Ethereum Classic Price Forecast: ETC steals the headlines, yet risks begin to multiply

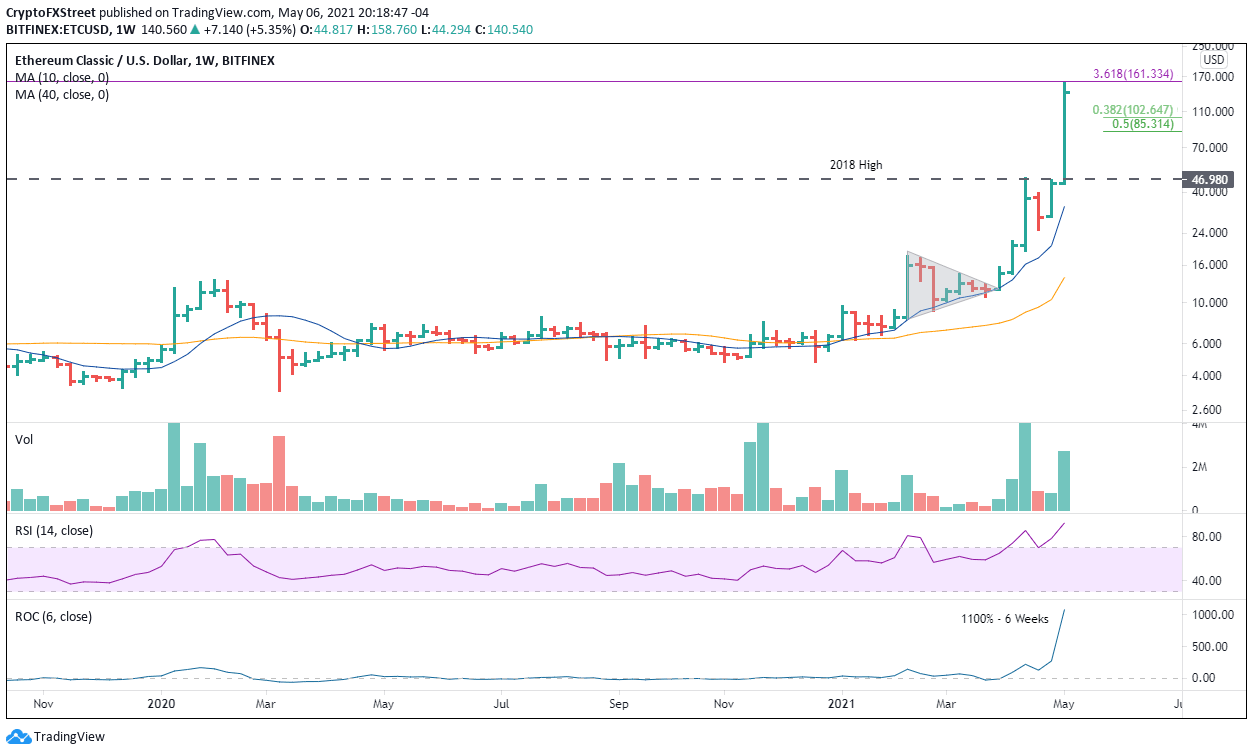

- Ethereum Classic price stampede has generated an 1100% gain in six weeks.

- Daily Relative Strength Index (RSI) at historic levels.

- According to social volume, retail investors are chasing the rally.

Ethereum Classic price has taken frenzy to a new level, producing historic gains from any statistic. Still, the lofty heights are in jeopardy as the technicals and sentiment argue for a sharp reversal in the coming hours and days.

Ethereum Classic price displays risks building exponentially

To put the Ethereum Classic price advance into perspective, it is essential to consider a few performance stats calculated at the time of writing.

- Second-largest daily gain at over 50%.

- Largest 3-day gain at over 150%.

- Largest 6-week gain at over 1100%.

- Largest monthly gain at over 270%.

- Second-largest 6-month gain at over 1900%.

On top of the tremendous performance stats, the daily RSI is at 95, the highest reading since trading began in 2016. Moreover, at the intra-day high today, Ethereum Classic price was 2% below the 361.8% Fibonacci extension of the 2018 bear market, a prime level to trigger a notable correction in price.

Support is tricky to label following such an advance, but speculators can find a bid at the 38.2% retracement at $102.65. The retracement level originates from the rally started at a symmetrical triangle breakout, the beginning of April. The retracement level should be firm, considering that it is right above the psychologically important $100.00. It would be a 25% decline from the current price and 35% from the intra-day high.

A failure at $100.00 would significantly distress the bullish outlook and raise the probability that Ethereum Classic price will test the 50% retracement at $85.31.

ETC/USD weekly chart

Based on the convergence of extreme optimism in the performance statistics, there is little room for the rally to continue. If Ethereum Classic price pushes back above the 361.8% extension it would diminish the bearish outlook, but only for a short period.

Santiment’s Social Volume metric shows the number of mentions of ETC on 1000+ crypto social media channels, including Reddit, Discord, Twitter and private chats. Today, the metric went parabolic with Ethereum Classic price, featuring the magnitude of interest among the retail investor ranks.

Often, extreme readings for retail investor sentiment mark the high and the beginning of a sizeable decline.

Santiment Social Volume metric

Stratospheric social volume readings multiply the risks facing traders and ensure the race for the exits will be as quick as today’s spike in euphoria.

To be sure, taking profits never hurt anyone.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.