Ethereum bulls swing higher despite screaming sell signals

- Ethereum price shows bullish resurgence after flipping a crucial resistance barrier.

- Transaction data shows that ETH bulls will face massive hurdles up to $3,814.

- A daily candlestick close below $2,820 will invalidate the bullish thesis.

Ethereum price is showing mixed signals as it tries to overcome a massive resistance area. Clearing it will open the path for retesting all-time highs but failing to do so might result in further losses.

Ethereum price ignores sell signs

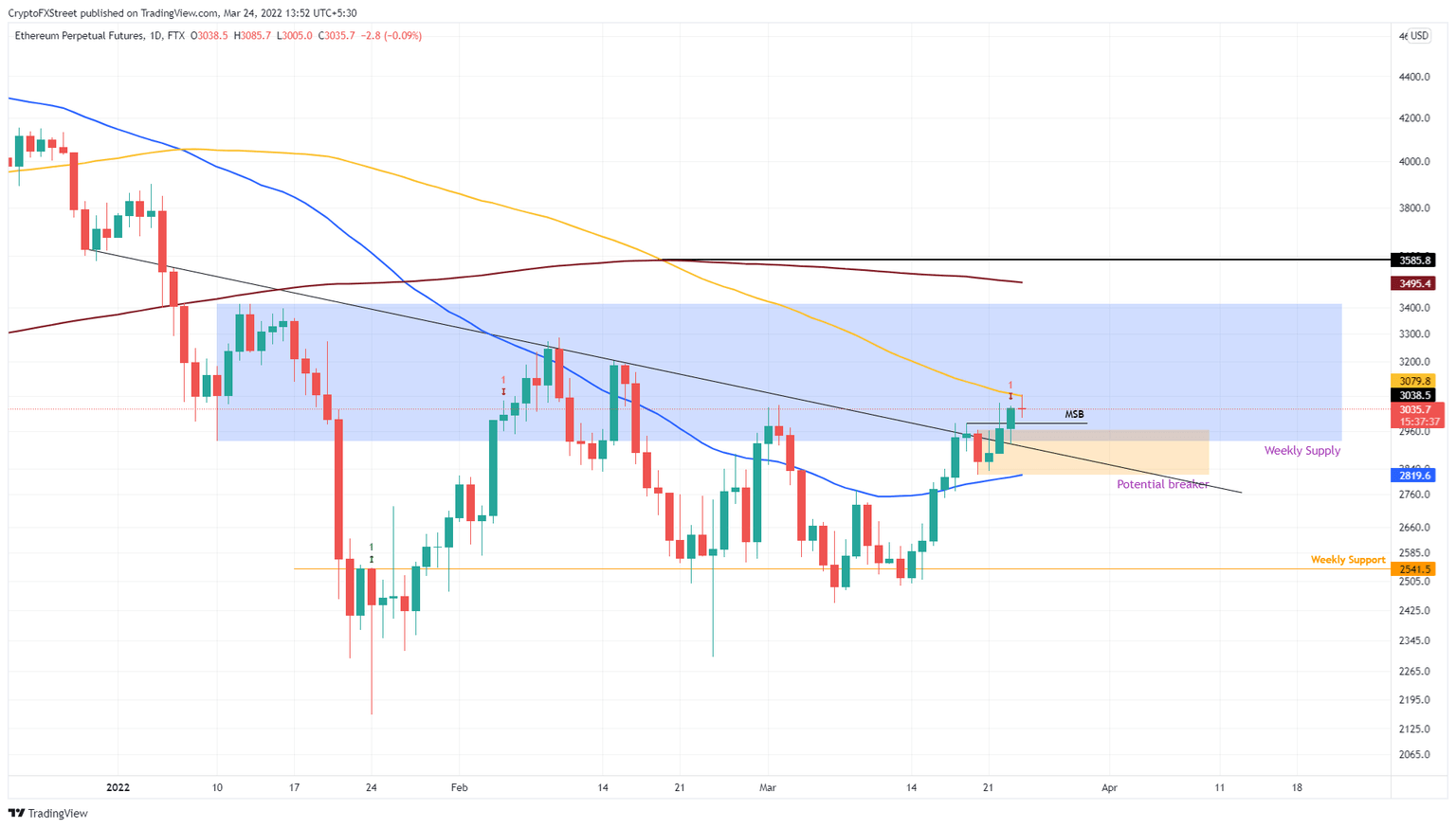

Ethereum price has been stuck under a declining trend line since December 30, 2021, and below the 50-day Simple Moving Average (SMA) since December 09, 2021. A combination of these hurdles prevented ETH from moving higher.

However, on March 17, buyers pushed Ethereum price over the 50-day SMA and five days later, the declining trend line. Yet at the same time – as a result of this uptrend – the Momentum Reversal Indicator flashed a red ‘one’ sell sign, forecasting one-to-four red candlesticks.

Ignoring this sell-sign, Ethereum price has opened today on a bullish note. Investors need to understand that this uptrend is highly unlikely to sustain without Bitcoin’s help. Additionally, if BTC retraces, ETH will follow without hesitation.

In a case where Ethereum price manages to move past the $3,500 barrier, there is a good chance this move might add to the larger run-up that eyes a retest of $4,000 and subsequently higher levels.

ETH/USDT 1-day chart

Supporting the unsustainability of the recent upswing for Ethereum price is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This index shows that ETH will face massive resistance from underwater investors, ranging from $3,200 to $3,800. Here, roughly 12 million addresses that purchased 14 million ETH are “Out of the Money.”

An up move into this zone, therefore, will likely be met with selling pressure from investors trying to break even.

That said, there is a chance for ETH to move up to $3,200 from its current position before facing these significant headwinds.

ETH GIOM

The recent uptick in the number of daily active addresses from 566,000 to 650,000 over the past month indicates that investors are interacting with the Ethereum blockchain. This 15% rise in addresses indicates that market participants are interested in ETH at the current price levels.

ETH DAA

Although bulls are trying to break through the hurdles, Ethereum price is still highly correlated with BTC. So a daily candlestick close below $2,820 will invalidate the bullish thesis.

This development will open the path for a retest of $2,541 support level, where buyers might attempt another uptrend.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%20%5B12.06.45%2C%2024%20Mar%2C%202022%5D-637837086474088636.png&w=1536&q=95)