Ethereum buying spree likely in August as DAI whale holdings climb higher

- Ethereum price is likely to rally in August due to a spike in whale wallets holding the stablecoin DAI.

- Whales holding between $100,000 and $10 million worth of DAI have scooped up the highest percentage of the stablecoin’s supply since December 2020.

- DAI accumulation has been typically associated with a price rally in Ether, the altcoin is trading at $1,833 at the time of writing.

Alt season ended with the close of July, however, Bitcoin price action is disappointing for market participants. Heading into August, BTC price is below the $30,000 psychological level, and analysts are looking for altcoins and stablecoins where participants are pouring in their capital as “dry powder” for future buys.

Analysts at crypto intelligence tracker Santiment have noticed a relationship between a rise in DAI stablecoin holdings of whales and Ethereum price rallies. If the pattern repeats itself, ETH price is likely to rally in August.

Also read: BALD rug pull wipes out 90% of value, hitting Base DEX LeetSwap: A timeline of events

Ethereum price could rally with DAI whale and shark accumulation

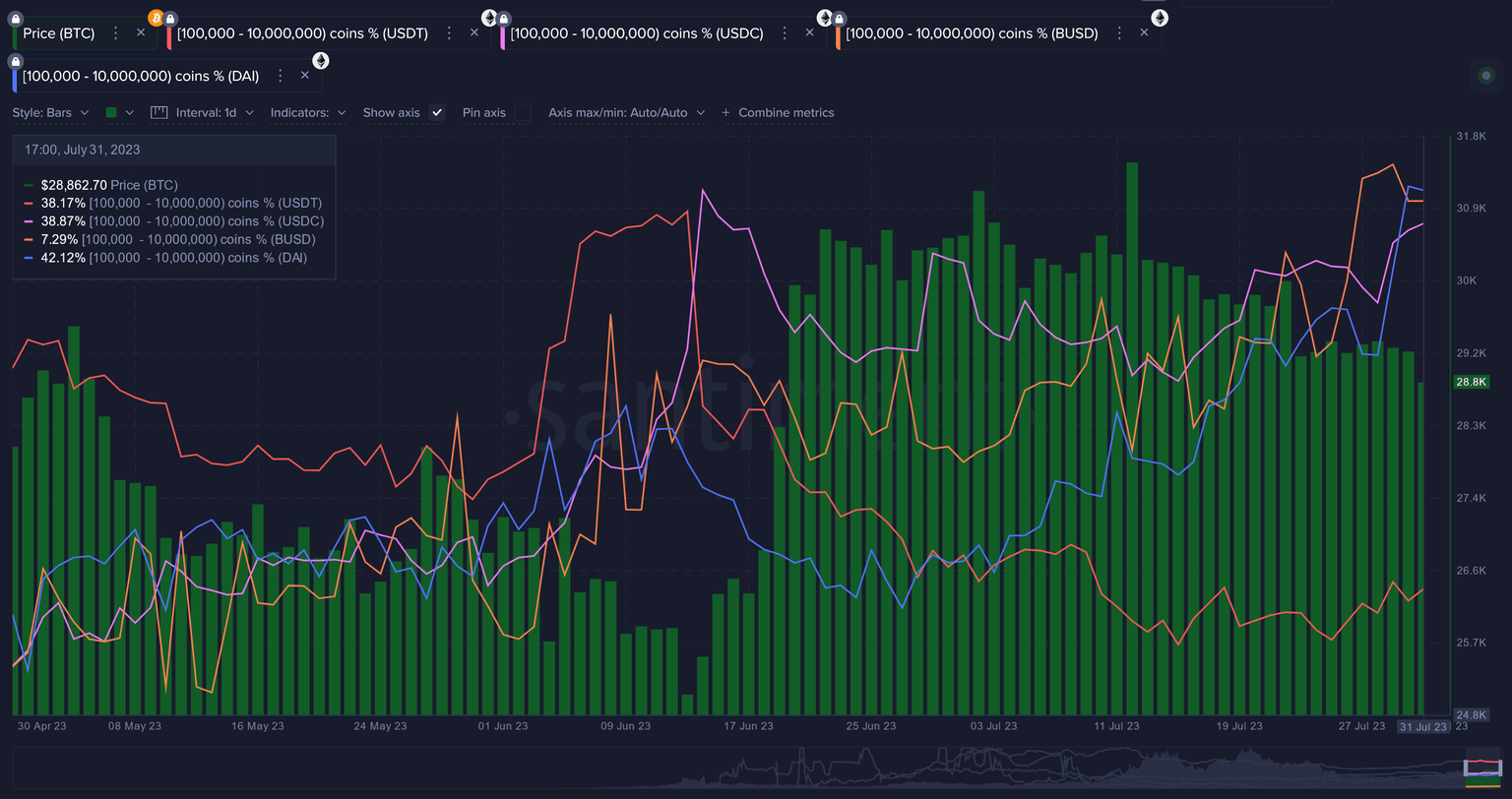

Crypto markers noted a decline in whale purchases of stablecoins in July. While large wallet addresses accumulated Bitcoin and Ether, they were less likely to replace their stablecoin holdings. Interestingly, there has been a turning point in Tether (USDT), USD Coin (USDC), Binance USD (BUSD) and DAI.

Analysts at Santiment have reported fiat inflow to the above-mentioned altcoins as whales begin “loading up” on stables yet again, fueling hopes of recovery in asset prices. Santiment analysts are keeping an eye on DAI in particular. This stablecoin recently overtook BUSD as the third largest stable asset in the crypto ecosystem.

Wallets holding between $100,000 and $10 million worth of DAI now hold 42.1% of the token’s supply. This is the largest level since December 2020.

DAI holdings of addresses with $100,000 to $10 million worth of the stablecoin

DAI has typically been associated with Ether price rallies in the past, leading analysts to the conclusion that an ETH price rally is around the corner. DAI holdings of the whale wallets are likely to foreshadow an eventual Ethereum buying spree that pushes up the price for ETH.

It's important to note that the US Securities and Exchange Commission’s (SEC) lawsuit against Richard Heart of HEX has a key role to play here.

SEC v. Richard Heart, Hex, PulseChain and PulseX

The SEC charged Richard Heart (aka Richard Schueler) and three unincorporated entities that he controls – Hex, PulseChain and PulseX – on July 31. Find more details here.

Importantly, an address that is not named in the US financial regulator’s complaint, but matches transactions mentioned in the lawsuit, holds over $35 million in DAI. Of the $35 million, $26.8 million worth of the stablecoin was transferred to the Tornado Cash mixer.

The address holdings from Arkham Intelligence

While this doesn’t necessarily paint a bearish picture for DAI whales or Ether price, it’s important to note that the involvement of the stablecoin’s transactions in the lawsuit makes it likely that sentiment among holders shifts and whales shed holdings for an alternative or exchange DAI for a different asset. In that case, a rise in DAI holdings may fail to act as a bullish catalyst for Ethereum in the short term.

Ethereum is trading at $1,833 on Binance at the time of writing.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.