Ether prints record winning streak as London hard fork looms

Ether has notched a 12-day winning streak, the longest ever.

Ether looks to extend its record daily winning streak in the runup to a planned upgrade on Ethereum’s blockchain that could significantly reduce the cryptocurrency’s supply growth.

The second-largest cryptocurrency by market cap was trading 1.6% higher on the day near $2,600 at press time, having rallied 43% over an unbroken string of 12 straight daily price gains, according to Coinbase data.

“Ether has notched a 12-day winning streak, the longest ever,” blockchain analytics firm IntoTheBlock tweeted early today, citing $2,598 and $2,753 as key resistance levels on the path toward $3,000.

ETH daily chart. Source: TradingView

Aside from bitcoin’s price recovery from $30,000, ether may have received a boost from Ethereum’s upcoming 11th backward-incompatible upgrade, or hard fork, slated to happen on Aug. 4.

The so-called London hard fork contains four Ethereum Improvement Proposals (EIP), of which EIP-1559 will activate a mechanism that would burn a portion of fees paid to miners. Once it takes effect, increased network usage will result in a higher amount of ETH being burned, thereby curbing the cryptocurrency’s supply growth over time.

The upgrade may bring ether a store-of-value or deflationary-asset appeal in the eyes of some investors – a narrative so far largely focused on bitcoin. The top cryptocurrency’s supply is capped at 21 million, and its per-block issuance is reduced by 50% every four years.

Under simulations run by Dune Analytics, the upgrade would have burned more than 2.9 million coins in 365 days if implemented a year ago, amounting to over 70% net reduction in supply growth.

“The highly anticipated Ethereum London hard fork event will expose users to a more flexible and cheaper fee structure and introduce a mild burn effect, billed to make ether deflationary,” Greg Waisman, co-founder and COO at the global payment network Mercuryo, said. “The coin has trailed an uptrend from the weekend, and we may see this brewing positive sentiment over the coin shoot its price to $3,000 in the coming days/weeks following the update.”

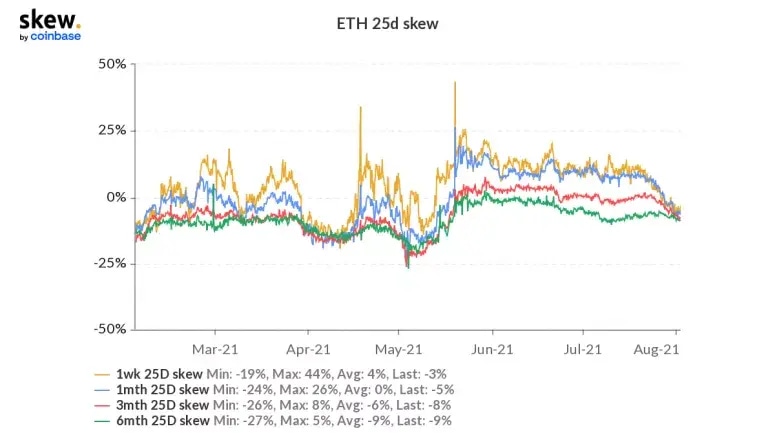

Options data shows investors are positioning for continued gains. Both long-term and short-term put-call skews are flashing negative values for the first time in nearly three months. That’s a sign of greater demand for calls or bullish bets relative to puts.

One-week, one-, three- and six-month put-call skews hover below zero, an across-the-board bullish market positioning last observed in early May.

Ether put-call skews. Source: Skew

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.