Enjin Coin price rally secures foothold while ENJ calmly consolidates

- Enjin Coin price overcomes the well-established resistance of a broadening descending wedge pattern.

- ENJ clears the neckline of head-and-shoulders bottom on an intra-day chart.

- An advance of over 70% in six days is a reason to consolidate.

Enjin price strength has made ENJ one of the more notable cryptocurrencies since April 23, registering a 75% gain from the absolute low and, more importantly, installing it in a stronger position to attack the all-time high in the coming weeks.

Enjin price not full of contradictions or vague promises

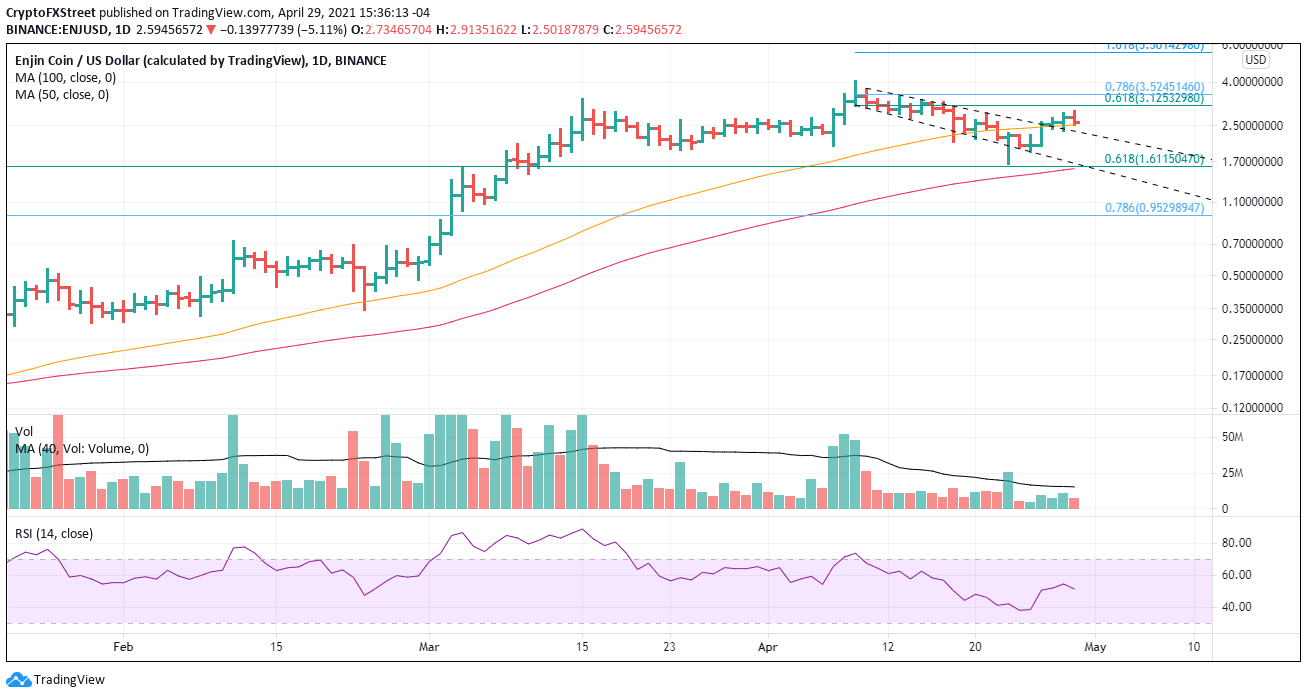

The breakout above the wedge’s trend line and the 50-day simple moving average (SMA) on April 27 was a pivotal development in the ENJ bottoming process. Yesterday’s bullish outside day and push above the April 21 high at $2.85 was a welcomed secondary confirmation.

After a sizeable rally of 75% in a short time, it can be anticipated ENJ will fortify the progress with a mild consolidation along the 50-day SMA at $2.53, with some potential to weaken down to the wedge’s upper trend line at $2.36.

Once the consolidation is complete, ENJ should enter stage 2 of the rebound, carrying the altcoin through the 61.8% and 78.6% Fibonacci retracement levels of the April decline at $3.12 and $3.52, respectively.

The all-time high at $4.03 will be a challenging level, but if ENJ generates a similar momentum surge as the first half of the rally, it should carry Enjin Coin price to the 161.8% extension of the April decline at $5.50.

ENJ/USD daily chart

A reversal back into the broadening descending wedge pattern would discredit the stated bullish outlook and inform market operators that a more complex consolidation is developing or ENJ is bracing for a new correction low.

Early support is the April 25 low at $1.88, which corresponds closely with the March 24 low at $1.92. The dominant price level to watch is $1.60, the intersection of the wedge’s lower trend line with the 61.8% retracement of the 2021 advance and the 100-day SMA. Any further weakness would have long-term bearish implications.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.