Ethereum Classic price contemplates 35% upswing as Mystique upgrade takes shape for ETC

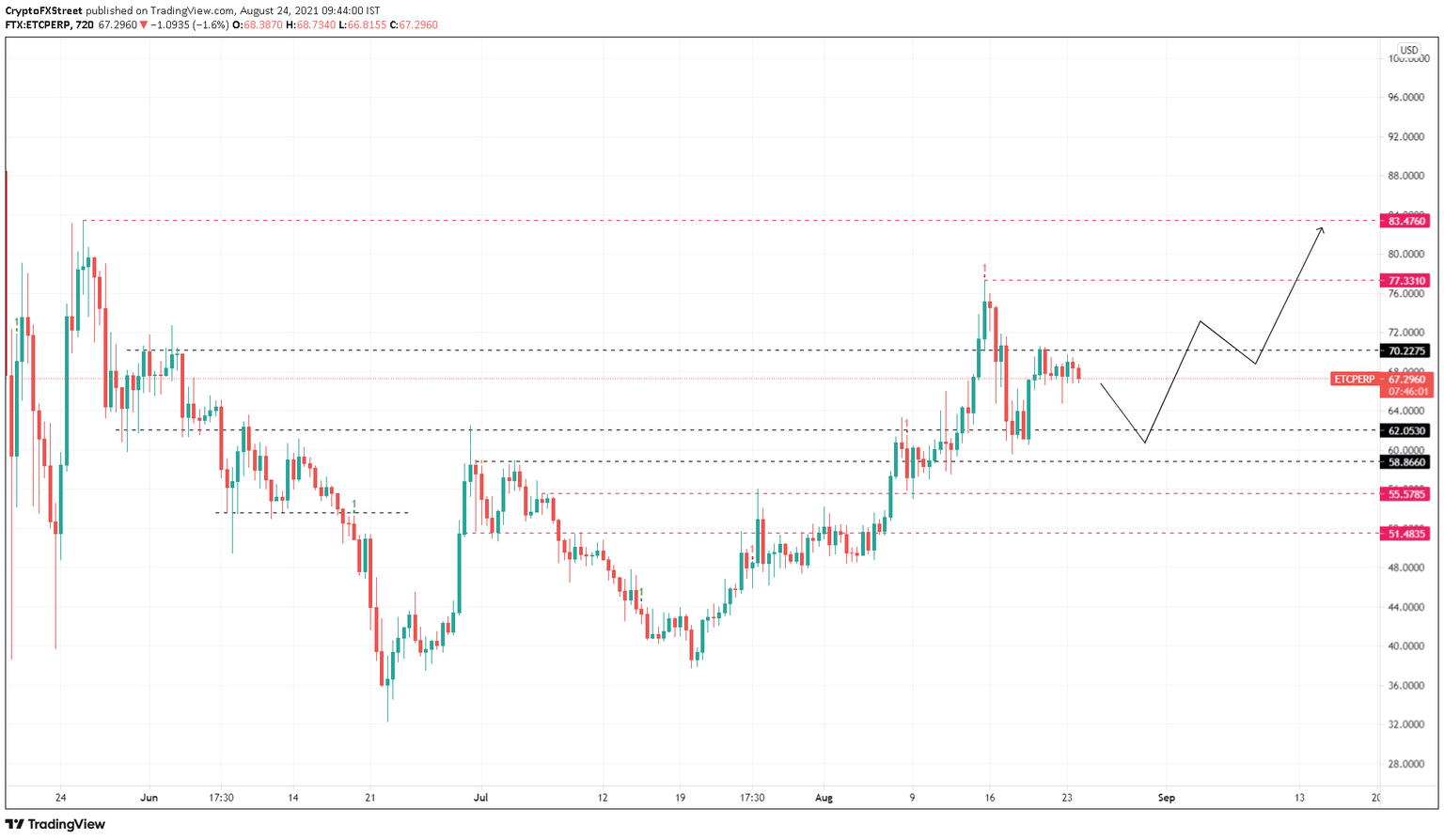

- Ethereum Classic price is experiencing a slowdown as it approaches the $70.22 resistance level.

- According to the recent developer call, the Mystique hard fork is next for ETC.

- A bounce from $62.05 is likely to trigger a new uptrend to $83.48.

Ethereum Classic price is experiencing exhaustion of the bullish momentum as it approaches a crucial resistance level. A retracement seems likely considering the general structure of the big crypto, which is expected to drag altcoins, including ETC, with it.

Mystique hard fork to hit ETC next

After the Magneto hard fork was successfully implemented on the Ethereum Classic blockchain on July 24, the ETC developers are now eyeing Mystique. This new upgrade adds support after Ethereum underwent the London hard fork.

According to the official blog, Mystique,

adds support for a subset of protocol-impacting changes introduced in the Ethereum Foundation (ETH) network via the London hardforks.

In addition to these updates, Mystique will also add various operation codes to Ethereum Classic, all of which have been in use on the Ethereum blockchain since early 2021. In doing so, the Ethereum Virtual Machine (EVM) capabilities will face significant enhancements while also improving interoperability, immutability and compliance standards.

While the date for Mystique has not been finalized yet, it will also have to be adopted via hard fork like Magneto.

Ethereum Classic price to continue its uptrend

Ethereum Classic price showed an inability to conquer the $70.23 resistance level after sliding below it on August 17. This development indicates ETC buyers are exhausted, and a retracement seems likely.

The support barrier at $62.05 is the immediate foothold that could absorb the selling pressure. The down move could also attract sidelined investors, with $62.05 serving as stable ground for a lift-off that restarts a new uptrend.

The resulting rally will likely shatter the recent swing high at $77.33 and tag $83.48, roughly 35% from the $62.05 support barrier.

ETC/USDT 12-hour chart

On the other hand, a breakdown of the $62.05 demand zone will indicate that the buyers are disinterested and that the downswing will likely continue lower.

If the sell-off breaches the $58.86 support floor, it will create a lower low, invalidating the bullish thesis. Such a move might send ETC down to $55.79 and, in a highly bearish case, $51.48.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.