Ether ETFs debut modestly compared to blockbuster Bitcoin launch

Spot Ether ETFs made their long-awaited entrance on the market yesterday (Tuesday, July 23rd), generating over $1 billion in trading volume. While this marks a significant milestone for the world of Ethereum, it pales in comparison to the explosive debut of spot-Bitcoin ETFs back in January, which saw a staggering $4.6 billion traded on the first day.

Did Ether ETFs underwhelm, or is this just the beginning of a steady climb? Let's dive in and explore the implications of this launch for the future of Ethereum.

Ether ETFs: The emergence of a new way to invest in Ethereum

For those unfamiliar with Ethereum, let us quickly recap what it is.

Ether (ETH) is the native cryptocurrency of the Ethereum network, the second-largest blockchain platform in terms of market capitalisation. Unlike Bitcoin, which is largely used as a digital currency, Ethereum is a programmable blockchain that enables developers to create decentralised apps (dApps) and smart contracts.

This feature has fuelled the growth of Decentralised Finance (DeFi), a rapidly expanding ecosystem of financial products and services, as well as other blockchains, based on Ethereum.

Spot-Ethereum ETFs: A gateway to Ethereum

Ether ETFs, offering a convenient way to invest in Ethereum without directly holding the cryptocurrency, have finally arrived. This launch, backed by established financial institutions like BlackRock and Fidelity alongside crypto-focused firms like Grayscale, signifies the surging interest in digital assets across all corners of the financial landscape.

This allows a broader range of investors, both retail and institutional, to participate in the Ethereum ecosystem. Compliance is the core of institutional finance, in which stringent standards are crucial. This has historically been a significant hurdle for institutional investors who have been hesitant to enter the crypto market.

Regulatory ambiguity and the difficulty of directly obtaining and holding crypto assets have been major deterrents. However, the introduction of Ether ETFs provides a compelling alternative that bridges the gap for individuals looking to invest in Ethereum.

The introduction of Ether ETFs is a big milestone for Ethereum, since it has the ability to promote platform usage and investment, much like Bitcoin ETFs did.

Spot-Bitcoin ETFs: A blockbuster debut that Paved the way for ETFs on ETH

Earlier this year, the debut of spot Bitcoin ETFs in the United States was a huge success. These ETFs directly hold Bitcoin, allowing investors to watch the cryptocurrency's price without having to buy, store, and secure the tokens.

The record-breaking trading volume witnessed on the launch day of Bitcoin ETFs underscored the significant investor interest in cryptocurrencies. This surge in demand paved the way for the recent debut of Ether ETFs. Since their January launch, Bitcoin ETFs have attracted a remarkable $17 billion in net inflows, further solidifying this interest (FactSet).

In the shadow of Bitcoin: Why might Ether ETFs struggle?

While the arrival of Ether ETFs marks a significant milestone for Ethereum, some experts predict their trading volume will likely fall short of the explosive debut witnessed with Bitcoin ETFs.

Firstly, the sheer size of the Bitcoin market dwarfs Ethereum's. This translates to a much larger pool of potential investors already familiar with Bitcoin. Bitcoin's established presence and longer history have allowed it to gain widespread recognition, even among those with limited knowledge of cryptocurrencies.

Secondly, Ethereum's technology and purpose are perceived as more complex compared to Bitcoin. While both function as cryptocurrencies, their underlying structures and functionalities differ. Bitcoin, often viewed as a "digital gold," primarily functions as a store of value. Its technology is relatively simpler, focusing on a secure network for peer-to-peer transactions.

Ethereum, on the other hand, is a more versatile platform. It not only facilitates transactions, but also powers dApps and smart contracts. This broader functionality, while powerful, can appear more complex to some investors unfamiliar with these concepts.

Finally, Ether ETFs currently lack staking, a feature that allows cryptocurrency holders to earn additional yield by locking up their coins. This feature's absence in Ether ETFs might deter some investors who prioritise earning passive income from their crypto holdings.

While Ether ETFs might not replicate the blockbuster launch of Bitcoin ETFs, they could still carve out a significant niche as a diversification tool for investors who are looking for exposure to a different blockchain ecosystem, or for potentially higher growth.

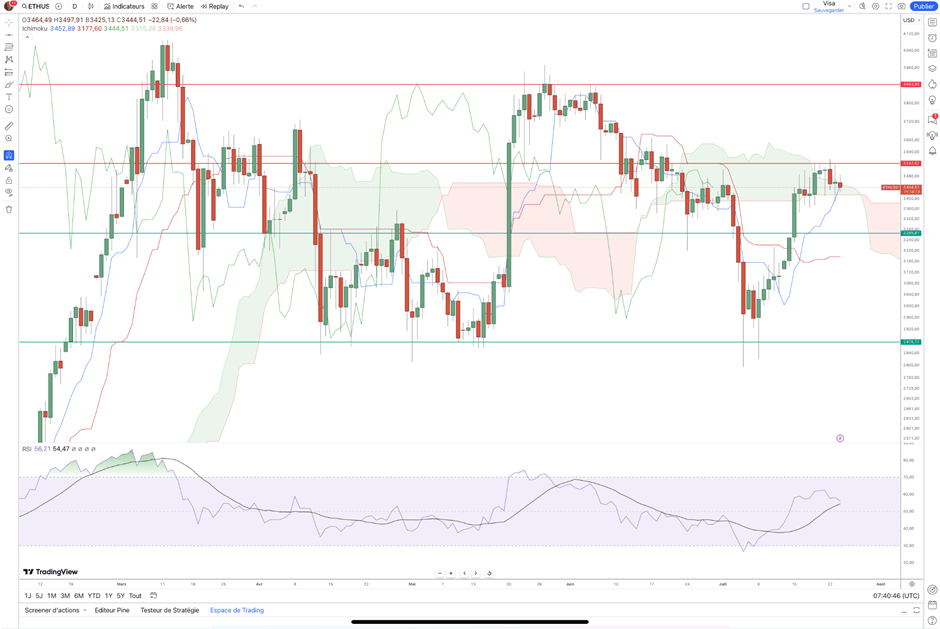

ETH/USD technical snapshot

ETH/USD Daily Chart - Source: TradingView With ActivTrades Data

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and as such is to be considered to be a marketing communication.

All information has been prepared by ActivTrades (“AT”). The information does not contain a record of AT’s prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

Stay up to date with what's moving and shaking on the world's markets and never miss another important headline again! Check ActivTrades daily news and analyses here.

Author

Carolane de Palmas

ActivTrades

Carolane graduated with a Masters in Corporate Finance & Financial Markets and got the AMF Certification (Financial Markets Regulator in France). Afterward, she became an independent trader, investing mostly in European and American stocks/indices.