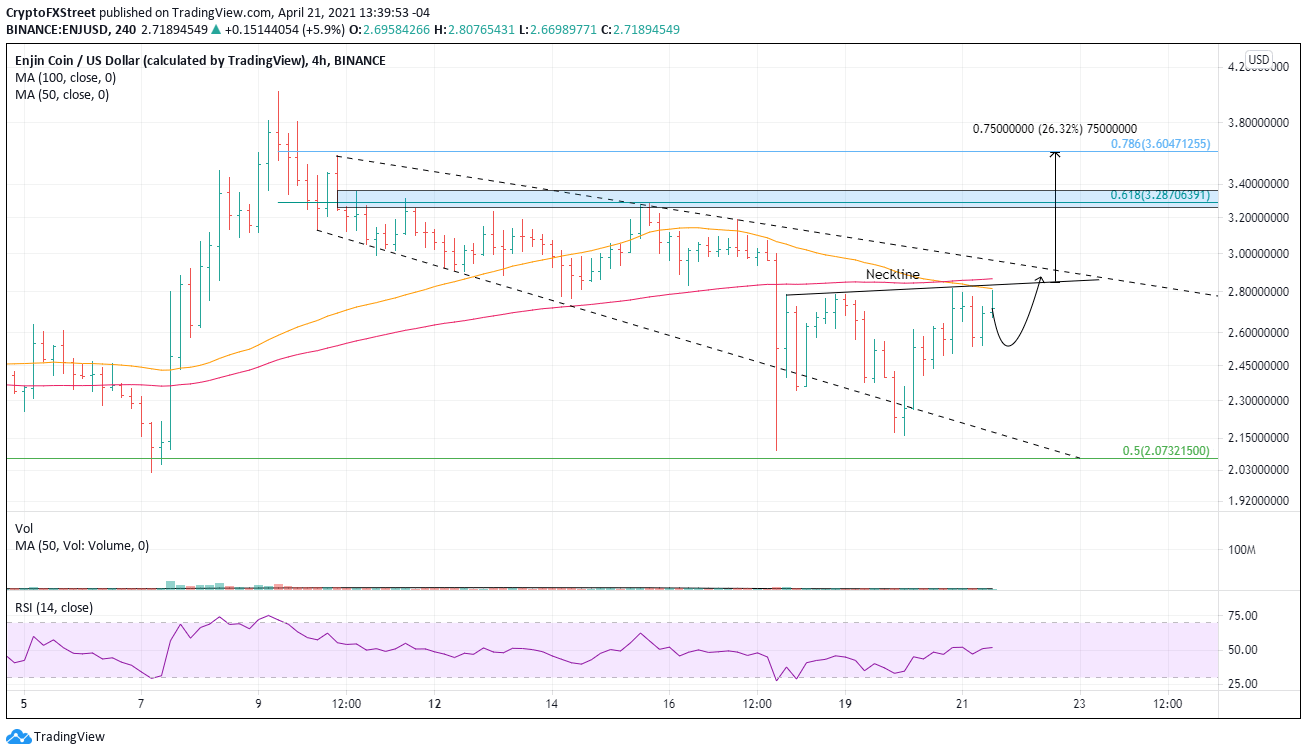

- Enjin Coin price is quietly forming a head-and-shoulders bottom pattern.

