Enjin Coin Price Prediction: ENJ to rally 24%, takes another jab at crucial resistance barrier

- Enjin Coin price is at an inflection point, a swift move above which could propel it by 25%.

- On-chain indicators support a move higher for ENJ.

- A breakdown of the support level at $1.412 will invalidate the bullish scenario.

Enjin Coin price shows a higher possibility of an uptrend that could test a critical supply barrier. On-chain metrics add a tailwind to this scenario, hinting that ENJ is primed for a swing high.

Enjin Coin price poised for a move higher

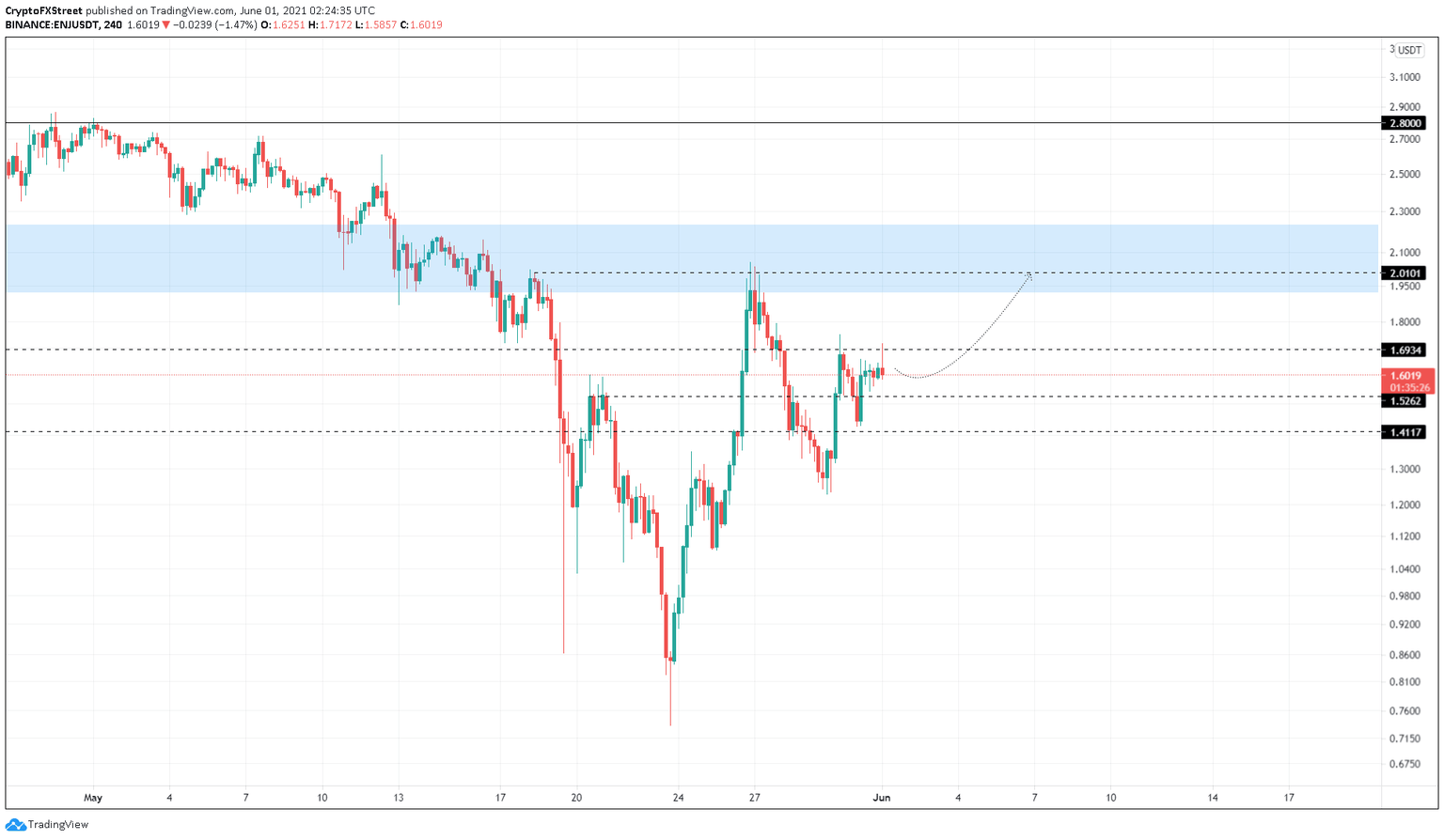

Enjin Coin price is currently trading at $1.602 after facing rejection at a minor resistance level at $1.693. If the buyers slice through this barrier, ENJ will likely rally 25% into the supply zone that extends from $1.922 to $2.234.

