- BlackRock has filed to add options to its Ethereum Trust.

- Ethereum ETF investors show strength, forcing net inflows despite the bearish turbulence.

- Ethereum recorded 152.4K ETH in exchange net outflows, suggesting investors bought the dip heavily after massive sell-off.

- Ethereum may have bottomed and could be set for a rally despite bearish trend.

Ethereum (ETH) is up 2% on Tuesday as BlackRock files to add options to its iShares Ethereum Trust (ETHA). Meanwhile, traditional and crypto-native investors have been scooping up ETH after the dip from Black Monday's sell-off. ETH also appeared to have found a bottom and could be set to reclaim the $2,803 support level.

Daily digest market movers: Ethereum bulls buy the dip

According to the latest filings on the Securities & Exchange Commission's (SEC) website, Nasdaq and BlackRock have applied to add options to the iShares Ethereum Trust.

"The Exchange believes that offering options on the Trust will benefit investors by providing them with an additional, relatively lower cost investing tool to gain exposure to spot ether as well as a hedging vehicle to meet their investment needs in connection with ether products and positions," the filing states.

Nasdaq and BlackRock's filing to add options on Ethereum ETFs has hit the SEC site. Final SEC decision on this from SEC likely to be around April 9th, 2025.

— James Seyffart (@JSeyff) August 6, 2024

(SEC is not the only decision maker on adding options here. Also need signoff from OCC & CFTC) https://t.co/K4HunUPp7S pic.twitter.com/5kQH0mljTz

Meanwhile, Ethereum's crash on Monday saw several whales return to the market, buying up the dump from investors who capitulated following the high FUD across the market. The buying pressure was visible across crypto-native and traditional investors, as many may have viewed the dip as an opportunity to purchase ETH at discounted prices.

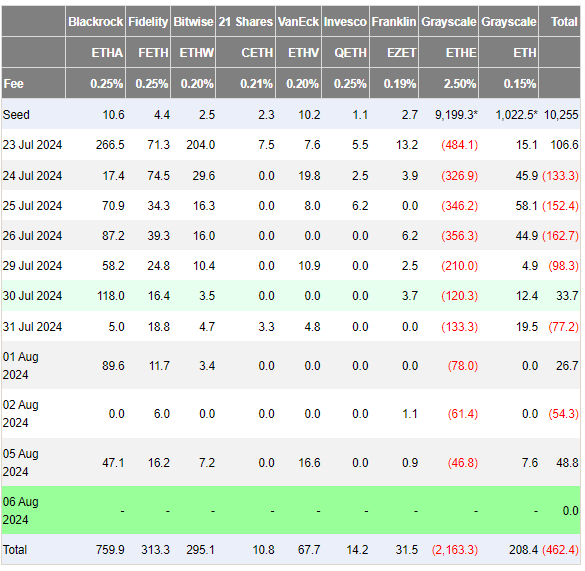

On the traditional market landscape, spot Ethereum ETFs recorded $48.73 million in net inflows on Monday despite outflows across Bitcoin ETFs, per Farside Investors data. This is only the third time ETH ETFs have seen net inflows after launch day.

Grayscale Ethereum Trust (ETHE) asset loss continued to diminish as it experienced $46.8 million in outflows — its lowest since ETH ETFs launch. BlackRock's ETHA and Fidelity's FETH had inflows of $47.1 million and $16.2 million, respectively, while Van Ecks' ETHV had its largest buying day since launch with $16.6 million in inflows.

ETH ETF Flows

Crypto-native investors also pounced on the dip, as ETH recorded a total exchange net outflow of 152.4K ETH — its highest since June 12 — as prices dipped to around $2,400, according to CryptoQuant's data. In addition, ETH exchange reserves, which have been rising since the beginning of July, flipped on Monday and have now begun to fall. This indicates increased buying pressure among investors.

ETH Exchange Netflows

Lookonchain data noted that five whale addresses purchased 144,071 ETH worth over $331.11 million during the crash.

However, some crypto community members think this may be bearish for ETH in the long term, expressing sentiments that most buying activity may be from investors looking to make a quick profit if ETH quickly rebounds.

Bullish or Bearish on $ETH?

— Lookonchain (@lookonchain) August 6, 2024

We noticed that 5 whale addresses bought 144,071 $ETH($331.11M) during the market crash!

7 Siblings spent 129.3M $USDC to buy 56,093 $ETH at $2,305.

0x267e...f91e spent 101.97M $USDC to buy 44,653 $ETH at $2,284.

