- Enjin Coin price has breached the bull flag pattern, signaling a 65% upswing to $4.14.

- The SuperTrend indicator has flashed a buy signal, further supporting the bullish narrative.

- Whales have begun accumulating ENJ, adding credence to the optimistic outlook.

The Enjin Coin price surged nearly 35% on Wednesday after Coinbase announced that it would list ENJ and three other coins. The spike has pierced through a critical resistance level, triggering a massive bullish outlook.

Enjin Coin price eyes new all-time high

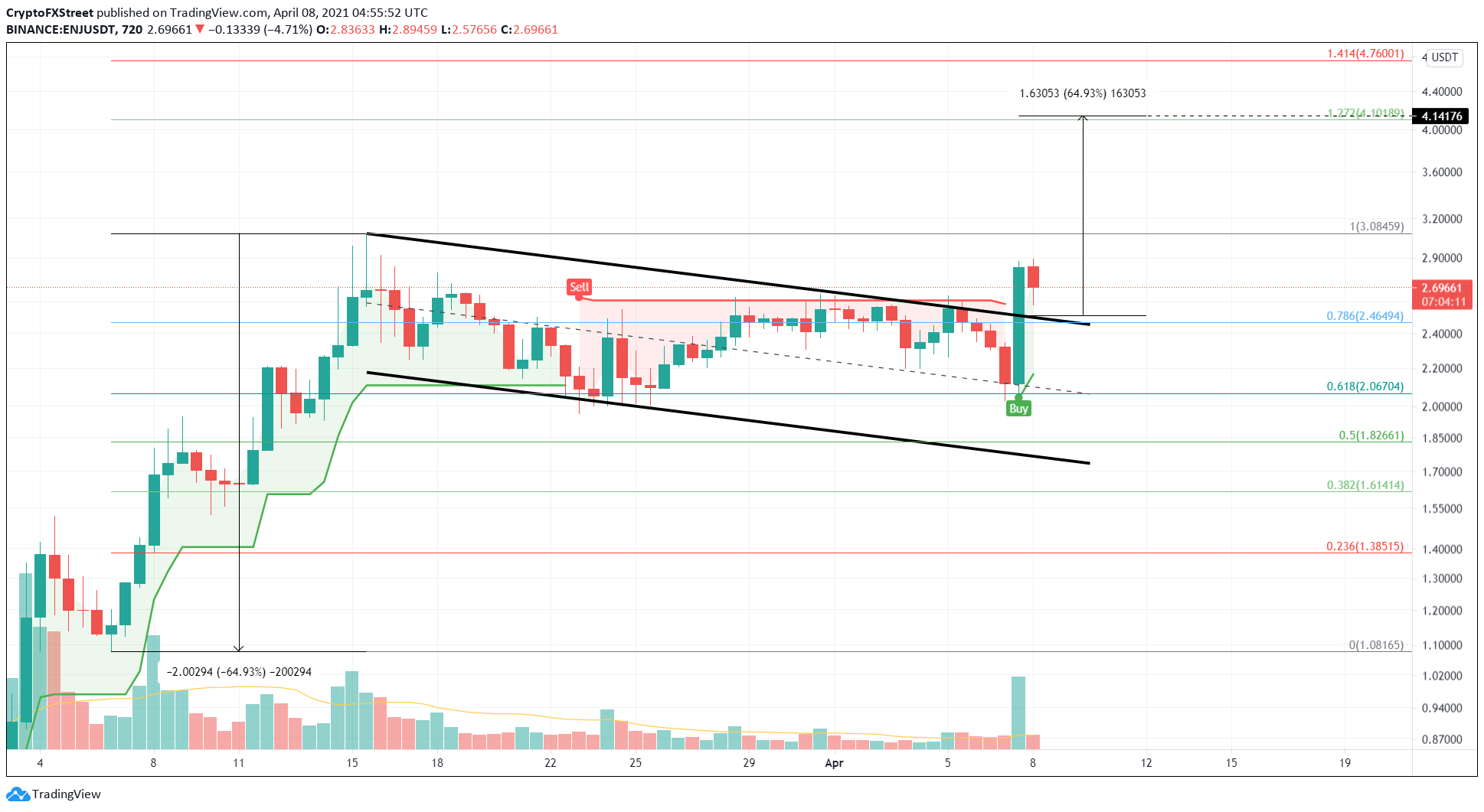

The Enjin Coin price broke out of a bull flag on Wednesday as it skyrocketed 35% after popular US-based exchange Coinbase listed it. This technical formation is a continuation pattern that contains an initial spike in price known as a flag pole and a consolidation in the form of a descending channel, referred to as the flag.

