ETH/USD: Ethereum is grossly undervalued, Blockfyre’s research reveals

- Four factors point out that ETH is too cheap.

- On the weekly chart, ETH/USD is supported by SMA100.

Ethereum (ETH) is grossly undervalued at the current levels, according to the study performed by the crypto research firm Blockfyre. The team outlined at least four factors to support their conclusions.

We charted several progress indicators for Ethereum against its price development since its genesis. Besides other factors, the following 4 indicators have caught our interest the most. We feel comfortable to state that Ethereum is significantly undervalued at current prices? – they wrote on Twitter.

The four metrics include the development activity, gas usage, mean dollar investment age, and miner’s balance. Considering that all of them demonstrate a positive trend, EHT is undervalued and poised for a strong price increase.

Blockfyre is a research company based in Germany and focused on in-depth research of the digital asset market and investments.

According to Blockfyre co-founder Simon Dedic, the sharp decrease of ETH price in 2018 was caused by ICO projects selling large amounts of ETH to obtain capital in dollars. Meanwhile, miners and investors are mostly holding ETH since 2018.

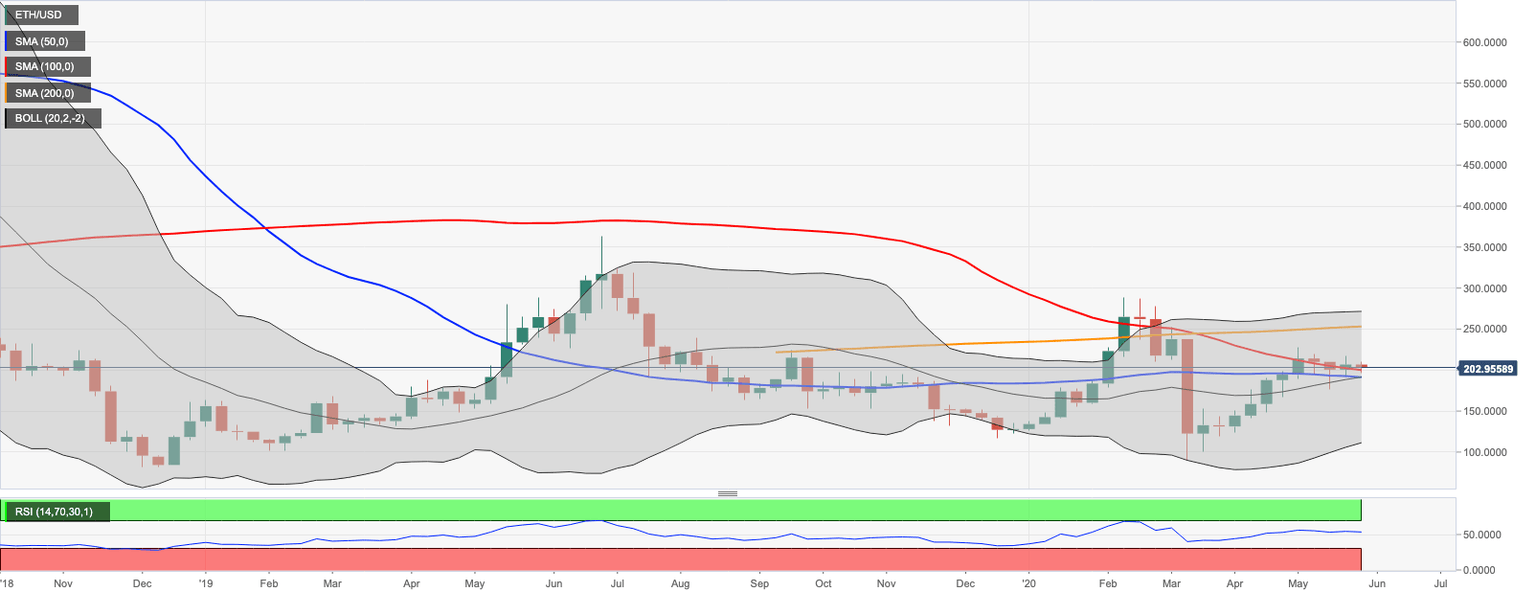

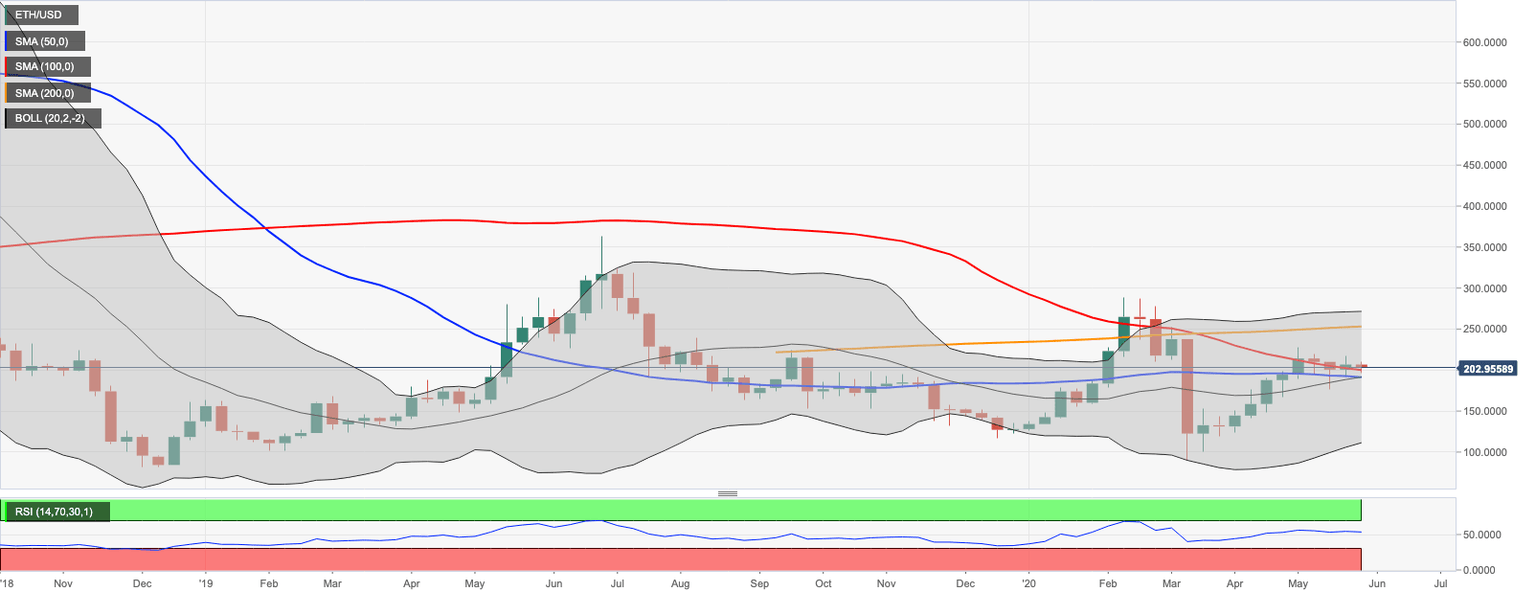

ETH/USD: Technical picture

At the time of writing, ETH/USD is changing hands at $202.50. The coin found strong support at the psychological $200.00, which is strengthened by weekly SMA100. This technical barrier has been limiting the decline since the previous week. If it is broken, the sell-off will extend towards the lowest level of the previous week at $191.49 with weekly SMA50 and the middle line of the weekly Bollinger Band located below that level.

On the upside, a sustainable move of $210.00 is needed for the upside to gain traction. Once this barrier is out of the way, the price will move towards the highest level of the previous week at $217.00 and $220.00.

ETH/USD weekly chart

Author

Tanya Abrosimova

Independent Analyst