#Nomad Bridge Exploiter spent… pic.twitter.com/yZoHPUn5eC

Ethereum also recorded its highest trading volume across the spot and futures market since May 2021, as per Coinalyze. The high activity across the Ethereum network saw gas fees rise to levels last seen before March's Dencun upgrade. The spike in fees saw 5,222.45 ETH burnt — also the highest since March 14, according to data from Etherscan.

ETH technical analysis: Ethereum's decline could help reset it for a rally

Ethereum is trading around $2,500 on Tuesday, up 2% on the day. Prices seem to have stabilized after heavy liquidations from the market crash on Monday. The total ETH liquidations in the past 24 hours have slowed to $76.82 million. Long liquidations have reduced to $30.54 million, trailing short liquidations, which have crossed $46 million.

ETH/USDT Daily chart

ETH found support around the $2,100 price range after the massive sell-off on Monday.

The Moving Average Convergence Divergence (MACD) indicator shows that bearish momentum is dominant after the MACD line (blue line) fell to -177 and crossed below the signal line (orange line). This is further strengthened by the 50-day simple moving average (SMA) breaching the 100-day SMA and attempting to go below the 200-day SMA.

While the outlook is bearish, the RSI indicator suggests that ETH may have found a bottom and could see a rebound.

The Relative Strength Index (RSI) shows that ETH is oversold. It fell to 21, a one-year low last seen in August 2023. The last time the RSI hit this level, ETH consolidated for a few weeks and began a rally that lasted for seven months before the market correction in late March.

The RSI, coupled with the on-chain and ETF buying pressure, suggests ETH could quickly reclaim the $2,803 support level and stage a rally to tackle the rectangle's upper side resistance at $4,093 — its yearly high. The thesis will be invalidated if ETH breaches the $2,100 support level.

Ethereum FAQs

Ethereum is a decentralized open-source blockchain with smart contracts functionality. Serving as the basal network for the Ether (ETH) cryptocurrency, it is the second largest crypto and largest altcoin by market capitalization. The Ethereum network is tailored for scalability, programmability, security, and decentralization, attributes that make it popular among developers.

Ethereum uses decentralized blockchain technology, where developers can build and deploy applications that are independent of the central authority. To make this easier, the network has a programming language in place, which helps users create self-executing smart contracts. A smart contract is basically a code that can be verified and allows inter-user transactions.

Staking is a process where investors grow their portfolios by locking their assets for a specified duration instead of selling them. It is used by most blockchains, especially the ones that employ Proof-of-Stake (PoS) mechanism, with users earning rewards as an incentive for committing their tokens. For most long-term cryptocurrency holders, staking is a strategy to make passive income from your assets, putting them to work in exchange for reward generation.

Ethereum transitioned from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) mechanism in an event christened “The Merge.” The transformation came as the network wanted to achieve more security, cut down on energy consumption by 99.95%, and execute new scaling solutions with a possible threshold of 100,000 transactions per second. With PoS, there are less entry barriers for miners considering the reduced energy demands.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Dogecoin and Bitcoin Cash Price Prediction: Funding rates decrease indicate weakness in DOGE and BCH

Dogecoin and Bitcoin Cash registered 3% and 8% losses on Tuesday following increased selling pressure from the futures market. The decline comes amid large-cap cryptos like Bitcoin, Ether and XRP, holding still with slight gains.

XRP could sustain rally amid growing ETF and SEC vote prospects

Ripple flaunted a bullish outlook, trading at $2.1505 on Tuesday. Investor risk appetite has continued to grow since the middle of last week, propping XRP for a sustainable upward move triggered by the swift decision by US President Donald Trump to suspend reciprocal tariffs for 90 days.

VeChain Price Forecast: VET bulls aim for a double-digit rally

VeChain price hovers around $0.023 on Tuesday after breaking above a falling wedge pattern the previous day; a breakout of this pattern favors the bulls. Bybit announced on Monday that VET would be listed on its exchange. Moreover, the technical outlook suggests rallying ahead, targeting double-digit gains.

Dogecoin, Shiba Inu and Fartcoin price prediction if Bitcoin crosses $100K this week

The meme coin market fell sharply on Monday, shedding 4.8% in market capitalization to settle at $49.25 billion, according to data compiled from CoinGecko. The sell-off coincided with increased volatility across broader crypto markets while investors rotated funds into Bitcoin briefly tested $85,000.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20-%20All%20Exchanges%20(SMA%2030)-638585659536891125.png)