Ethereum blob usage explodes as traders rush to layer-2 solutions

-

Ethereum has seen a surge in blob usage, averaging over 21,000 blobs this month, matching March's record activity.

-

The Dencun upgrade allows Layer 2 solutions to efficiently bundle transactions and post them to Ethereum.

-

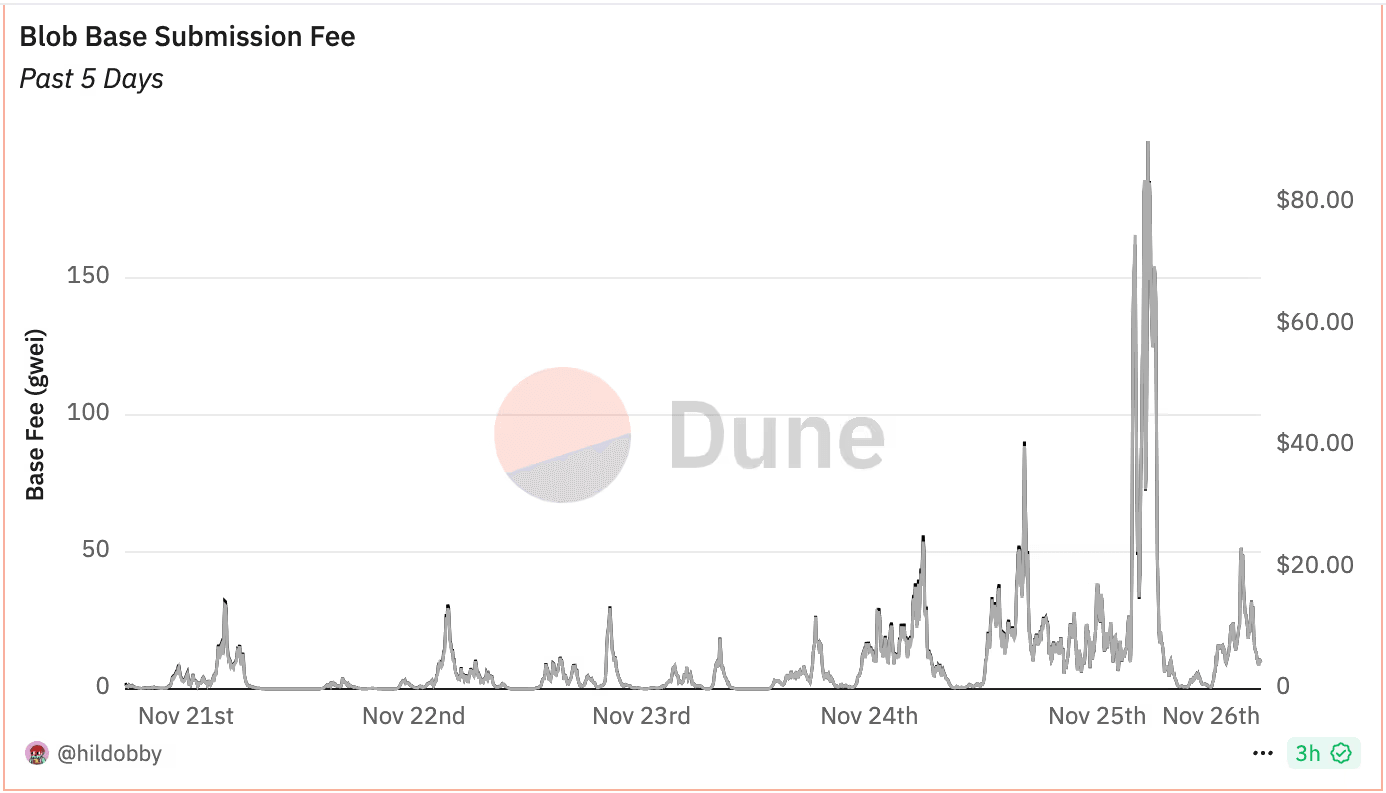

Blob fees spiked, leading to the burning of over 166 ETH worth $560,000 in the past week.

Ethereum is witnessing a surge in "blob" usage, an effective data management tool introduced earlier this year, signaling that more users are embracing layer-2 scaling solutions for faster and more affordable transactions.

