- Hardfork Phoenix was activated on ETC blockchain.

- ETC/USD recovered from the initial sell-off, further upside is limited.

An essential hardfork Phoenix was activated on the Etehreum Classic blockchain at block 10,500,839. The fork happened on May 31, 2020, ten days earlier than it was previously expected. It has been the third network update since the start of the year, focused on increasing ETC network interoperability with the main Ethereum (ETH) blockchain.

Phoenix marks the 3rd hard-fork completed within 1 year on the Ethereum Classic blockchain. The Atlantis, Agharta, and Phoenix hard-fork completed the ETC-ETH agenda making way for more valuable research and innovations to come, the team reported in the blog post.

Ethereum Classic (ETC) technical coordinator Stevan Lohja, confirmed that Phoenix had implemented all Ethereum (ETH) Istanbul features for absolute technical compatibility.

At the time of writing, OpenEthereum and Besu clients are syncing, while Coregeth and Multigeth clients are already in sync. The majority of cryptocurrency exchanges confirmed Phoenix support.

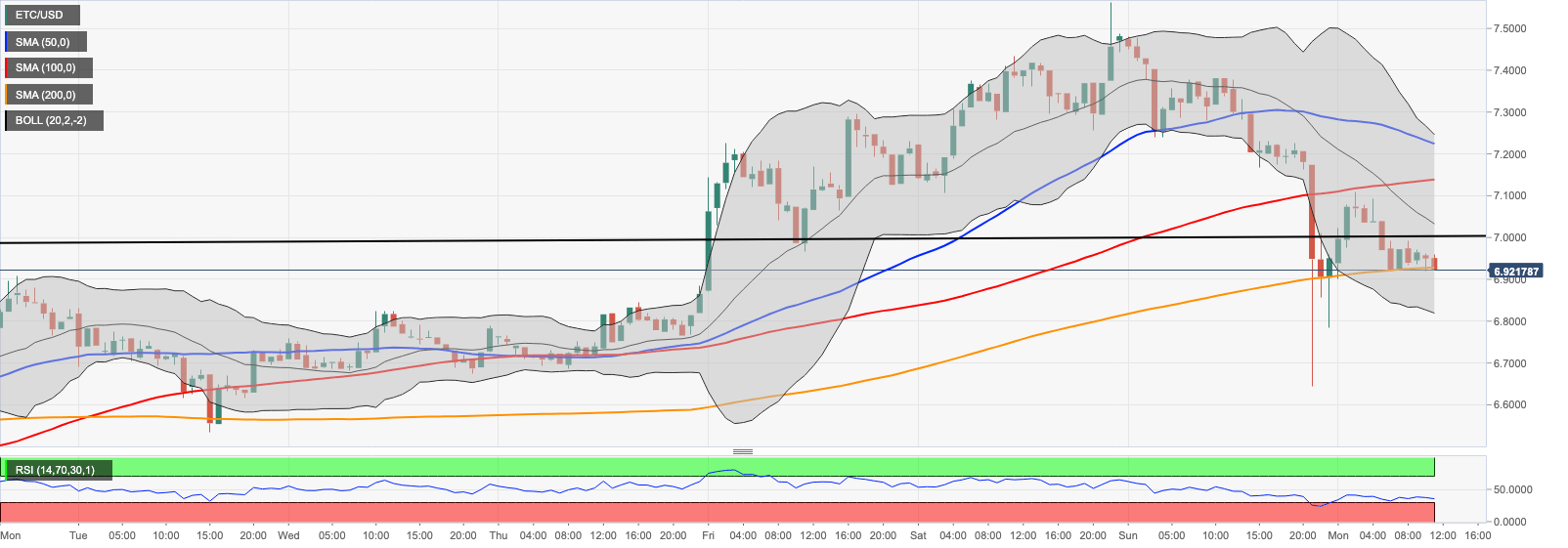

ETC/USD: Technical picture

ETC/USD dropped to $6.64 after the fork; however, by the time of writing, the coin regained some ground to trade at $6.92. The coin is moving inside a short-term upward-looking channel created by 1-hour SMA200 ($6.90) on the downside and SMA100 ($7.14) on the upside. a sustainable move above this area is needed for the upside to gain traction. And allow for a move towards $7.56, the recent recovery high.

On the downside, a move below $6.90 will worsen the short-term technical picture and push the price towards the recent low of $6.64. This support is followed by a psychological barrier of $6.60.

ETC/USD 1-hour chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.