Enjin Coin network activity explodes sending ENJ price up by 100%

- Enjin price is up by 70% in the past three days after Coinbase listed the digital asset.

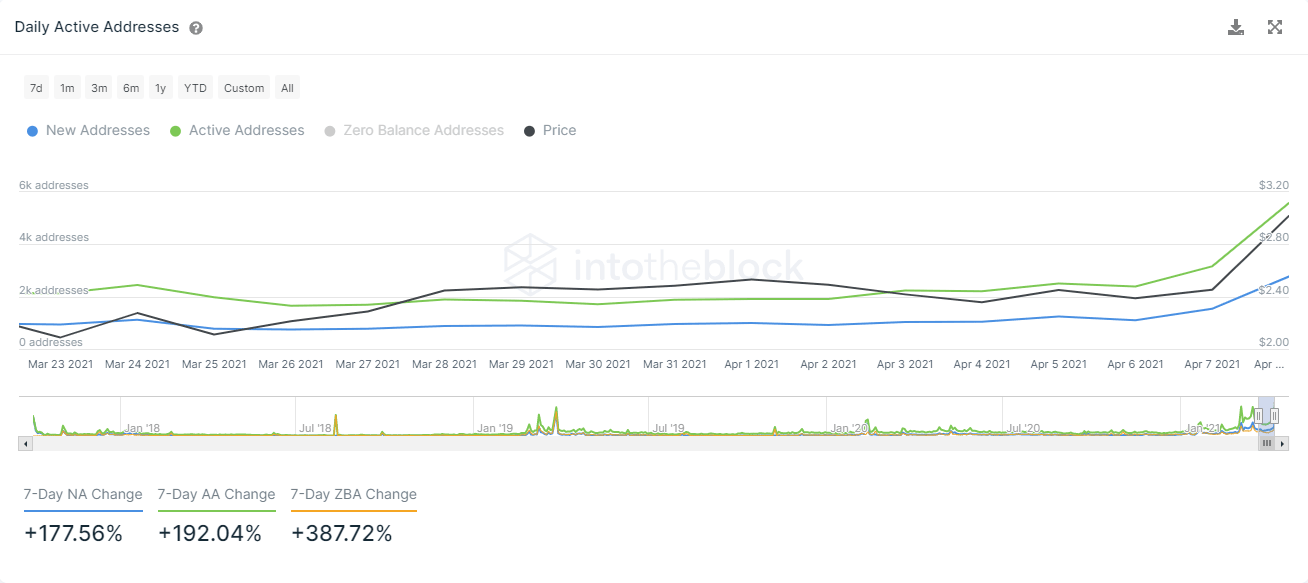

- The network of ENJ has seen a colossal surge of addresses in the past week.

- Whales have been profit taking which adds selling pressure to Enjin.

The Enjin Coin has experienced a massive rally after Coinbase announced it will list the digital asset. The surge from $2.02 to $4 took less than three days, but ENJ faces significant selling pressure now.

Enjin Coin price could see a significant correction after massive surge

On April 7, Coinbase Pro listed four new tokens including ENJ which had a massive rally to new all-time highs. The number of new addresses spiked by 177% in the past week. Similarly, the number of active addresses also exploded by 192%.

ENJ Network Activity

This metric indicates that the recent surge was organic, but Enjin Coin price is overextended nonetheless. On the 6-hour chart, the TD Sequential indicator has presented a sell signal in the form of a red ‘9’ candlestick.

ENJ/USD 6-hour chart

ENJ fights to stay above the $3.57 support level (78.6% Fibonacci). A breakdown below this point will drive Enjin Coin price down to $3 at the 50% Fibonacci level.

ENJ Supply on Exchanges

The recent rally made a lot of investors deposit their ENJ coins on exchanges, increasing the supply from 40.15% to 42.3% inside exchanges. This indicates that many traders have sold or are looking to take profits, increasing selling pressure.

ENJ Supply Distribution

The Supply Distribution chart adds credence to this theory as it shows a massive decline in whales holding between 1,000,000 and 10,000,000. The number of these investors dropped from a peak of 80 on March 2 to 57 currently.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B19.11.42%2C%252009%2520Apr%2C%25202021%5D.png&w=1536&q=95)

%2520%5B19.12.42%2C%252009%2520Apr%2C%25202021%5D.png&w=1536&q=95)