Ethereum classic is looking for more gains

Ethereum Classic with ticker ETC/USD is moving nicely as expected since last update, when we mentioned and highlighted about a three-wave A-B-C pullback in (B)/(2) after we noticed a five-wave impulse into wave (A)/(1).

As you can see, three-wave A-B-C corrective setback can be now coming to an end with ideal support here around 17 area, so watch out for a bullish continuation into wave (C) or (3) soon.

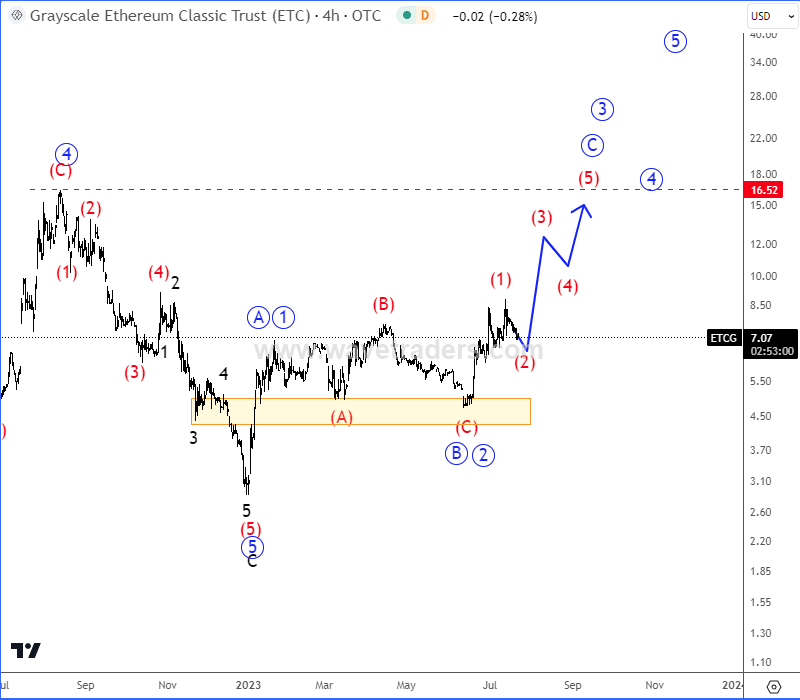

One of the main reasons why ETC/USD can go higher is Ethereum Classic GrayScale Investment Trust (ETCG), which remains nicely bullish after we spotted a completed (A)-(B)-(C) flat correction in B/2. We are currently tracking either wave C or 3, which should be completed by a five-wave cycle of the lower degree and it can push the price at least back to the former wave 4 swing high and 16 area for wave C or maybe even higher for wave 3, if 16 level will be broken decisively.

Get Full Access To Our Premium Elliott Wave Analysis For 14 Days. Click here.

Author

Gregor Horvat

Wavetraders

Experience Grega is based in Slovenia and has been in the Forex market since 2003.