- Enjin Coin price shows temporary retracement after the Coinbase announcement hype fades away.

- Accumulation of buyers around the MRI’s breakout line at $3.15 could spark another bull rally.

- A breakdown of the $2.46 support barrier could invalidate the bullish outlook.

Enjin Coin price shows a swift retracement after the Coinbase listing announcement. However, this move might lead to another explosive rally.

Enjin Coin price eyes higher high

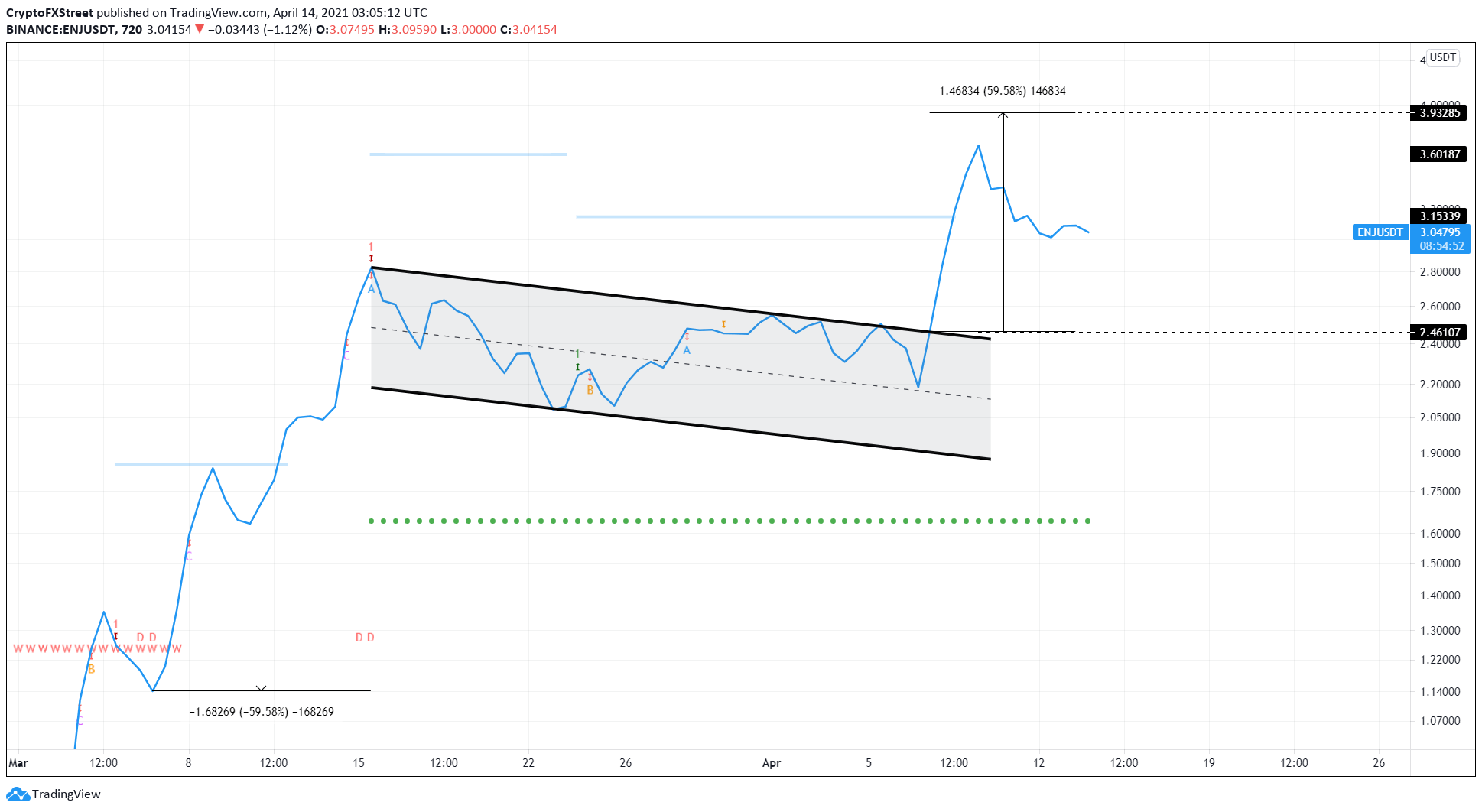

Enjin Coin price was forming a bull flag pattern even before the Coinbase listing announcement. This technical formation is made up of two distinctive moves, an initial burst followed by a consolidation.