Enjin Coin price will likely create a third equal high at $2.01.

ENJ/USDT 4-hour chart

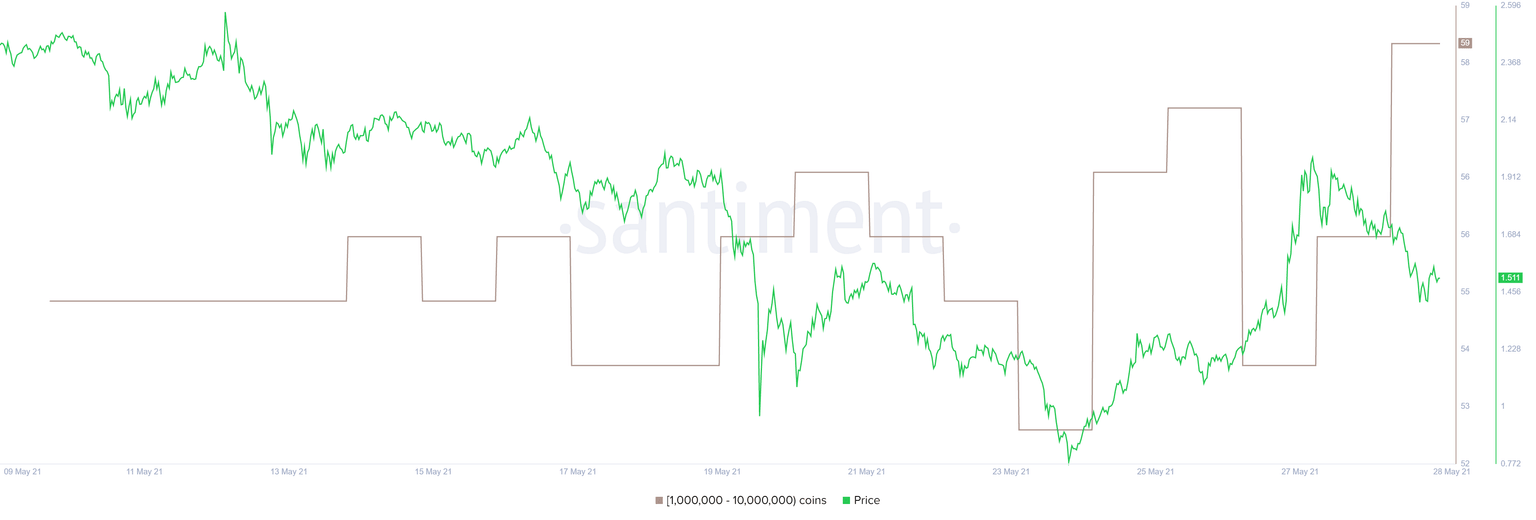

Supporting this move higher is the accumulation that ENJ investors are witnessing. From May 23 to date, whales holding between 1,000,000 to 10,000,000 tokens have increased from 53 to 59.

This 11% rise suggests that these market participants believe in the performance of Enjin Coin price.

