Ethereum celebrates first anniversary of ETH Merge with 99.9% drop in energy usage

- Ethereum network’s energy usage reduced by 99.9% after its transition from proof-of-work to proof-of-stake through the Merge.

- Ethereum developers included EIP-7514 in its Dencun upgrade to work on a better validator reward scheme for stakers.

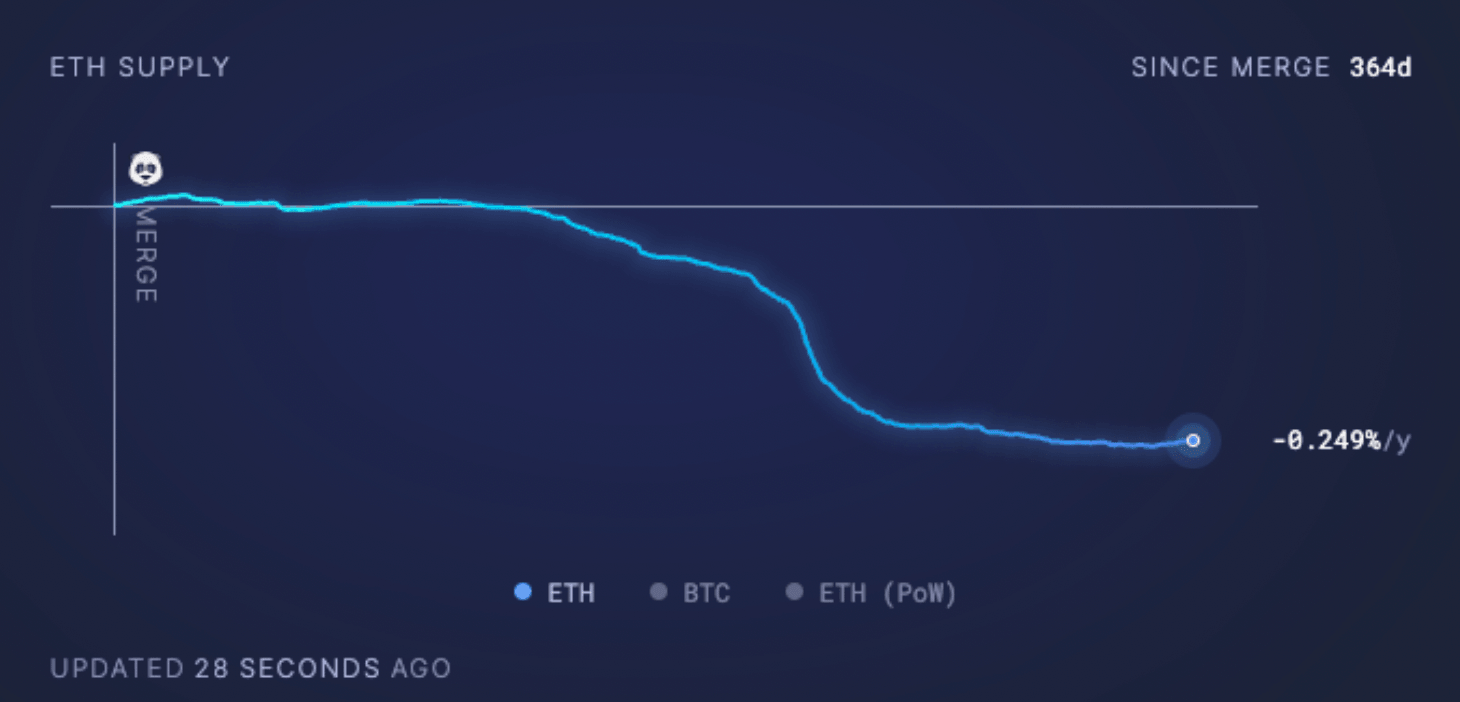

- ETH tokens worth more than $488 million at current prices have been burned since the Merge and the total supply reduced by 0.25%.

The great Ethereum Merge completes its first anniversary on Friday, September 15. The network’s energy usage has dropped drastically over the past year since Ethereum’s transition away from proof-of-work to proof-of-stake.

The blockchain network’s core developers concluded their “all core devs” call early on Friday, with some key changes like the inclusion of a new Ethereum Improvement Proposal, EIP-7514.

Ethereum Merge completes year of dramatic decline in energy usage

The Ethereum Merge, the transition from proof-of-work to proof-of-stake, reduced energy usage by 99.9% on the blockchain. The Merge occurred on September 15, 2022, and since then over 300,000 ETH worth $488 million has been burned. Based on data from Ultrasound.money, at the current rate Ethereum’s supply has reduced 0.25% in a one-year time frame.

ETH supply since Merge

The Merge marked a key upgrade in the largest altcoin network’s blockchain. Ethereum core developers concluded the “All core devs” call early on Friday. Developers made progress on discussing the next important update in Ethereum, called Dencun.

Wrapped up another @ethereum #AllCoreDevs today: we covered devnet updates, additions to Dencun, and had a full overview of Reth !

— timbeiko.eth ☀️ (@TimBeiko) September 14, 2023

Agenda: https://t.co/QVmZtfKJUS

Stream: https://t.co/GriPWtKWh4

Recap below https://t.co/mSgoATmlsH

Developers have included EIP-7514 in the Dencun upgrade to slow down the growth of the ETH staking rate. The concept is to utilize the time to design a better validator reward scheme.

The next discussion is scheduled for September 28.

Ethereum price since the Merge

Ethereum price remained nearly unchanged since the Merge. ETH price on September 15, 2022 was $1,635. At the time of writing, ETH is exchanging hands at $1,629 on Binance. The altcoin’s price did not undergo major changes a year after the Merge. However, the impact on metrics like energy usage and supply is more significant.

ETH holders had hopes riding on a dramatic price increase a year past the Merge. However, macroeconomic factors and crisis events in crypto like lawsuits and bankruptcies have played a role in the inflow of capital to the chain.

Ethereum FAQs

What is Ethereum?

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

What blockchain technology does Ethereum use?

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

What is staking?

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Why did Ethereum shift from Proof-of-Work to Proof-of-Stake?

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.