Elrond Price Prediction: EGLD projects a 15% crash after an explosive run

- Elrond price is hitting the brakes on its 30% ascent to $60.

- Investors can expect a 14% drop to $48.50 as sell signals emerge.

- A daily candlestick close that flips the $59 hurdle into a support level will invalidate EGLD’s bearish thesis.

Elrond price has hit a dead end after the recent rally locked horns with a four-month resistance level. Lack of buying pressure coupled with the exhaustion of buyers could be key in triggering a pullback for EGLD.

Elrond price decides to shed weight

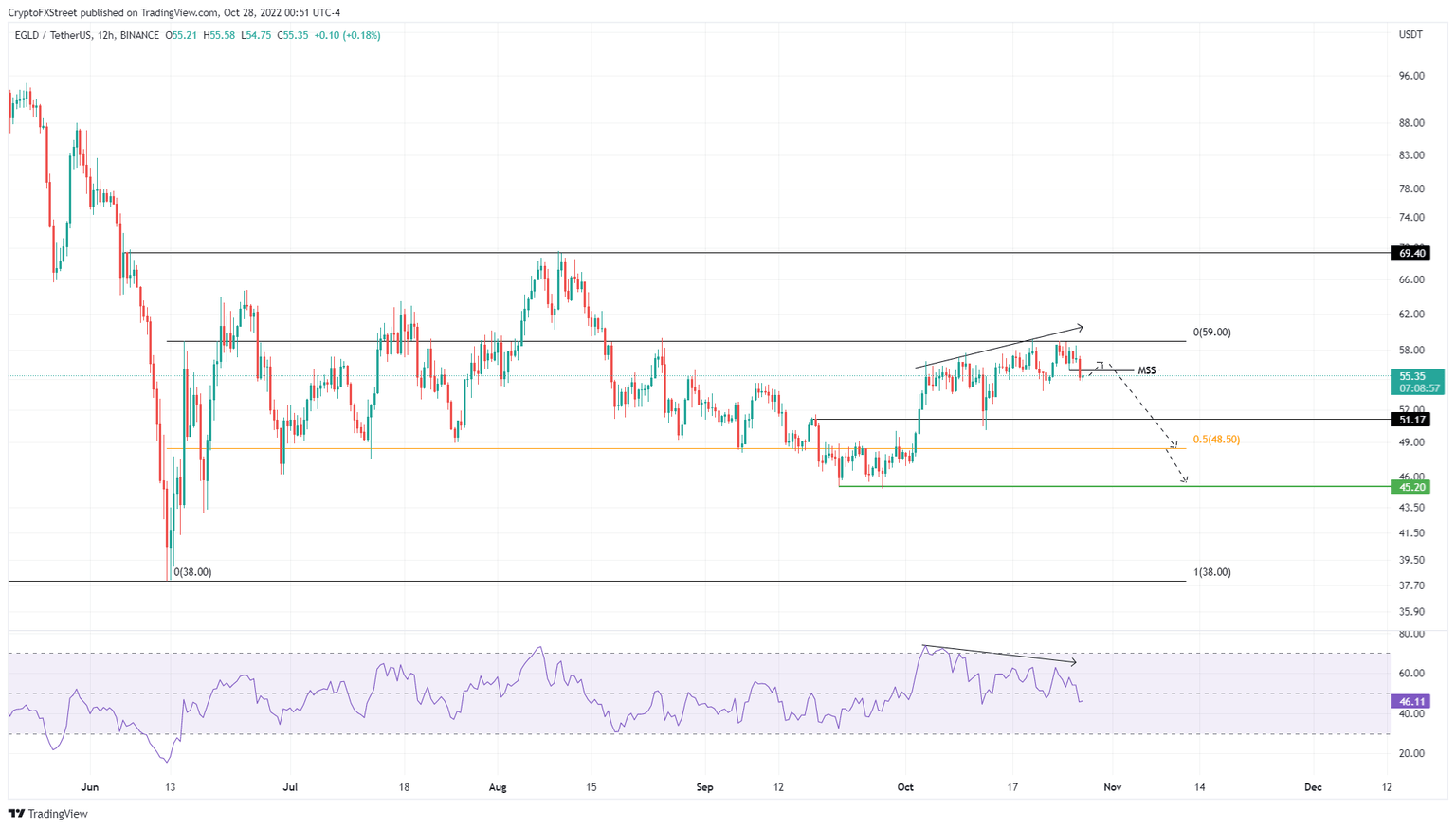

Elrond price rallied roughly 30% between September 27 and October 27, tagging the upper limit of the $38 to $59 range. Although EGLD briefly broke above this consolidation, it failed to sustain the bullish momentum resulting in a re-entry inside the range on August 17.

Since this point, Elrond price has tried to break free on multiple occasions but has failed. The latest retest is a testament to the significance of the $59 hurdle. To add to this bearish outlook, EGLD has produced a set of higher highs between October 4 and October 27, while the Relative Strength Index (RSI) has set up lower highs.

This technical formation is termed bearish divergence and indicates that the altcoin is rallying higher while momentum is declining. Due to this signal, Elrond price will likely tumble. The support levels that could absorb the incoming selling pressure include $51.17. A breakdown of this barrier could see EGLD retest $48.50, which is the midpoint of the aforementioned range.

Therefore, investors can expect a 14% drop to $48.50 in the coming days.

EGLDUSDT 12-hour chart

On the other hand, if sidelined buyers step up, Elrond price could slice through and flip the $59 hurdle into a support floor. Doing this will instill confidence in investors and could trigger a further spike in buying pressure.

Such a development will invalidate the bearish thesis for Elrond price and potentially propel the altcoin to $69.40.

Here's how Bitcoin's moves could affect Elrond price

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.