- Ethereum Classic price declines to the 61.8% Fibonacci retracement in four days.

- Daily volume shows no signs of panic selling.

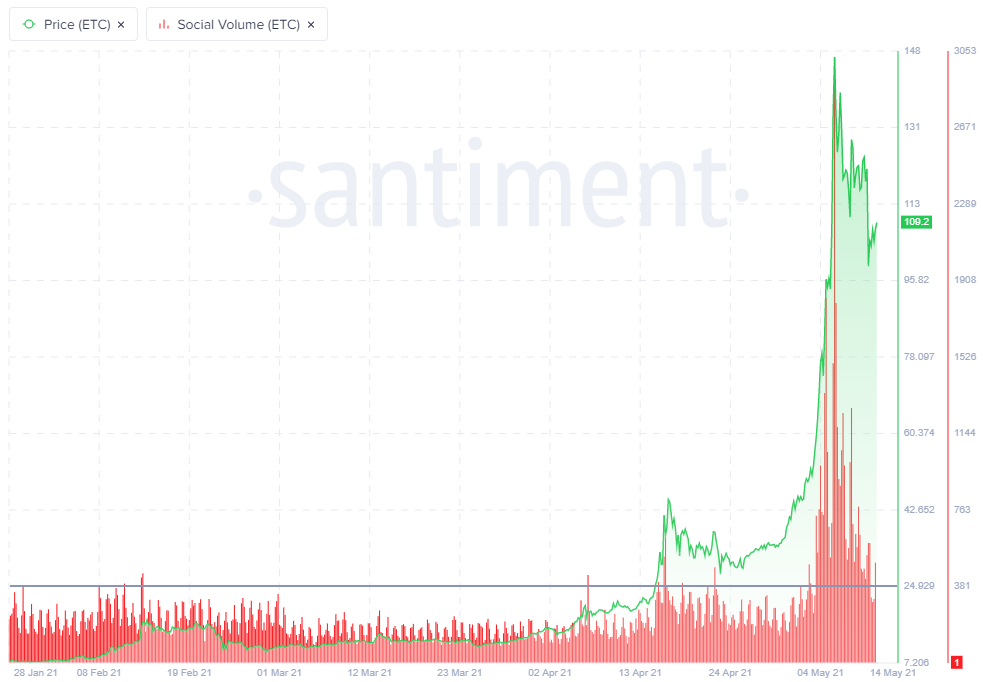

- Social media mentions aggressively decline to prior average.

Ethereum Classic price resolves pennant continuation pattern to the downside on relatively light volume following three consecutive inside days on the bar chart. Residual selling pressure may dampen rebound attempts, but if a new low is printed, it should be marginal.

Ethereum Classic price quietly solves overbought condition

From May 2 to May 6, Ethereum Classic price rallied 200% from a cup continuation pattern, easily the best 4-day gain since trading began in 2016. At the same time, the rally nearly tagged the 361.8% Fibonacci extension of the 2018 decline at $161.33.

The depth of the pullback at 40%, combined with the minimal accompanying volume, pinpoints a relative calm among the investor ranks and attributes the decline more to a function of a technically overbought condition rather than an aggressive exit.

Moving forward, Ethereum Classic price will experience some gyrations as bottoming processes tend to do. Still, a rally above $129.64 will confirm a firm low and a renewal of the larger bullish trajectory.

A rally above $129.64 should ignite an acceleration of the rebound that will carry Ethereum Classic price to the May 6 high at $158.76. Speculators should anticipate some resistance just above the 361.8% extension of the 2018 decline at $161.33 before a push into new highs. Additional resistance will be exposed at the confluence of the 161.8% extension of the current decline at $200.29 and the 461.8% extension of the 2018 decline at $205.01.

ETC/USD 12-hour chart

The bottoming process remains intact unless the May 10 low at $91.54 is undercut on a daily closing basis. It would signal that a more complex bottom is being formed, or worse, a deeper retracement, possibly to the 78.6% retracement of the early May rally at $71.33.

Beware of a collective sell-off, an event that will negatively affect Ethereum Classic price, particularly if the origin of the decline extends from Ethereum price weakness.

The Santiment social volume metric tracks the number of mentions of ETC on over 1000 cryptocurrency social media channels, ranging from discord groups, crypto subreddits, Telegram groups and private traders chats. At the May 6 high, there were over 3000 mentions on social media from a low of 182 on May 2, the day Ethereum Classic price broke out from a cup base. It was a 1500% spike in four days.

Since the May 6 high, social media mentions have returned to 501, representing an 83% decline and placing it close to the average level of around 380.

ETC related mentions on social media

Social media volume spikes consistently align with local tops or even significant highs. Still, the quick descent for ETC suggests speculators have already moved on from the cryptocurrency, thereby providing a new source of buying pressure should Ethereum Classic price target new highs.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP gains as traders gear up for futures ETFs debut this week

XRP climbs over 3% on Monday, hovering around $2.33 at the time of writing. The rally is likely catalyzed by key market movers like XRP futures Exchange Traded Funds (ETFs) approval by the US financial regulator, the Securities and Exchange Commission (SEC), and a bullish outlook.

Bitcoin Price Forecast: BTC eyes $97,000 as institutional inflow surges $3.06 billion in a week

Bitcoin (BTC) price is stabilizing above $94,000 at the time of writing on Monday, following a 10% rally the previous week. The institutional demand supports a bullish thesis, as US spot Exchange Traded Funds (ETFs) recorded a total inflow of $3.06 billion last week, the highest weekly figure since mid-November.

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum (ETH) recovered the $1,800 price level on Saturday after US spot Ether ETFs (exchange-traded funds) recorded their first weekly inflows since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation (formerly Janover) filed a registration statement with the Securities & Exchange Commission (SEC) on Friday, signaling its intent to offer and sell a wide range of securities, including common and preferred stock, debt instruments and warrants for the purchase of equity

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.