- EOS/USD has lost over 1% in a matter of minutes amid a widespread sell-off on the market.

- The price may slip to $2.54 before the recovery resumes.

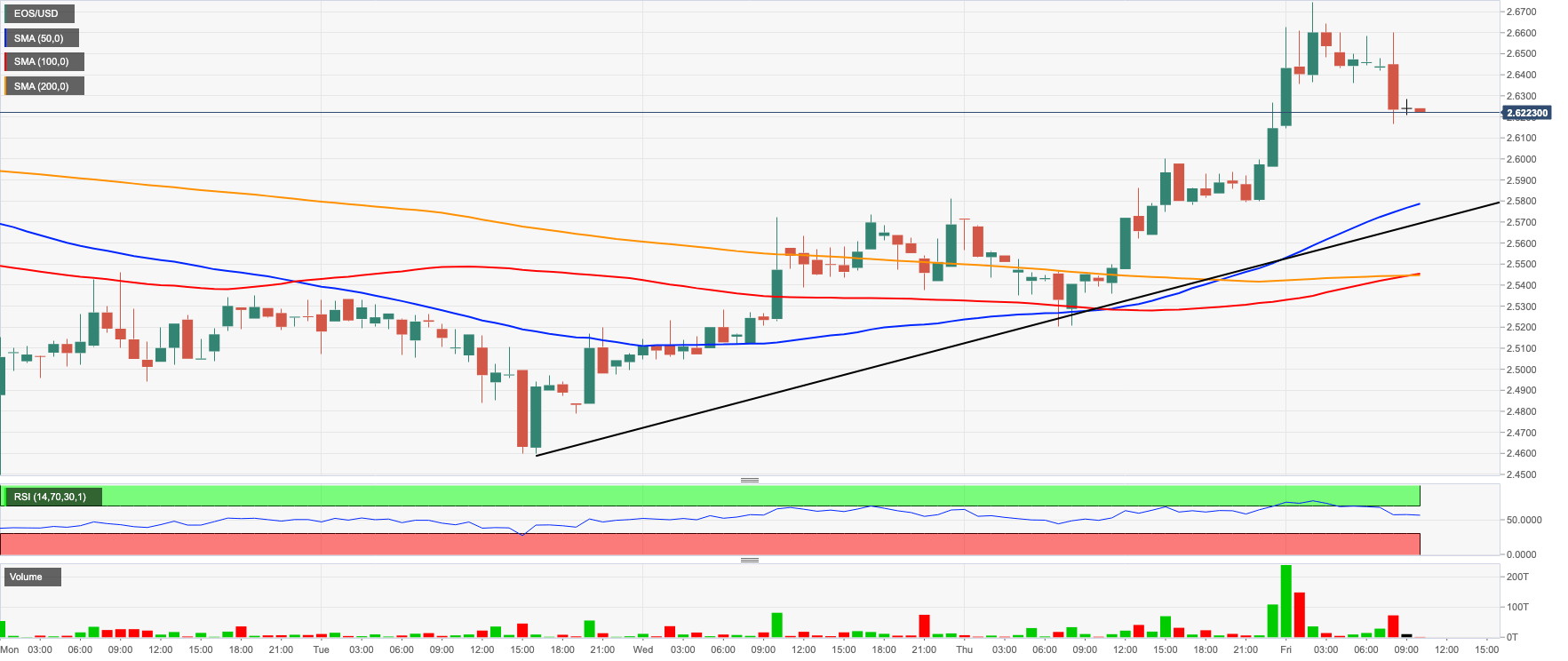

EOS/USD attempted a recovery above 4-hour SMA200 (currently at $2.65) and touched the intraday high at $2.67. However, the upside momentum proved unsustainable as the price of the digital asset dropped to $2.62, losing over 1% of its value in a matter of minutes. Since the start of the day, EOS/USD has barely changed, though it is still 3.5% higher from this time on Thursday.

The retreat below 4-hour SMA200 has worsened the short-term technical picture and pushed the price inside the recent consolidation range. Considering the downward-looking RSI on the intraday chart, more sell-off may be expected towards the lower boundary of the channel. Let’s have a closer look at the technical picture to see what may be in store for EOS.

EOS/USD: technical picture

On a 1-hour chart, EOS/USD is still moving within an upside trend, while the recent retreat qualifies as a natural correction after a sharp increase from 2.55 on Thursday to $2.67 on Friday. If the sell-off gains traction, the price may retest 1-hour SMA50 at $2.58, closely followed by the short-term bullish trendline. This area has a potential to stop the correction and trigger a new recovery attempt. The next support comes at $2.54 (a combination of 1-hour SMA100 and SMA200).

EOS/USD 1-hour chart

On the upside, a move above 4-hour SMA200 is needed to improve the technical picture and bring the short-term recovery back on trac with the next major focus on $2.70, which is closely followed by daily SMA100 at $2.74. In the long-run EOS/USD has a good chance to test this area as the daily RSI points upwards. However, considering the short-term picture we may see a decline towards at least $2.54-$2.50 area before new buyers pop in.

EOS/USD daily chart

-637263441162740761.png)

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

XRP Price Prediction: How Ripple's alignment with the $18.9T tokenization boom could impact XRP

Ripple (XRP) approached the critical $2.00 level during the Asian session on Friday after a minor correction the previous day reinforced higher support at $1.95.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC and ETH show weakness while XRP stabilizes

Bitcoin (BTC) and Ethereum (ETH) prices are hovering around $80,000 and $1,500 on Friday after facing rejection from their respective key levels, indicating signs of weakness. Meanwhile, Ripple (XRP) broke and found support around its critical level.

Can Trump's tariff pause and declining inflation keep Bitcoin afloat? Experts weigh in

Bitcoin (BTC) dived below $80,000 on Thursday despite US Consumer Price Index (CPI) data coming in lower than expected and President Donald Trump's 90-day reciprocal tariffs pause on 75 countries.

Bitcoin miners scurry to import mining equipment following Trump's China tariffs

Bitcoin (BTC) miners are reportedly scrambling to import mining equipment into the United States (US) following rising tariff tensions in the US-China trade war, according to a Blockspace report on Wednesday.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.