Ethereum bears trapped while waiting for ETH to break $2,500

- Ethereum price has been halted at the $2,500 level, stubbornly defended by buyers.

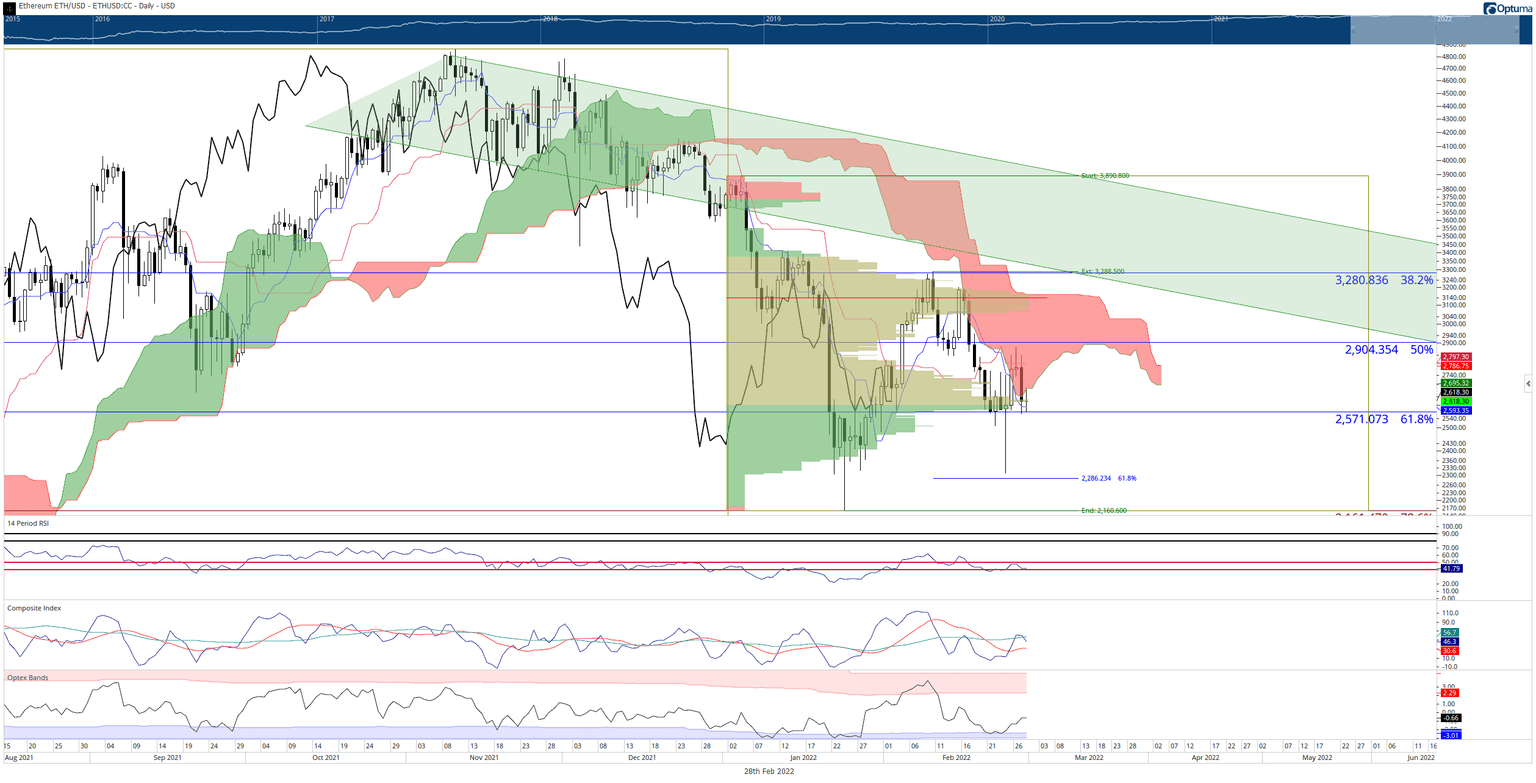

- Bearish Ichimoku entry is now confirmed on the daily chart, signaling extreme weakness and risks of imminent price drops.

- ETH is now at a make-or-break point for bulls.

Ethereum price action showed some relief from near-term selling pressure by closing inside the Ichimoku Cloud this past Saturday. However, continued concerns over Russia’s invasion of Ukraine and the mention of nuclear weapons dropped ETH on Sunday to a loss of nearly 7%. However, despite the drop, ETH’s final support level has held.

Ethereum price must hold $2,500, or ETH will drop another 15%

Ethereum price confirmed one of the most sought-after short-entry patterns in the Ichimoku Kinko Hyo system: an Ideal Bearish Ichimoku Breakout. The conditions for this pattern are as follows:

- Future Senkou Span A is below Future Senkou Span B.

- The Tenkan-Sen is below the Kijun-Sen.

- The current Close is below the Tenkan-Sen and Kijun-Sen.

- The current Close is below the Ichimoku Cloud.

- The Chikou Span is below the bodies of the candlesticks and in open space.

This pattern was confirmed on Sunday’s Close and was the first time this pattern has appeared since December 13, 2021.

Bulls are barely holding onto support at the $2,500 support zone. The 61.8% Fibonacci retracement and the Tenkan-Sen shared the $2,500 level, and both represent the final support structure for Ethereum before it would experience another drop. The final weekly support level for Ethereum price is the bottom of the Ichimoku Cloud (Senkou Span B) and the 61.8% Fibonacci expansion at $2,300. If bulls fail to hold that, then sub-$2,000 are almost guaranteed.

ETH/USD Daily Ichimoku Kinko Hyo Chart

If bulls wish to invalidate any near-term bearish bias, they will need to rally Ethereum price to a close at least above the bottom of the Ichimoku Cloud (Senkou Span A). Unfortunately, that becomes increasingly difficult every day after today, as Senkou Span A rises dramatically to the $3,000 value area around March 15, 2022.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.