- Ethereum is rangebound with no signs of recovery.

- Foley survey revealed, that long-term investors choose Ethereum.

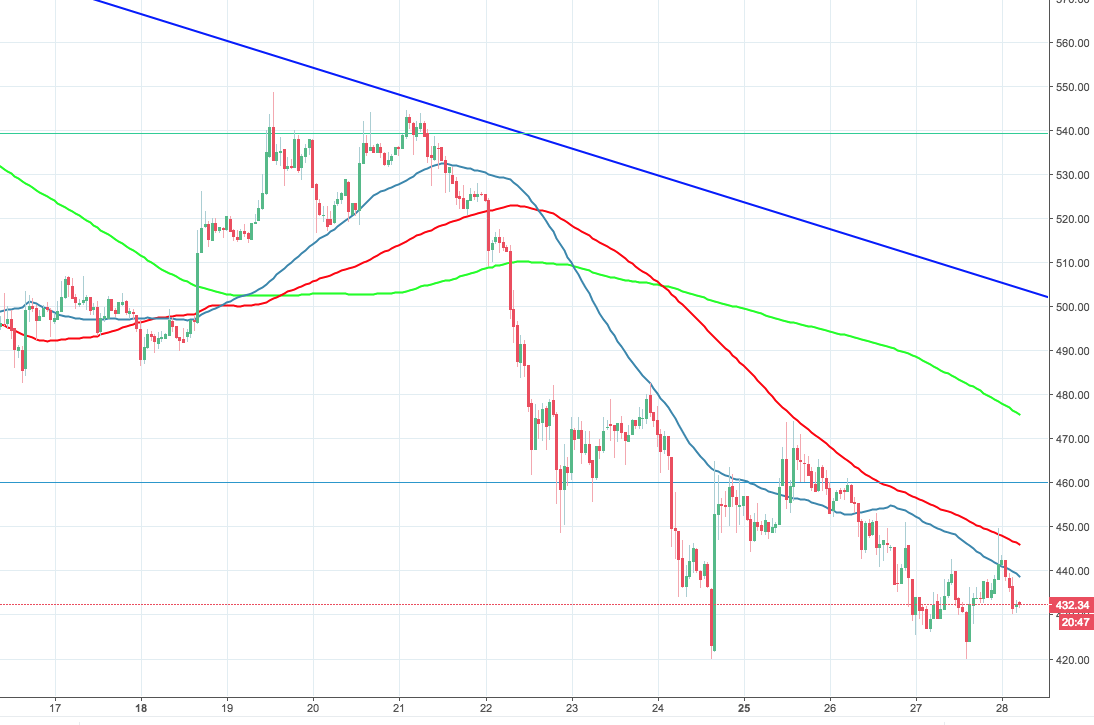

Ethereum is changing hands at $433 at the time of writing. The coin is mostly unchanged on a daily basis, however, it is down about 1.8% from the start of the day.

The US-based company Foley & Lardner LLC surveyed a vast pool of respondents and found out that an overwhelming majority (84%) wants the industry to be regulated, especially when it comes to controversial that initial coin offerings.

Bitcoin and Ethereum are the most popular coins, the report shows; however it is hardly surprising. Bitcoin is believed to gain broader acceptance as a means of payment - this view shared by 43% of respondents, while Ethereum is regarded as the best investment option (38%).

"Bitcoin and Ethereum are the ‘safest’ crypto assets to build a business around because they are the only crypto assets that the SEC and the CFTC agree upon. That’s not to say that Bitcoin or Ethereum investment is safe – it’s not. It’s also not a prediction that these assets will outlast all of their competitors. A competitor of Bitcoin and Ethereum could arise to take their place, or the entire asset class might disappear," Patrick Daugherty from Foley's blockchain task force writes.

Ethereum's market value has settled at $43.5B, while the average daily trading volume reduced to $1.3B from eye-popping $4B on Monday. It was a one-off increase of undetermined origin.

On the intraday level, ETH/USD is capped by 50 and 100-SMA at $438 and $445 respectively (hourly chart). A sustainable move higher will pave the way towards 200-SMA at $475 and critical $500 handle. An extended sell-off will bring $420 into focus.

ETH/USD, the hourly chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

US SEC may declare XRP a 'commodity' as Ripple settlement talks begins

The US Securities and Exchange Commission (SEC) is considering classifying XRP as a commodity in its ongoing settlement talks with Ripple Labs. The SEC is considering classifying XRP as a commodity in its ongoing settlement talks with Ripple Labs.

Ethereum developers delay Pectra mainnet launch with new testnet Hoodi

Ethereum developers announced on Thursday that they will launch a new testnet, "Hoodi," to enable validators and infrastructure providers to adequately test the upcoming Pectra upgrade before mainnet deployment, according to Tim Beiko, who runs Ethereum's core protocol meetings.

Cardano Price Prediction: ADA could hit $0.50 despite high probability of US Fed rate pause

Cardano price stabilized above $0.70 after posting another 5% decline in its 3rd consecutive losing day. Multiple ADA derivatives trading signals are leaning bullish, but the US trade war impact outweighs the positive shift in inflation indices.

Stablecoin regulatory bill receives green light during Banking Committee hearing

The US Senate Banking Committee voted on Thursday to advance the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, which aims to establish proper regulations for stablecoin payments in the country.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.