ENJ supply distribution chart

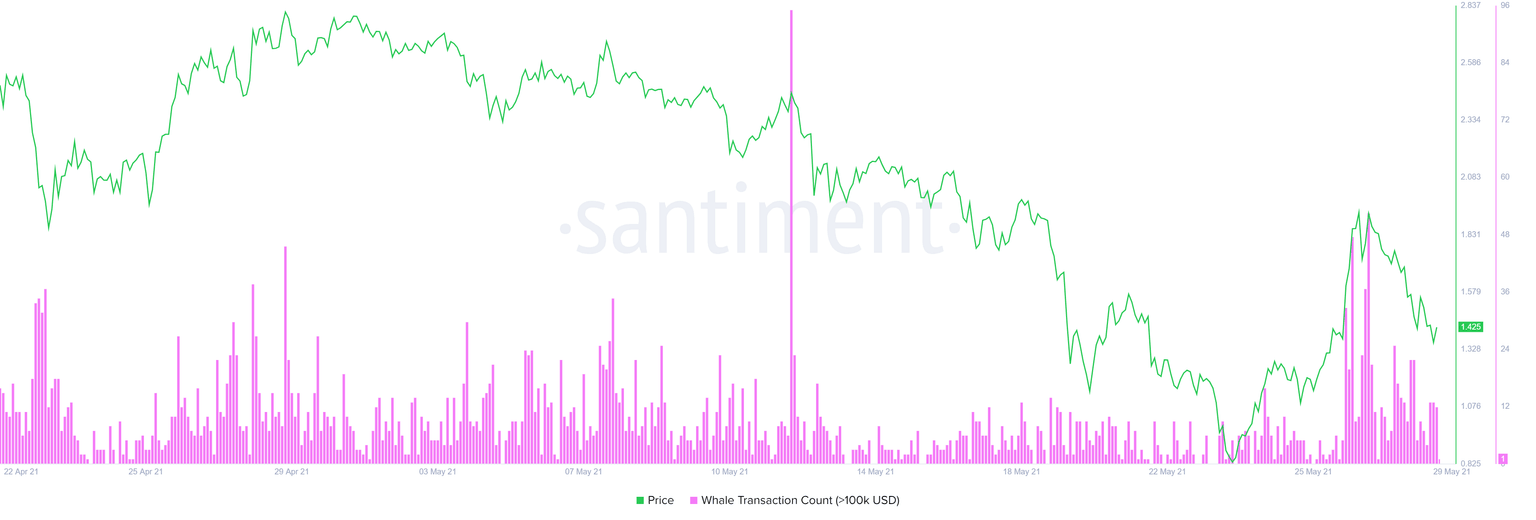

Furthermore, there seems to be no immediate threat of a sell-off, as confirmed by the whale transaction metric. In fact, transfers worth $100,0000 or more have declined from 74 on May 27 to 1 on May 29, suggesting an extremely low possibility of a potential spike in selling pressure.

ENJ whale transaction count chart

While things seem to be looking up, investors need to note that the directional bias for Enjin Coin price after tagging $2.01 is unknown. Therefore, market participants need to exercise caution here.

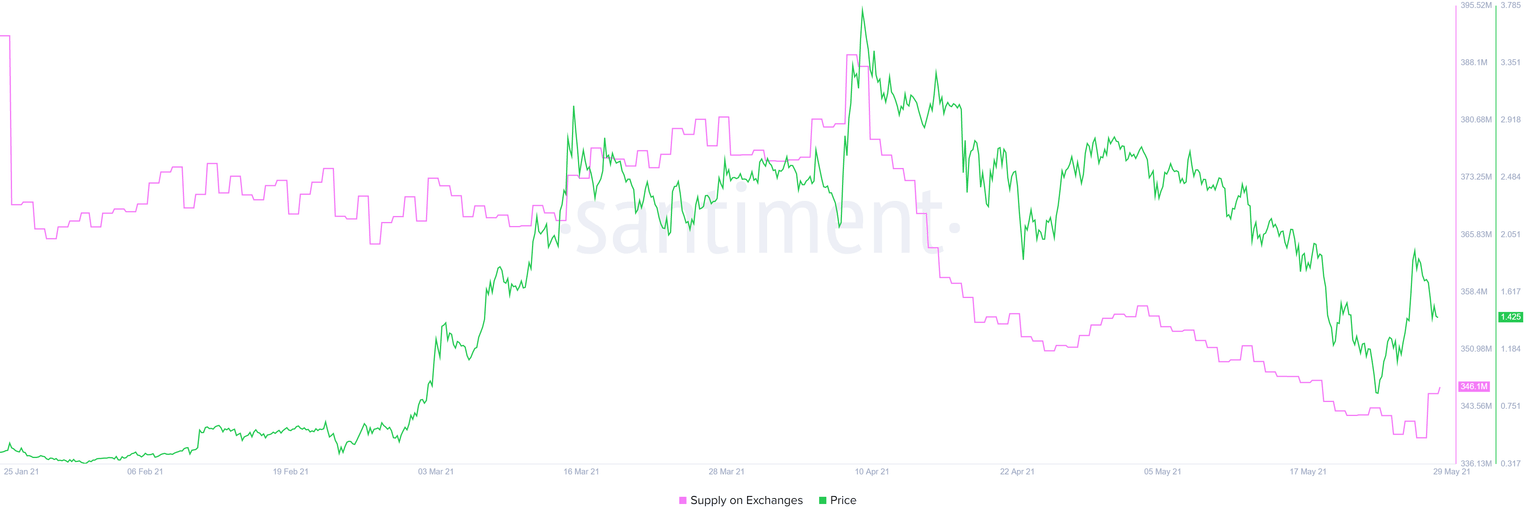

A potential downswing could evolve here after hitting $2.01. Supporting such a move is the slight increase in the supply of Enjin Coin held by exchanges from 343 million to 345 million ENJ from May 23 to date.

ENJ supply on exchanges chart

If Enjin Coin price fails to breach the immediate resistance level at $1.693, it will signal weakening buying pressure. In that case, a breakdown of the support at $1.412 will invalidate the bullish thesis detailed above.

Under these circumstances, Enjin Coin could slide 10% to retest the swing low set up on May 30 at $1.235.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.