Ethereum Classic Price Forecast: ETC bulls take charge, a retest of $30 on the cards

- Ethereum Classic price has been consolidating around the $27 level for almost two weeks.

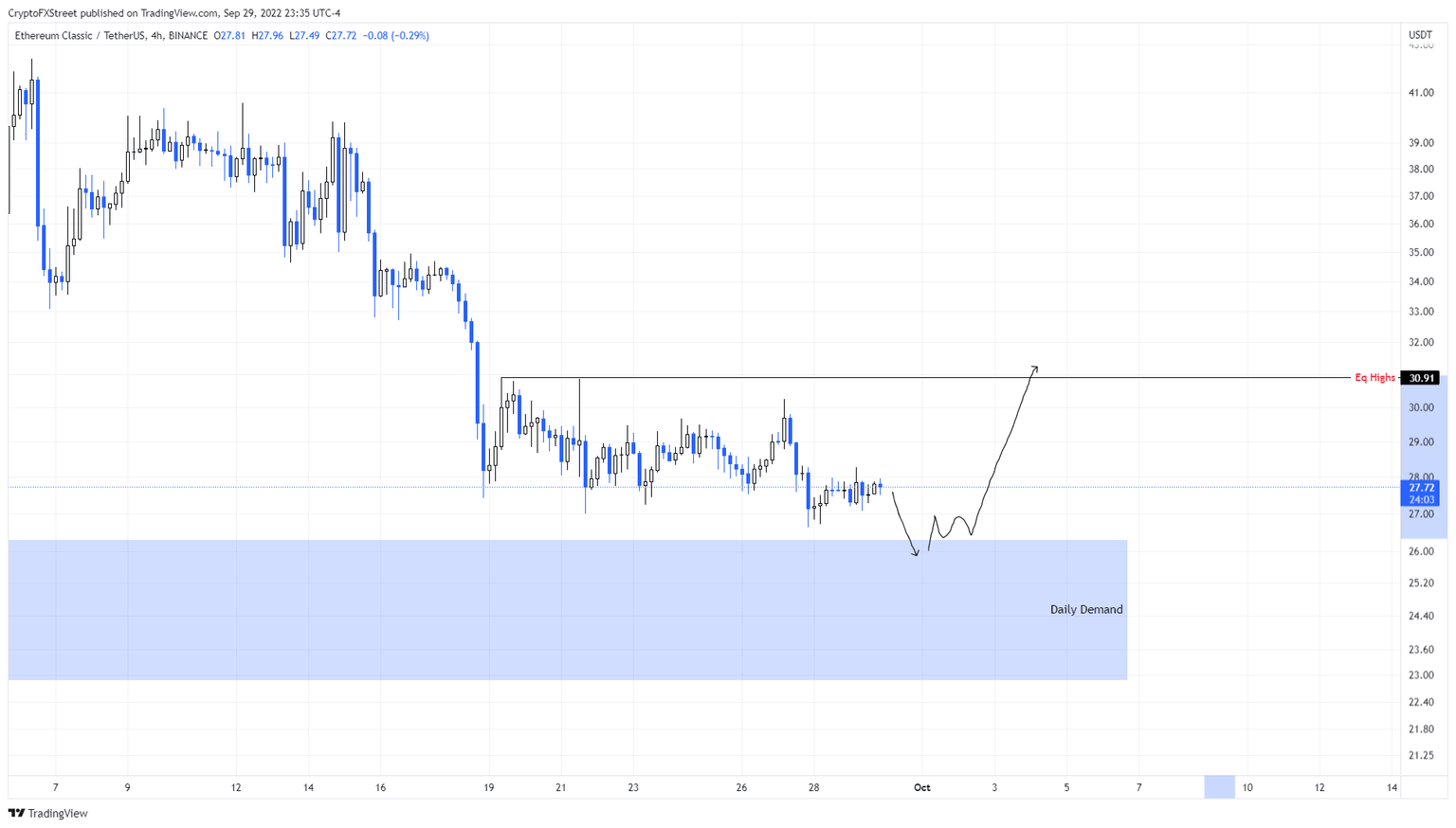

- Investors can expect a dip into the $22.88 to $26.30 demand zone, followed by an explosive move to $30.

- A daily candlestick close below $22.88 will invalidate the bullish thesis for ETC.

Ethereum Classic price ranges with no directional bias in sight. This trend could continue unless Bitcoin price decides to do something. Regardless, investors should prepare for a minor downtrend before ETC rallies.

Ethereum Classic price makes its move

Ethereum Classic price lost its directional bias after dropping 20% between September 17 and 18. The consolidation after September 18 has been around the $27 level and ETC is currently attempting to overcome it.

While the possibility of an upswing is on the cards for Ethereum Classic price, investors need to prepare for a potential reversal that pushes ETC lower. A dip into the $22.88 to $26.30 demand zone is clearly the best-case scenario for bulls, as it would provide momentum to move prices higher.

Therefore, a 5% downswing followed by a quick reversal is likely. The spike in bullish momentum here could trigger ETC to rally by 17% to $30.91. Market makers might sometimes push Ethereum Classic price to sweep this level and collect the buy-stop resting above these highs.

ETC/USDT 4-hour chart

On the other hand, if Ethereum Classic price fails to react to the $22.88 to $26.30 demand zone and continues to slice through it, it will indicate an overwhelming increase in selling pressure. If this trend continues, ETC could produce a daily candlestick close below the said demand zone and invalidate the bullish thesis.

This development could see Ethereum Classic price revisit the $20 psychological level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.