A decisive close above the flag’s upper trend line at $2.51 forecasts a 65% upswing to $4.14. This target is obtained by adding the flag pole’s height to the breakout point.

Adding credence to the bullish outlook is the SuperTrend indicator’s recently spawned buy signal.

Therefore, a continuation of this bullish momentum could propel ENJ toward the 127.2% Fibonacci extension level at $4.14. However, this trajectory has pit stops at $3.08 and $3.60, and the bulls could take a breather around these areas. Hence, investors need to keep a closer eye on these levels.

ENJ/USDT 12-hour chart

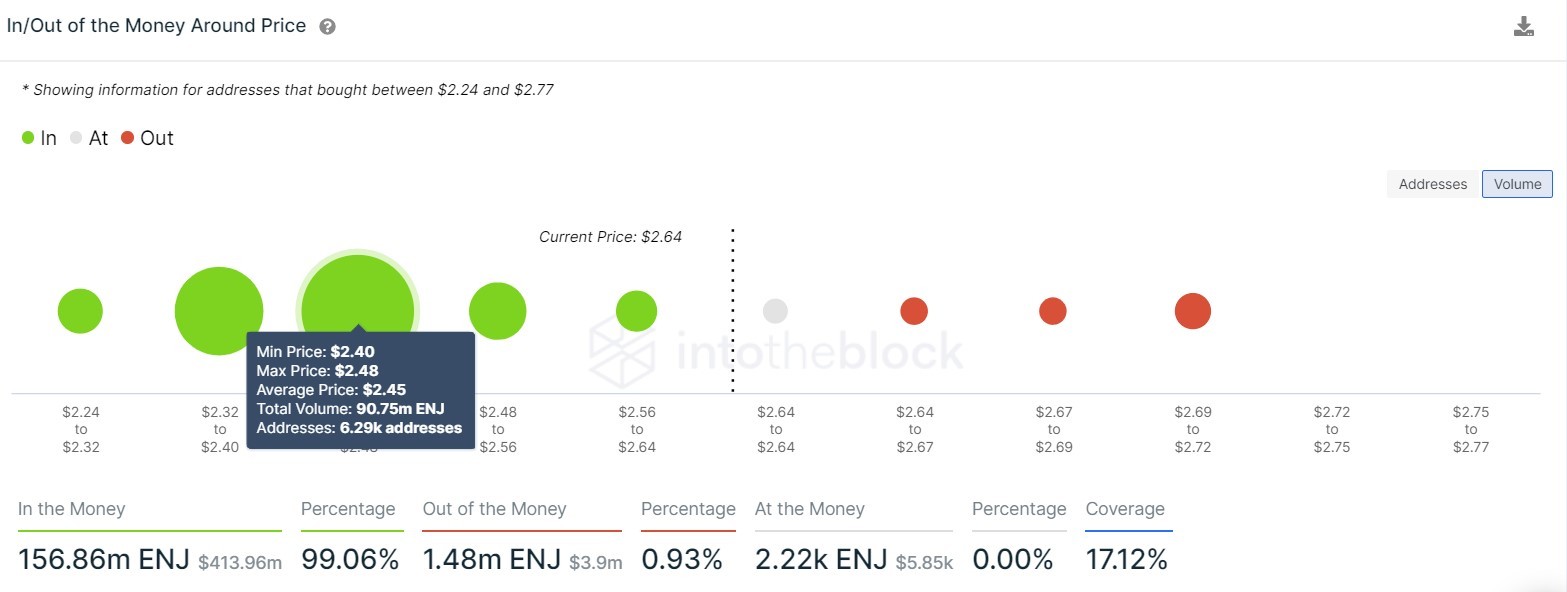

Further adding a tailwind to this bullish narrative is the lack of resistance as seen in IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model.

A stable demand barrier is present at $2.45, where roughly 6,300 addresses hold nearly 90.8 million ENJ tokens. Hence, any short-term bearish momentum is likely to bounce off this level.

