Ethereum Classic (ETC) reached its highest level in almost three weeks Wednesday, buoyed by Barry Silbert-backed Digital Currency Group's $50 million investment and by an overall cryptocurrency market recovery led by Bitcoin (BTC).

The 17th-largest cryptocurrency by market value traded as high as $63.19 — a nearly 98% rise from its June 22 low of $31.91. Meanwhile, the market value of all the Ethereum Classic tokens in circulation crossed $7.53 billion.

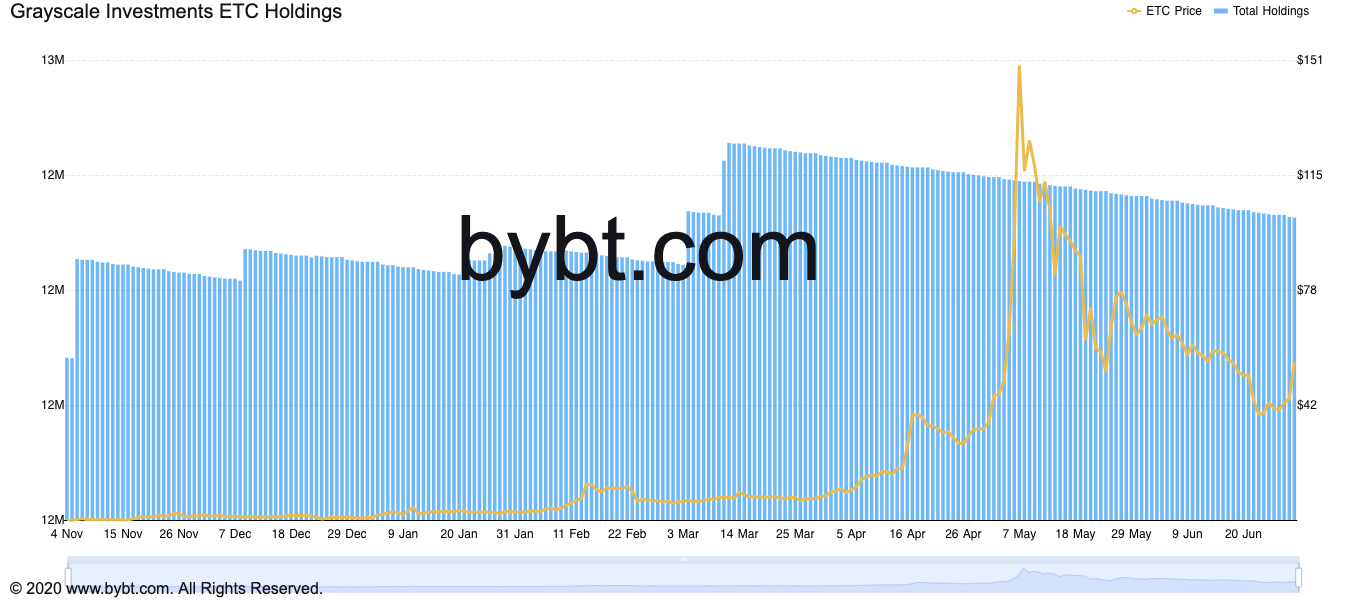

Digital Currency Group (DCG) revealed on June 21 that it has authorized the purchase of up to a total of $50M worth of shares of Grayscale Ethereum Classic Trust (OTCQX: ETCG). Grayscale is a New York-based investment firm that provides accredited investors access to digital currency products in the form of traditional securities.

Grayscale ETC holdings . Source: Bybt.com

On the day of the announcement, Ethereum Classic fell by 22.56%, much in line with the rest of the cryptocurrency market, which, in turn, was responding to China's increasing crackdown on the regional crypto sector, including a complete ban of mining-related activities.

But despite the heavy sell-off, the Bitcoin and altcoin markets bounced back in tandem. Traders particularly recognized buying opportunities in the Bitcoin market as BTC/USD slipped below $30,000—a psychological support level that lately kept the pair's downside bias from flourishing any deeper.

Bitcoin has been trading between $30K and $40K since May 19. Source: TradingView.com

Meanwhile, altcoins merely tailed the Bitcoin rebound owing to their high correlation with the top digital asset.