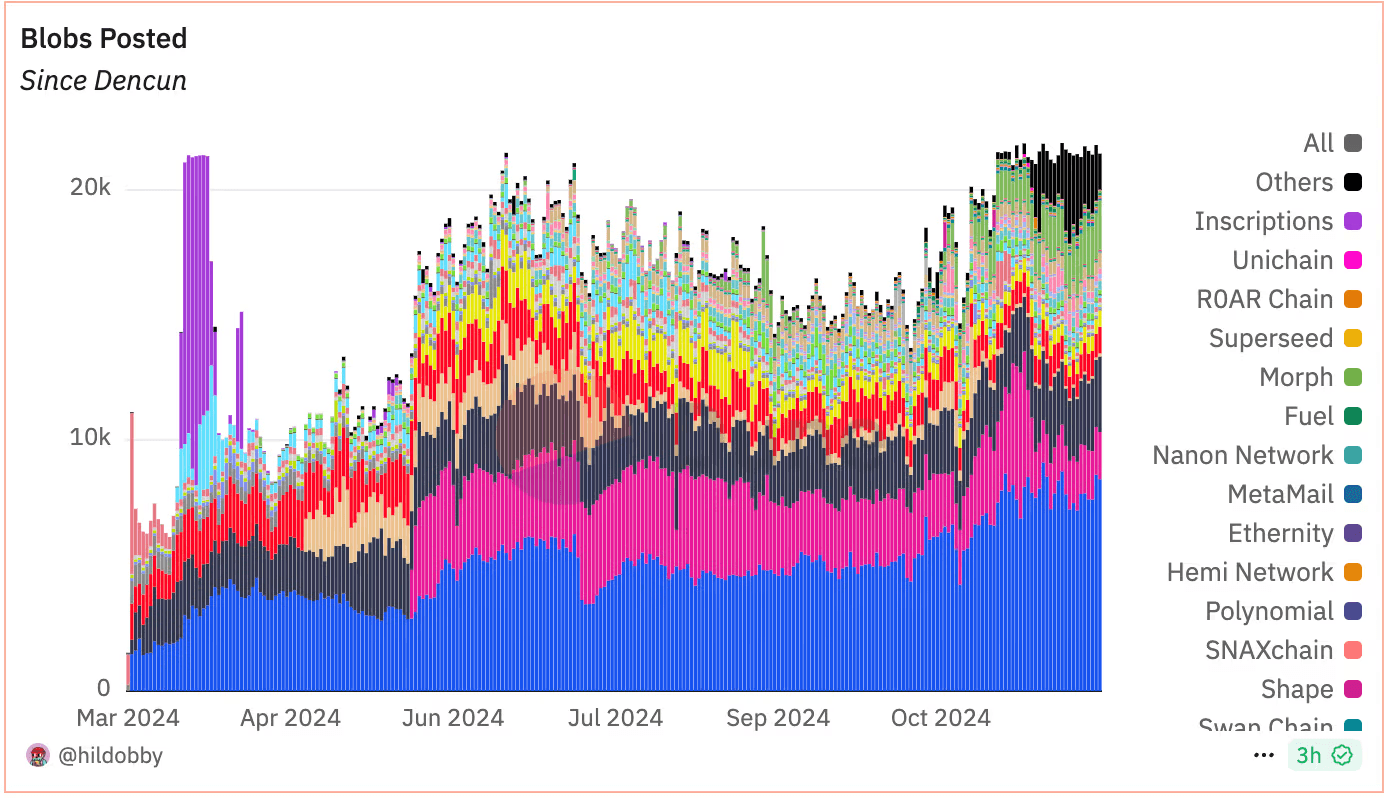

The number of blobs or binary large objects posted to Ethereum has consistently averaged more than 21,000 this month, matching the record activity seen in March, according to pseudonymous data analyst Hildobby's Dune Analytics dashboard.

Ethereum's Dencun upgrade, which went live earlier this year, introduced blobs, which attach large data chunks to regular transactions, storing data offchain without congesting the mainnet, unlike call data which is stored permanently. Think of blobs as a consolidated large box filled with letters while paying for an entire box instead of call data, which is akin to paying for each letter posted separately.

The spike in the number of Blobs posted points to increased adoption of layer-2 protocols such as BASE, Arbitrum, Optimism and others. These protocols use blobs to bundle transactions together, process them off-chain and then post them to the Ethereum main chain for verification.

"Transactions for ETH and its L2s are continuing to reach all-time highs, now +40% vs. the Summer. Meanwhile, the average blob count has increased ~20% driving L2's Blob Fees to a 30-day high," Matthew Siegel, head of digital assets research at VanEck, said on X.

Blobs posted on Ethereum by layer 2s

Blobspace is a dedicated area within Ethereum's blocks where layer 2s temporarily post their data, but it comes with a cost, depending on network conditions. Note that these blob fees paid in Ethereum's native token ether are burned just as transaction fees, taking out the cryptocurrency's circulating supply from the market. This contradicts the popular narrative that layer-2 protocols are predatory to the mainchain.

The blob base submission fee spiked as high as $80 on Monday, the highest since March, and the average number of blobs posted in each ethereum block rose to 4.3. More importantly, blob fees have burned over 166 ETH worth $560,000 in the past seven days, the ninth largest, according to ultrasound.money.

"Blob fees have historically been very low since the implementation of blobs in EIP4844 as they have their own fee market which has largely not seen price discovery. Recently, as onchain activity has begun to spike, demand for blobspace on the L1 has increased, and the blob fee market has entered price discovery," Artemis said in the newsletter.

The data suggests potential ether outperformance ahead. The second-largest cryptocurrency by market value, rose to a four-month high of $3,546 Monday, outperforming bitcoin's 5% drop, but has since pulled back to $3,370, CoinDesk data show.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.