant decision point. The momentum of Bitcoin, Ethereum and the broader cryptocurrency market has buoyed altcoins. There is a Kumo Twist (when Senkou Span A crosses Senkou Span B) on October 11th. The Kumo Twist is the thinnest part of the Cloud and represents almost no resistance to prices move through it.

If Ethereum Classic price can move above the Cloud between October 10th and October 12th, a return to the $70 value area is highly probable. However, the $70 level has two levels that may halt further upside momentum: the 61.8% Fibonacci retracement and a high volume node in the Volume Profile.

ETC/USDT Daily Ichimoku Chart

However, buyers should be aware that Ethereum Classic price has some unambiguous bearish signals present on its chart. First, the bearish hammer candlestick that formed on Wednesday’s close signals some near-term selling pressure. Second, the Relative Strength Index remains in bear market conditions and shows rejection at the first overbought condition (55). Finally, there is strong hidden bearish divergence between the candlestick chart and the Composite Index.

Short sellers who prevent the bulls from taking over will likely target the 161.8% Fibonacci expansion at $36.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.