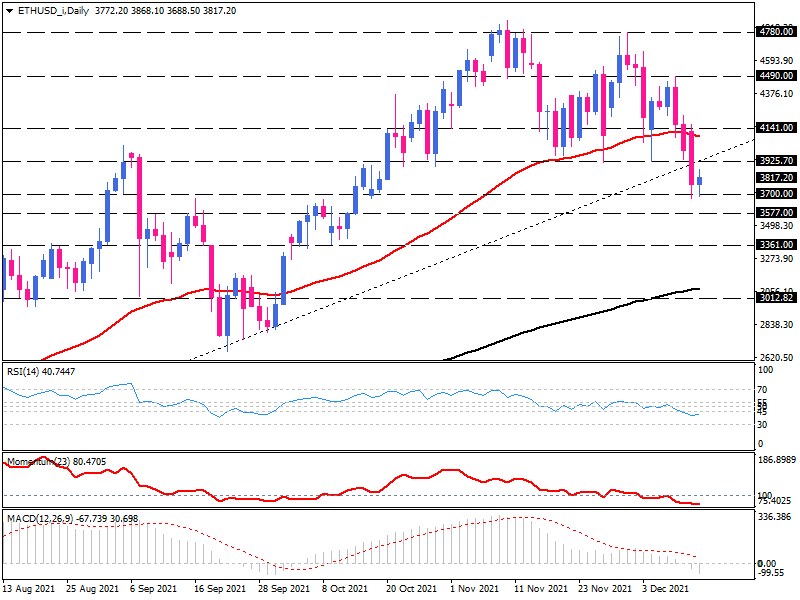

Ethereum has recently retreated from its all-time highs around 4780, and now faces the psychological block of 3700, which is proving difficult to overcome shortly. It is likely that bulls will defend this support level, and for now, they will try to bounce back and retest the broken uptrend line, which is located near the 3925-barricade.

Long-term bearish perspective

Nevertheless, from the long-term perspective, as long as the bearish scenario prevails, further selling pressure would continue to drag Ethereum down to the 3577 and 3361 barriers, respectively. A clear break below these lower supports could therefore push Ethereum towards the 200-day EMA as the next key level to watch.

In the case of momentum oscillators, there seems to be a tendency to sell. The RSI is floating in bearish territory and momentum is pointing down, below its baseline of 100. The MACD triggered a bearish signal, dragging itself into negative territory, moving below its signal line.

Alternatively, if the bullish momentum peaks, then the buyers will be able to leap over the broken trendline. Hence, they will be watching the 4141 handle and further action will prompt buyers to challenge last week's high at the 4490-mark.

Ethereum on the daily chart

The content of this material and/or any information provided should in no way be construed, expressly or by implication, directly or indirectly, as advice, recommendation, or suggestion of an investment strategy in relation to a financial instrument and is not intended to provide a sufficient basis for making investment decisions in any way. Any information, views or opinions presented in this material have been obtained or derived from sources believed to be reliable, but Errante makes no warranty as to their accuracy or completeness. Errante accepts no liability for losses arising from the use of this data and information. The data and information contained herein are for background purposes only and make no claim to be complete or comprehensive.

Recommended Content

Editors’ Picks

Shiba Inu eyes positive returns in April as SHIB price inches towards $0.000015

Shiba Inu's on-chain metrics reveal robust adoption, as addresses with balances surge to 1.4 million. Shiba Inu's returns stand at a solid 14.4% so far in April, poised to snap a three-month bearish trend from earlier this year.

AI tokens TAO, FET, AI16Z surge despite NVIDIA excluding crypto-related projects from its Inception program

AI tokens, including Bittensor and Artificial Superintelligence Alliance, climbed this week, with ai16z still extending gains at the time of writing on Friday. The uptick in prices of AI tokens reflects a broader bullish sentiment across the cryptocurrency market.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week. This week’s rally was supported by strong institutional demand, as US spot ETFs recorded a total inflow of $2.68 billion until Thursday.

XRP price could renew 25% breakout bid on surging institutional and retail adoption

Ripple price consolidates, trading at $2.18 at the time of writing on Friday, following mid-week gains to $2.30. The rejection from this weekly high led to the price of XRP dropping to the previous day’s low at $2.11, followed by a minor reversal.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.