Ethereum and altcoins gear up for alt season with this move in Bitcoin dominance

- Bitcoin dominance is declining from its peak, supporting the narrative of a price rally in altcoins and Ethereum.

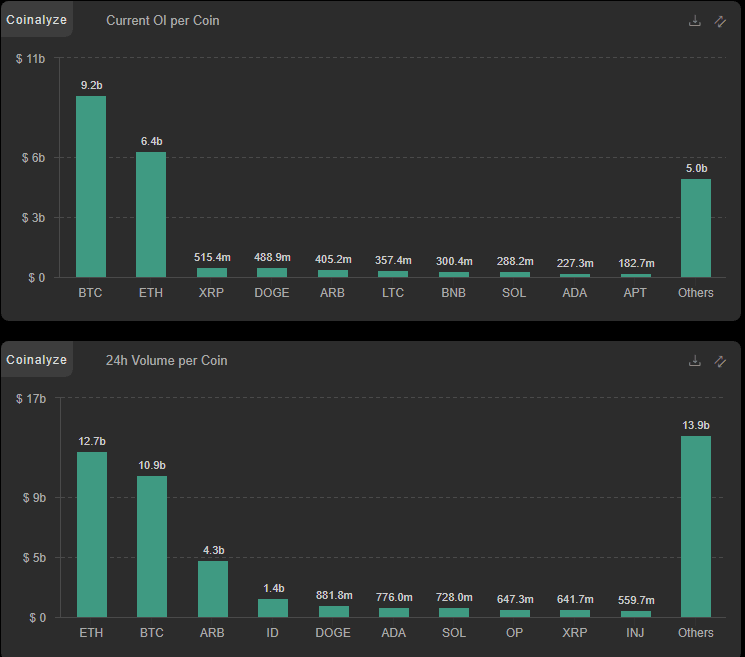

- Analysts have identified a shift in large Open Interest and trade volume to altcoins over the past 24 hours.

- Experts believe the best-trending moves will come as top altcoins are undervalued.

Ethereum and altcoins have witnessed a sizeable Open Interest shift, leading the crypto market in trade volume. Experts noted the shift as a sign of the upcoming alt season. Alt season signals the rotation of capital from Bitcoin to altcoins.

Also read: Cardano whale activity signals this move in ADA price

Ethereum and altcoins lead in large Open Interest and trade volume

Based on data from crypto intelligence tracker Coinalyze, the Open Interest (OI) in different altcoins has climbed over the past 24 hours. OI is a crucial indicator of market participants’ interest and commitment to an asset. Higher the OI, the higher the liquidity and expected trade volume in the market.

Analysts have noted an increase in the 24-hour trade volume in different altcoins, fueling a bullish thesis for the alt season.

Altcoin OI and trade volume

Bitcoin dominance experienced a pullback to 47.48% after recently hitting a peak above 49%. This is another factor that drives the alt-season narrative. A decline in Bitcoin dominance is typically followed by capital rotation to altcoins and results in an alt season.

Top altcoins remain undervalued

Adam, a technical expert, argues that altcoins are currently undervalued. Most alternative cryptocurrencies in the ecosystem are trending similar to FTM, rotating and ranging within a band.

A lot of alt-season talk, but a lot of altcoins looking very similar to FTM (on the left) are still sitting inside the 1std dev bands of a yearly vwap.

— adam (@abetrade) April 15, 2023

If we are about to truly have alt season, the best trending moves are yet to come.

A chart on the right of ETH for reference of… pic.twitter.com/QOdjwqfmJY

The analyst argues that altcoin prices will likely trend higher and break out of the band when the alt season begins. These moves would indicate the start of an alt season in top assets.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.