Ethereum Classic Price Prediction: ETC approaches inflection point, needs trigger to take off

- Ethereum Classic price pierced through the crucial resistance level at $61.66 but has not closed above it.

- A successful move above this barrier might trigger a 16% upswing to $71.91.

- If ETC produces a decisive close below $48.88, the bullish thesis will face invalidation.

Ethereum Classic price came very close to shattering a critical barrier but managed to reverse its trend and is currently hovering around an inflection point. A decisive close above this level will signal the presence of buyers and kick-start an upswing.

Ethereum Classic price at crossroads

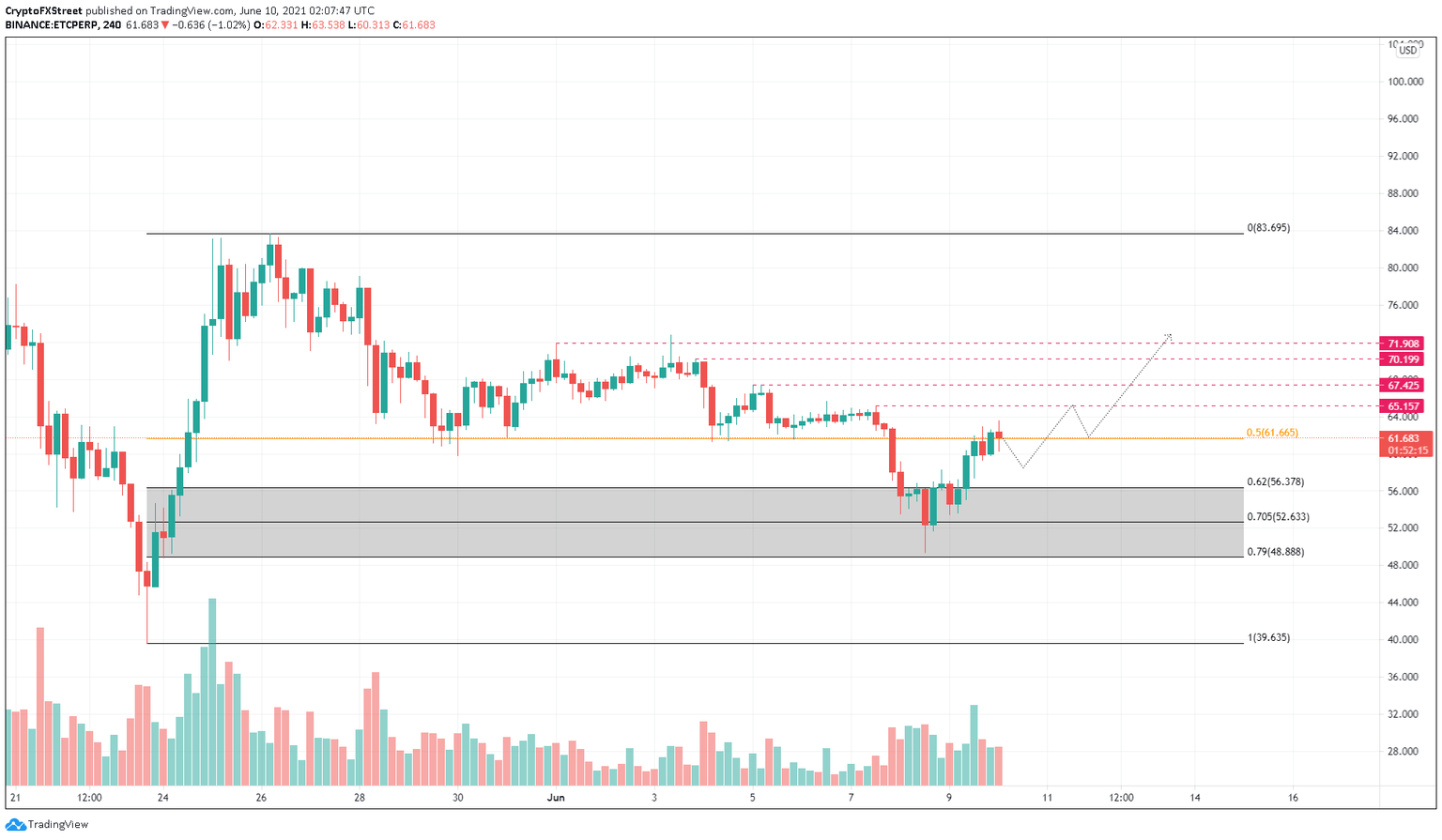

Ethereum Classic price dropped 24% between June 7 and Jun 8. Although ETC came close to breaching the 79% Fibonacci retracement level at $48.88, it did not. A quick reversal from the swing low at $49.41 pushed it 33% to where it currently stands, $61.68.

Interestingly, ETC sliced through the 50% Fibonacci retracement level at $61.66 and is holding above it. A decisive 4-hour candlestick close above it will signal the start of an upswing.

In that case, investors can expect Ethereum Classic price to rally to shatter the swing lows up to $71.91.

In total, this rally would be a 16% climb from its current position, $61.68. Since the upside potential is not capped, ETC might even target the subsequent swing high at $79.12 and the range high at $83.70 in an extremely bullish case.

ETC/USDT 4-hour chart

On the other hand, if Ethereum Classic price fails to stay above the 50% Fibonacci retracement level at $61.66, it will signal weak buying pressure or increased seller activity.

In such a case, market participants can expect ETC to consolidate between $61.66 and $52.63. If the profit-taking increases, Ethereum Classic price might dip to retest the 79% Fibonacci retracement level at $48.88.

A breakdown of this level ($48.88) will invalidate the upswing as it opens up the possibility of a down move to the range low at $39.64.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.