Ethereum Classic Price Prediction: ETC at risk of 17% decline

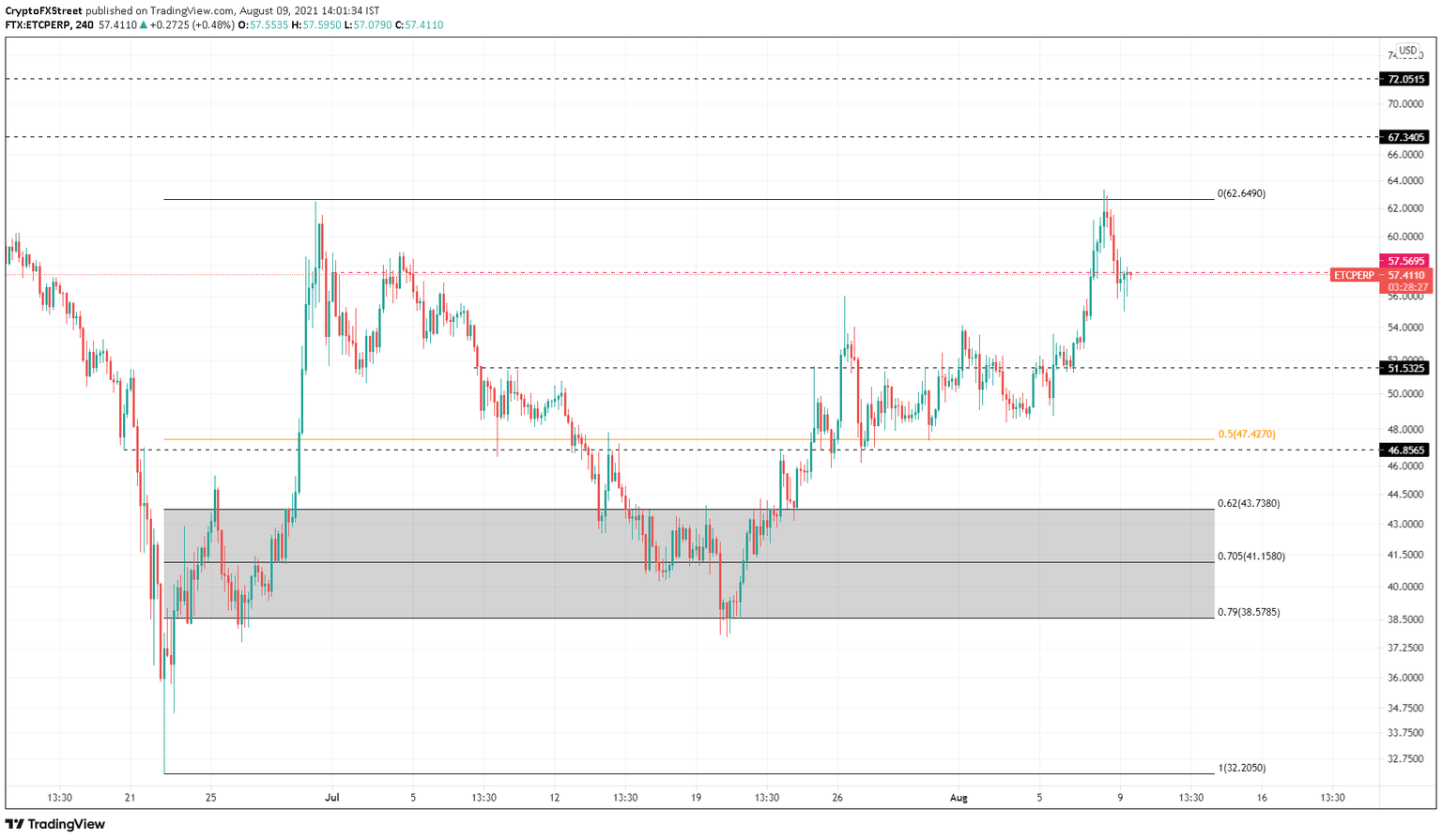

- Ethereum Classic price swept the range high at $62.65 but failed to sustain above it.

- ETC is likely to retrace to $51.53 and, in some cases, the $48.85 support level.

- A decisive close above $62.65 will invalidate the bearish thesis and kick-start a new uptrend.

Ethereum Classic price is currently retracing after failing to breach the trading range’s swing high successfully. The buyers’ inability has resulted in a retracement that could extend toward the immediate support levels and, in rare cases, the equilibrium point.

Ethereum Classic price eyes equal lows

Ethereum Classic price rose 67% between July 20 and August 8 as it briefly pierced the range high at $62.65. While the upswing was impressive, a failure to close above $62.65 indicates that a retracement is likely as investors rush to book profits.

So far, ETC has sliced through the immediate support barrier at $57.57 and is grappling with it in an attempt to reclaim it. If unsuccessful, market participants can expect ETC to be knocked down to the subsequent demand level at $51.53, roughly a 10% decline from $57.57.

If the ask orders continue to pile up, Ethereum Classic price will drop to $47.42. This descent constitutes a 17% crash from $57.57.

While a retest of the $47.42 support level is plausible, the August 5 swing low at $48.79 is where the reversal might likely occur.

ETC/USDT 4-hour chart

Regardless of the bearish outlook, altcoins are bound to follow suit if the big crypto takes a U-turn. In this case, Ethereum Classic price needs to breach through $57.57 and flip it into a support barrier. This move will confirm a resurgence of buyers and propel ETC to take another jab at conquering the range high at $62.65.

A decisive 4-hour candlestick close above this level will invalidate the bullish outlook and, in some cases, propel the altcoin up by 7% to retest the $67.34 resistance ceiling.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.