ENJ’s 150% upswing from March 6 to March 16 formed the flag pole, while the series of lower highs and lower lows that ensued resulted in a flag. This setup forecasts a 60% upswing, which is the flag pole’s height added to the breakout point.

On April 7, the altcoin breached the flag’s upper trend line, resulting in a 48% upswing to $3.66.

Although the target was in sight, a surge in profit-taking resulted in a 17% retracement to where ENJ is currently trading.

Now, a range-bound move might inspire accumulation among investors, which could result in a 40% upswing to $3.93. A confirmation of this bull rally will arrive after a decisive close above the immediate breakout line presented by the Momentum Reversal Indicator (MRI) at $3.15.

ENJ/USDT 12-hour chart

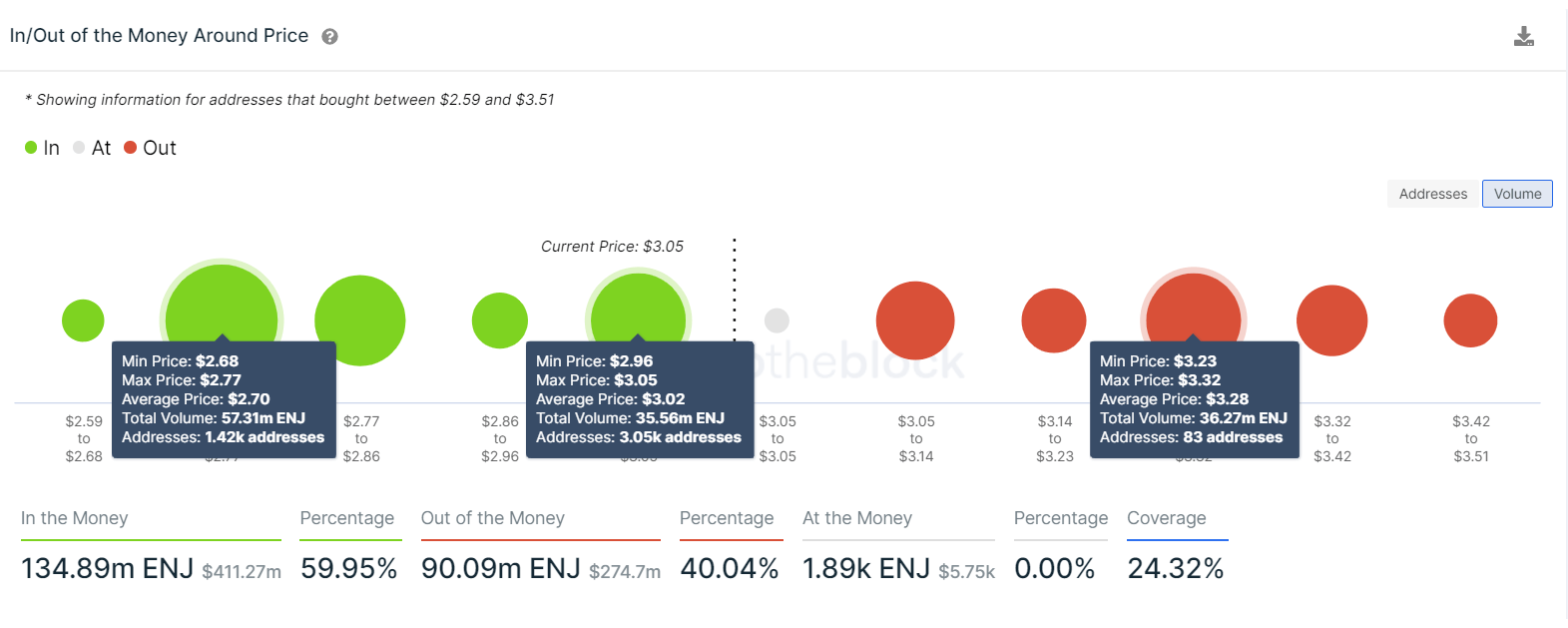

Favoring the bullish thesis is IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, which shows that roughly 4,600 addresses purchased nearly 132 million ENJ tokens between $3.02 and $2.70.

Likewise, underwater investors are present from $3.13 to $3.28, promoting the range-bound movement as mentioned above.

Enjin Coin IOMAP chart

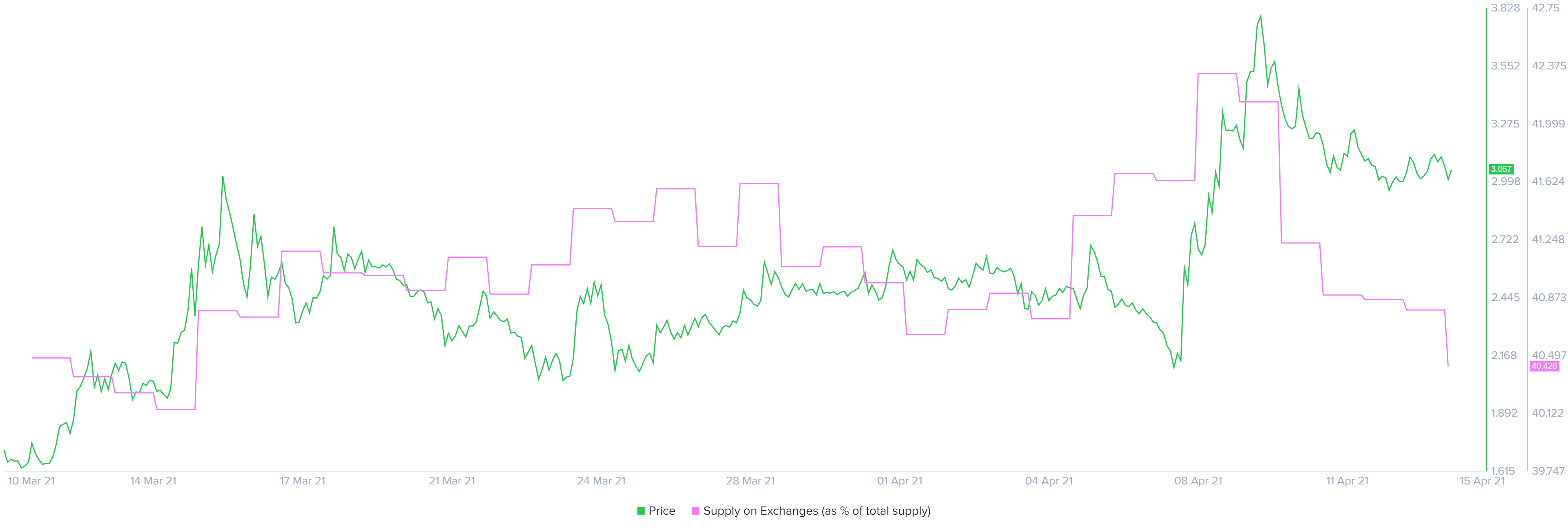

Additionally, supporting a move higher is a 4.4% drop in the ENJ held by exchanges. This reduction from 42.3% to 40.2% suggests that short-term sellers might be done selling, which further promotes the accumulation and a move higher as mentioned earlier.

Enjin Coin supply on exchanges chart

If the sellers breach the demand barrier at $2.46, a bearish picture might come into play. In such a case, a 6% pullback to $2.31 seems likely. A breakdown of this barrier could further push Enjin Coin price by another 6% to $2.17.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.