According to data provided by Crypto Watch, the 30-day correlation efficiency between Bitcoin and Ethereum's Ether (ETH) was 0.83 on Wednesday. A reading of 1 represents a perfect positive correlation between two assets.

Copycat hard fork

ETC's gains also appeared in days leading up to a major Ethereum Classic blockchain upgrade in July.

In detail, Ethereum Classic emerged from a controversial blockchain split that followed an approximately $150 million hack on the Ethereum-based DAO project in April 2016. The Vitalik Buterin team proposed to wipe out the attack from the Ethereum network history — a ledger rewrite that portrayed Ethereum as a centralized blockchain.

That led to the formation of two Ethereum camps: one that supported the reverting of chain and the other that didn't. In the end, the differences led to the formation of two competing yet independent Ethereum chains, one of them being the Ethereum Classic.

ETC's structure as a blockchain project varies from its competitors. Unlike Ethereum, ETC incorporates multiple development teams, including IOHK, ETC Cooperative, ETC Labs, etc. In general, most of these teams have focused on providing scaling solutions.

At the same time, their priority also remains to improve development tools (SDKs) and promoting cross-chain transactions so other projects can also build on Ethereum Classic.

On June 10, Steven Lohja, the lead developer at Mantis IOHK, announced to upgrade the Ethereum Classic blockchain with a hard fork called Magneto. The major update, as Lohja confessed, would be inclusive of the Ethereum Berlin upgrade features introduced earlier this year.

The Ethereum Classic's improvement proposals tend to improve the blockchain's network security while cutting down on its gas fees — it does so by storing addresses and keys in one place for users to access with a single transaction.

The ETC hard fork will go live in July, much in sync with Ethereum's London upgrade around the same period.

ETC technical setup

The latest ETC/USD rebound has come closer to invalidating a classic bearish setup that prevailed earlier.

ETC price was approaching $16.62 following its strong breakdown from the previous triangle range. Source: TradingView.com

The ETC/USD exchange rate bounced mid-way upon breaking its previously prevailing descending triangle setup. The pair found support right above its 200-day simple moving average (200-day SMA; the orange wave in the chart above) and moved higher to close above the triangle support around $51.77.

What's more, the rebound flipped ETC/USD's 20-day exponential moving average (20-day EMA; the green wave) from resistance to support. It now appears to do the same with the 50-day SMA (the blue wave) acting as resistance.

On the other hand, adjusting the triangle's support trendline lower makes it appear like a bullish falling wedge pattern.

ETC/USD hints falling wedge breakout. Source: TradingView.com

ETC/USD has broken bullish out of the pattern, much in line with its classic definition. A strong follow-through could have the pair rise by as much as the maximum Wedge height, i.e., the total maximum distance between its upper and lower trendline. It comes to be around $86.

That shifts the ETC/USD wedge profit target near $130.

Conversely, a potential reversal from 50-day SMA could have ETC/USD test the 20-day EMA as its interim support. Such a move would also risk invalidating the falling wedge structure.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Cardano Price Forecast: Sign of robust bullish reversal emerges despite dwindling DeFi TVL volume

Cardano rebounds to test resistance at $0.69 as technical indicator flashes a buy signal. A minor increase in the derivative Open Interest to $831 million suggests growing trader interest in ADA.

Crypto Today: Bitcoin's downside risks escalate as BTC spot ETF outflows extend

The cryptocurrency market is consolidating losses after starting the week amid high volatility. Bitcoin attempted to steady the uptrend above $106,000 but lost steam, resulting in a reversal to $105,204 at the time of writing on Tuesday.

Bitcoin falls below $106,000 as risk-off sentiment persists

Bitcoin price faces rejection around its $106,406 resistance level on Tuesday, hinting at a potential correction ahead. Market sentiment sours as growing Israel-Gaza tensions weigh on riskier assets, such as BTC.

Coinbase asset roadmap adds Ethena, ENA targets $0.34 breakout before listing

Ethena records its fourth consecutive positive day, signaling increased bullish momentum. Coinbase announces the addition of Ethena to the asset roadmap, making it tradable on the platform soon.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.