Enjin Coin IOMAP chart

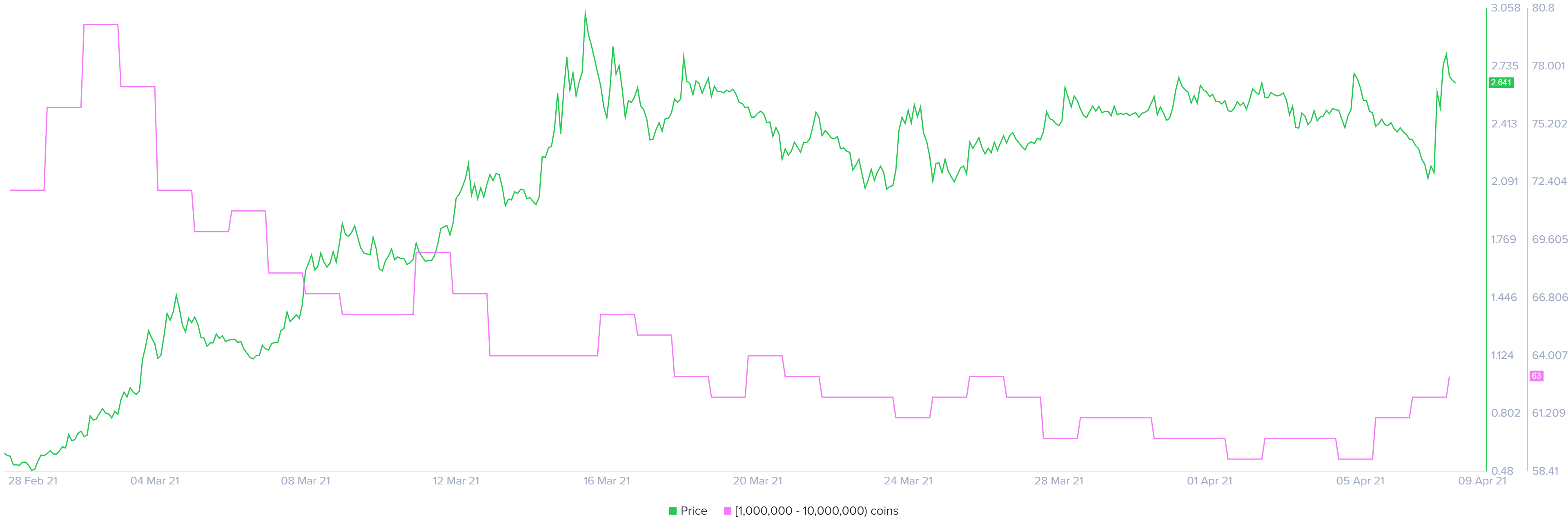

Additionally, the whales holding between 1,000,000 and 10,000,000 ENJ have begun accumulation after constantly off-loading their investments since March 2. At the time of writing, four new investors belonging to this category have joined the Enjin Coin network, which is a 6.7% increase.

This growth represents an increased interest among high net worth market participants in Enjin Coin at the current price levels.

Enjin Coin Supply distribution chart

All in all, the Enjin Coin price looks bullish and shows signs of surging toward the intended target at $4.14. However, if investors decide to book profits, it would increase the selling pressure and trigger a descent.

If this move re-enters the consolidation phase and produces a decisive close below $2.40, the bullish outlook stands to be invalidated. In such a scenario, investors can expect ENJ to slide 13% toward the 61.8% Fibonacci retracement level at $2.06.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Whale grabs 16,000 ETH as Ethereum Foundation vows support for L1, RWA and stablecoins

Ethereum Foundation's Co-Executive Director Tomasz K. Stańczak highlights simplified roadmap scaling blobs and improving L1 performance. Ethereum whale scoops 16,000 ETH, emphasizing growing interest in the token as the price recovers.

Bitcoin retests key resistance at $85K, breakout to $90K or rejection to $78K?

Bitcoin (BTC) price edges higher and approaches its key resistance at $85,000 on Monday, with a breakout indicating a bullish trend ahead. Metaplanet announced Monday that it purchased an additional 319 BTC, bringing its total holdings to 4,525 BTC.

XRP price teases breakout, bulls defend $2 support

Ripple (XRP) price grinds higher and trades at $2.15 during the early European session on Monday. The token sustained a bullish outlook throughout the weekend supported by bullish sentiment from the 90-day tariff suspension in the United States.

Senator Elizabeth Warren launches fresh offensive on crypto

Senators Elizabeth Warren, Mazie K. Hirono, and Dick Durbin want the DoJ’s decision to terminate crypto investigations reversed. The Senators raise concerns over the DoJ’s shift in priorities, terming it a “grave mistake.”

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.