Elrond Price Forecast: ERD/USD pumps 17% as $0.020 beckons

- Elrond journey of breaking barriers in July has been a success; eyes now on $0.20.

- MoonPay integrates Elrond, supporting Visa and Mastercard purchases in over 162 countries.

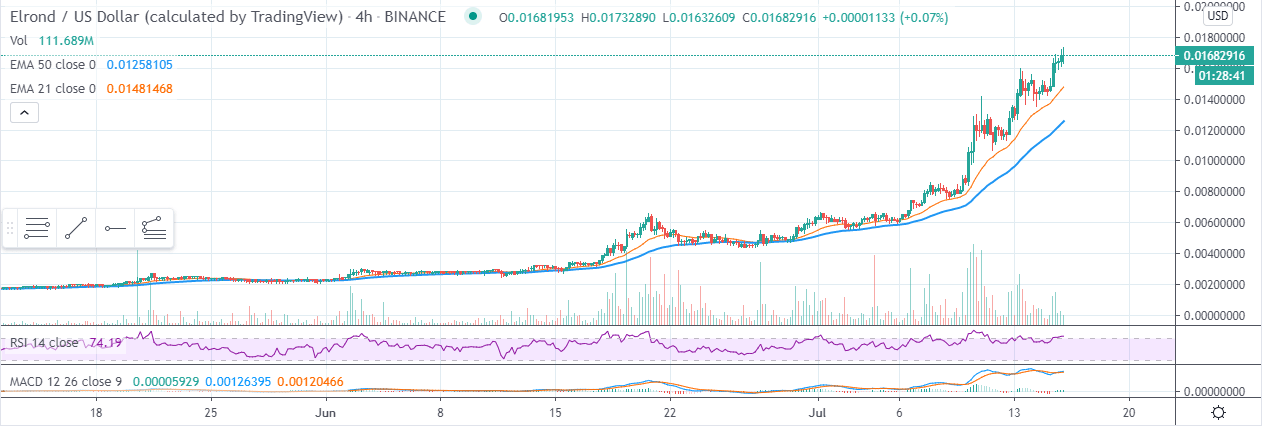

After taking down the resistance at $0.0060 at the beginning of July, Elrond has sustained consistent gains. The journey of breaking barriers is nothing but a success story. Moreover, the price has maintained the ground above both the 21 EMA and the 50 EMA. The 21 EMA continues to widen the gap above the 50 EMA in support of the ongoing bullish action.

At the time of writing, ERD/USD is trading at $0.0168 (on Binance) following a 17% rally in the last 24 hours. As Elrod moons, the majority of assets in the cryptocurrency market are in consolidation led by the major coins like Bitcoin, Ethereum and Ripple.

The price action actin is expected to hold above the short term initial support at $0.016 before spiking upwards to take down the seller congestion zone at $0.018. Bulls are slightly in control following the upward movement of the RSI above the average (50). The momentum is emphasized by the MACD currently holding the ground within the positive territory. A bullish divergence above the MACD is likely to draw more attention to ERD as it targets $0.02 in the near term.

ERD/USD 4-hour chart

MoonPay integrates Elrond for payments in 162 countries

ERD, the native token of the Elrond network now has support on MoonPay. This support will see ERD purchases done via both Visa and Mastercard in over 162 countries. MoonPay, currently supports payments on platforms such as Apple Pay, Samsung Pay, bank transfer and Google Pay. A statement by Elrond CEO, Beniamin Mincu in regards to the support said:

Convenience is the key that will lead to unprecedented growth for the Elrond ecosystem. Direct access to 100+ fiat on ramps, DeFi and Staking products on the Elrond network will soon be possible for first-time users, from their phones. This changes everything.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren