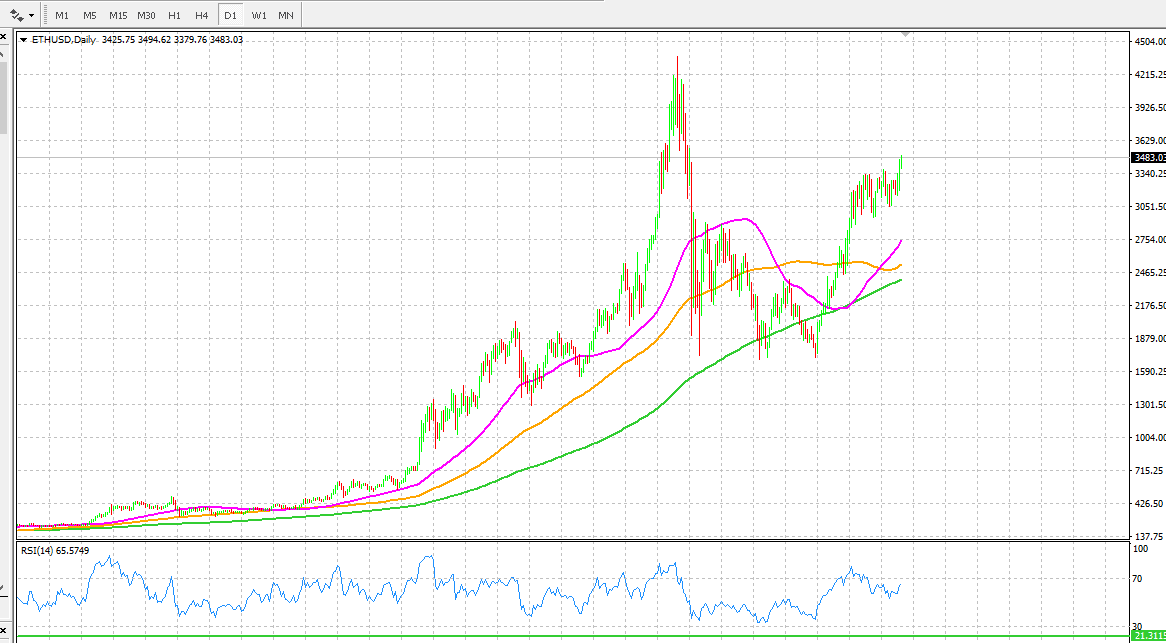

ETH ready to move higher

Industry development

FTX.US is the first company in the United States to acquire an approved crypto derivatives platform, LedgerX. The merged company will focus on developing products for institutional and retail investors while also attempting to establish a strong relationship with regulatory bodies. FTX.US announced in July that its daily volume accelerated nearly 150 times between June 2020 and June 2021, reaching an incredible $993 million on April 22. In order to attract more retail investors, the company intends to obtain a BitLicense that will allow it to trade spot products in New York. FTX.US also launched its NFT marketplace nearly three months ago, and the segment has grown significantly since then.

ETH’s price action

ETH’s price is looking highly bullish now as the price has broken out of its consolidation zone. ETH’s price has been trying to break out of its current consolidation zone for a while as you can see from the chart below however bulls never had the momentum on their side. However, it seems like that the momentum is finally o their side and ETH trader have one important price point in mind and that is break above the precious all time high. It is very much possible that we may see the ETH price breaking above the 5K if the momentum continues like and in fact the 10K target for ETH is also looking much more realistic now.

Author

Naeem Aslam

Zaye Capital Markets

Based in London, Naeem Aslam is the co-founder of CompareBroker.io and is well-known on financial TV with regular contributions on Bloomberg, CNBC, BBC, Fox Business, France24, Sky News, Al Jazeera and many other tier-one media across the globe.