Ether heads for 'death cross'

Though ether (ETH) is up more than 3.5% this week, it is still on track to form a so-called death cross.

Ether's 50-day simple moving average is on pace to move below its 200-day moving average, according to charting platform TradingView. The cryptocurrency's last death cross occurred in late January 2022.

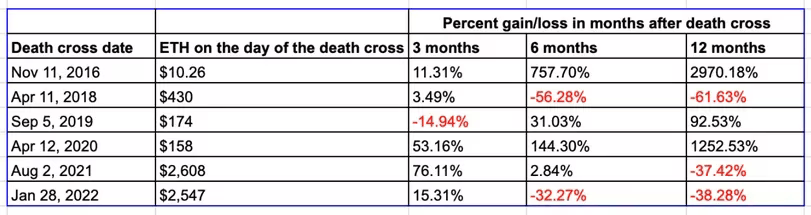

The death cross shows the short-term trend is now underperforming the long-term direction and is widely considered a long-term bearish indicator. But past numbers suggest otherwise.

Since its inception, ether has seen six death crosses, of which only three lived up to the reputation, and the rest caught traders on the wrong side of the market.

Death cross is not reliable as a standalone indicator. (CoinDesk/TradingView) (CoinDesk/TradingView)

Ether nursed double-digit losses at the end of 12 months following the death cross confirmations dated April 11, 2018, Aug. 2, 2021 and Jan. 28, 2022. In other words, a trader holding a short for 12 months following the occurrence of these death cross would have made handsome returns.

On the contrary, a trader holding a short position for 12 months following the first, third and fourth death cross would have missed out on triple-digit price rallies.

Most death crosses turned out to be contrary indicators, with prices rallying and averages following suit to produce a golden cross within three to six months of the preceding death cross.

To conclude, the death cross is unreliable as a standalone indicator. That said, the impending death cross is consistent with the bearish outlook in the ether options market and lingering concerns about the slowdown in Ethereum's network usage.

Ether changed hands at $1,710 at press time.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.