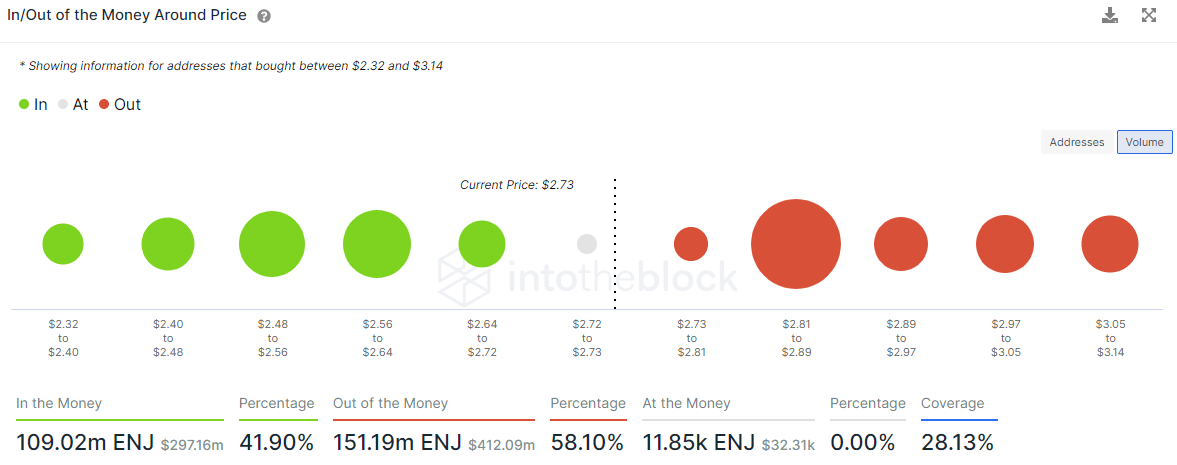

- IOMAP data shows notable resistance along the potential neckline.

- ENJ has grown into a leading ecosystem of integrated digital products, for trading and monetizing games.

Enjin Coin price outlook has shifted to neutral. It is on the verge of completing a high probability bottoming pattern, showing a positive divergence from some of the other cryptocurrencies that have printed new correction lows over the last couple of days.

Enjin Coin price has impressive short term potential if technicals align

Bottoms are rarely straightforward, and this will not be any different for ENJ as the Intotheblock In/Out of the Money Around Price data shows a big cluster of resistance from $2.81 to $2.89, which sits at the neckline of the potential head-and-shoulders bottom. A total of 154 addresses bought 82.55 million in that range.

ENJ IOMAP data

On the 4-hour chart, ENJ is close to completing a head-and-shoulders bottom with the neckline trigger at $2.85. Resistance will quickly emerge at the declining trend line at $2.92, but a successful break out will expose the altcoin to a quick rally to the 50% retracement of the April decline at $3.29, where it coincides with some price congestion created last week.

The approximate next target is the 78.6% retracement at $3.60, representing just over a 26% gain from the neckline. Depending on the impulsiveness of the rally, ENJ could reach the all-time high at $4.02. If it successfully prints a new high, market participants need to watch the daily Relative Strength Index (RSI) for confirmation.

ENJ/USD 4-hour chart

ENJ support emerges at the 50-day simple moving average (SMA) at $2.38 and then the 50% retracement of the 2021 rally at $2.07. Selling pressure will find the March low at $1.91 a challenge. There is an outside possibility that ENJ reaches the 61.8% retracement at $1.61.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Dogecoin Price Forecast: Bulls deploy $355M in DOGE longs amid Gensler exit confirmation

Dogecoin price crossed $0.40 on Friday, after a weeklong consolidation that saw DOGE tumble 13% from last week’s peak. Derivative market reports link the DOGE rally to Gary Gensler’s imminent exit.

Crypto Today: XRP gains 10%, Cardano, XRP, and DOGE price rallies, delay Bitcoin’s $100K breakout

The global cryptocurrency sector pulled $230 million capital inflows on Friday, as markets reacted positively to news of SEC Chair Gary Gensler’s imminent exit.

Cardano Price Forecast: ADA could rally by another 30% as on-chain data signals bullish sentiment

Cardano (ADA) surged 24% to $0.98 on Friday following rising weekly active addresses, increased open interest and spot buying pressure.

Shiba Inu holders withdraw 1.67 trillion SHIB tokens from exchange

Shiba Inu trades slightly higher, around $0.000024, on Thursday after declining more than 5% the previous week. SHIB’s on-chain metrics project a bullish outlook as holders accumulate recent dips, and dormant wallets are on the move, all pointing to a recovery in the cards.

Bitcoin: Rally expected to continue as BTC nears $100K

Bitcoin (BTC) reached a new all-time high of $99,419, just inches away from the $100K milestone and has rallied over 9% so far this week. This bullish momentum was supported by the rising Bitcoin spot Exchange Traded Funds (ETF), which accounted for over $2.8 billion inflow until Thursday. BlackRock and Grayscale’s recent launch of the Bitcoin ETF options also fueled the rally this week.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.