Espresso, project for composability between blockchains, pushes main product live

Espresso, a closely watched blockchain project to coordinate cross-chain transactions and interactions, shared Monday that its main product, known as the confirmation layer, has gone live.

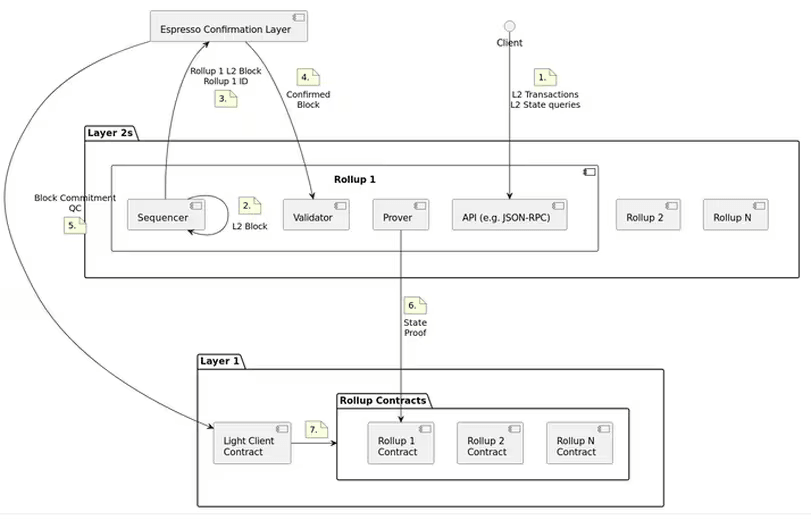

According to the team, the confirmation layer will be a critical piece of infrastructure for composability among rollups, allowing for two networks to read and trust each other's blocks of transaction data. A rollup is a type of auxiliary, or "layer-2," network atop a main blockchain, providing a venue for cheaper and faster transactions.

Specific benefits of Espresso's new confirmation layer could include faster bridging of assets between networks, decentralizing a key component of layer-2 blockchains known as the "sequencer," and providing a way for networks to stash reams of transactional data at a low cost, according to the project documentation.

“It's literally a protocol for when a rollup sequencer publishes its blocks to, that once published on the confirmation layer, they can't be changed, even when that chain later settles them to Ethereum,” Ben Fisch, CEO of Espresso Systems, said in an interview with CoinDesk.

Essentially, this takes on the role of a sequencer today, and adds some security to it. Sequencers are a crucial piece of infrastructure in rollups, bundling up transactions from users of the layer 2 so they can be recorded on the layer 1, in this case Ethereum.

“Optimism, for example, takes seven days to settle on Ethereum," Fisch said. "The confirmation layer enforces that whatever was published to the confirmation layer has to be what is eventually published and settled on the L1. And that means that any node that's reading from the conformation layer’s published blocks, can just execute them and know exactly what the state of the rollup is.”

Centralized sequencers

The issue with sequencers is that they are typically run by centralized entities, and pose as a single point of failure.

"As long as that sequencer is honest and doesn't get hacked or compromised, you can just confirm your transactions. That's actually how people use it primarily today – it just creates a massive security risk.” Fisch said. “So while users of the chain rely on it, bridge protocols and applications on other chains can’t. The more you create cross-chain dependencies on what a sequencer says, the more money a hacker can compromise.”

Schematic illustrating Espresso's system architecture (Espresso)

Over time, the confirmation layer will begin to integrate with some of the major rollups in the layer-2 space, like Arbitrum’s nitro stack, Optimism’s OP stack and Polygon’s chain development kit.

In March, Espresso raised $28 million in funds to contribute to its products and help with research. The series B round was led by venture capital giant Andreessen Horowitz's a16z Crypto and saw participation from many of the developer firms behind the leading layer-2 rollups like Arbitrum, Starknet and Polygon.

In addition to the confirmation layer, Espresso moving forward will focus its research and development in the field of composability and sequencing.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.