EOS price analysis: EOS/USD loses over 5% amid sharp sell-off on the market

- EOS/USD recovered from the intraday low to trade at $2.70.

- The upside is limited by the psychological $3.00.

EOS, the 8th largest digital asset with the current market value of $2.5 billion hit $2.53 low on Wednesday amid a sharp sell-off on the cryptocurrency market, At the time of writing, EOS/USD is changing hands at $2.70, still down over 5% on a day-to-day basis. The coin is moving in a lockstep with the market, which means it is vulnerable to further losses if bitcoin continues the decline.

EOS/USD, the technical picture

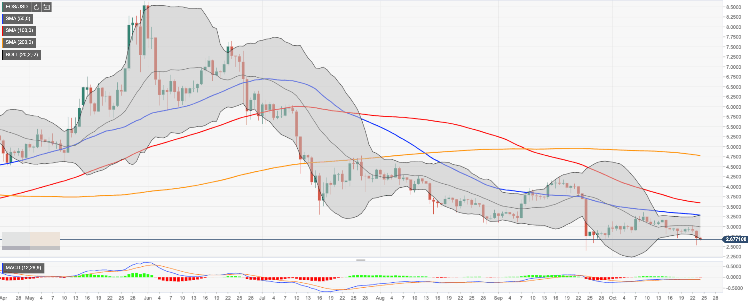

On a daily chart, EOS/USD is moving within the recent channel limited by $2.50 on the downside and $3.3 on the upside. The coin bottomed at $2.4 on September 24 and has been range-bound ever since. Wednesday's low of $2.53 creates initial support, which is followed by the above-mentioned lower boundary of the consolidation channel at $2.50. A sustainable move above this handle will open up the way towards $2.40 where fresh buying orders are likely to appear and push the price mack inside the range.

On the upside, we need to see a sustainable recovery above $3,00 for the recovery to gain traction. This resistance, created by the middle line of the Bollinger Band on a daily chart, has been limiting the upside momentum since October 16. The price attempted to break above this barrier on numerous occasions, but all of the attempts failed. Once it is out of the way, the upside is likely to gain traction with the next focus on $3.3. This is the upper boundary of the consolidation channel strengthened by SMA50 (Simple Moving Average) daily and the middle line of the Bollinger Band on a daily chart.

EOS/USD, the daily chart

Author

Tanya Abrosimova

Independent Analyst