Ethereum Classic Price Forecast: ETC bulls should expect at least one more low, here's the silver lining

- Ethereum Classic price lacks directional bias, with key indicators flashing bearish signals.

- ETC could drop at least 10% before a possible pullback, with the $18.2 to $16.4 zone presenting possible support.

- A daily candlestick close above 200-day EMA at $21.6 could invalidate the bearish thesis.

Ethereum Classic (ETC) price is moving horizontally, consolidating without any directional bias. The presence of both bulls and bears is felt, considering the tight zone within which the altcoin is moving. While the ongoing trend could continue for a while, technical indicators are concerning, ETC could record at least one more low before investors start recording profits.

Ethereum Classic price could shed 10% at least, 15% at most

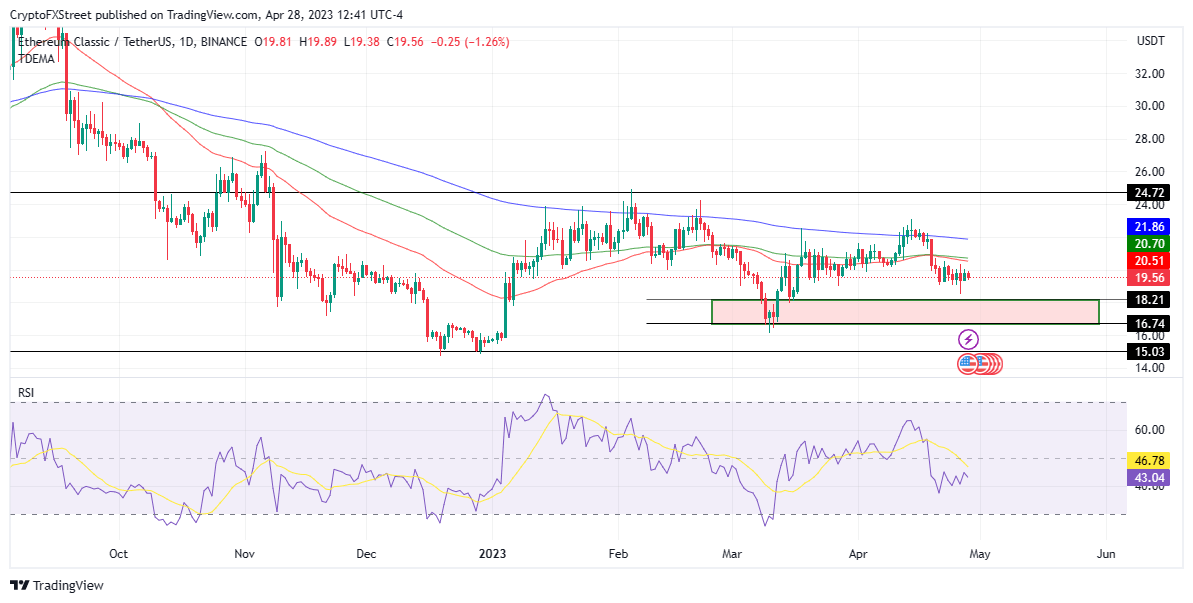

Ethereum Classic price has been consolidating under the bearish rule of the Exponential Moving Averages (EMA). The 200-day EMA, at $21.8 at the time of writing, has kept ETC stunted since September 2022. The 50- and 100-day EMA also came into play, suppressing possible upside for the altcoin at $20.5 and $20.7, respectively.

At the time of writing, Ethereum Classic price is $19.5, down almost 1% in the last 24 hours, 2.5% in the last week, and 3.1% in the last month. Overall, the altcoin is bearish, with strong indications of a continued downtrend as investors await a significant catalyst from within the Ethereum network.

Based on the overall trajectory, Ethereum Classic price could record another notable low in the next few days or weeks before a significant recovery. In such a case, the altcoin could find support around $18.2 or lower around the $16.7 support level in the dire case, denoting a 15% downswing from current rates.

Overhead pressure due to the EMA and the bearish movement of the Relative Strength Index (RSI) - below the mean line and heading south- supported the bearish outlook, indicating a further decline.

ETC/USDT 1-day chart

On the other hand, a bullish takeover could change the narrative for Ethereum Classic price. If sidelined investors buy ETC, the altcoin’s market value could increase in the short term. This move could see the altcoin recover above the three EMA and record a potential leap. A decisive candlestick close above 200-day EMA at $21.8 could invalidate the bearish narrative.

In a highly bullish case, the northbound move could see Ethereum Classic price tag the $24.7 resistance level, denoting a 25% upswing.

Also Read: Bitcoin and Ethereum holders rejoice as US PCE comes in below expectations

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.