Elrond Price Forecast: EGLD eyes rebound from crucial support following 60% downswing

- Elrond rejection from the all-time high explores price levels under $100.

- Support at $95, and the 100 SMA is holding EGLD in position ahead of a potential upswing.

- The downtrend will remain intact if Elrond closes the day under the 100 SMA on the 4-hour chart.

Elrond is among the biggest losers in the cryptocurrency market. A bearish wave has seen both small and large coins correct from their recent highs. EGLD’s massive upswing ran into a strong barrier at $225, paving the way to a 60% breakdown below $100. Meanwhile, bulls seem to be working on a recovery mission as long the primary support holds firmly.

Elrond downtrend is nearing exhaustion

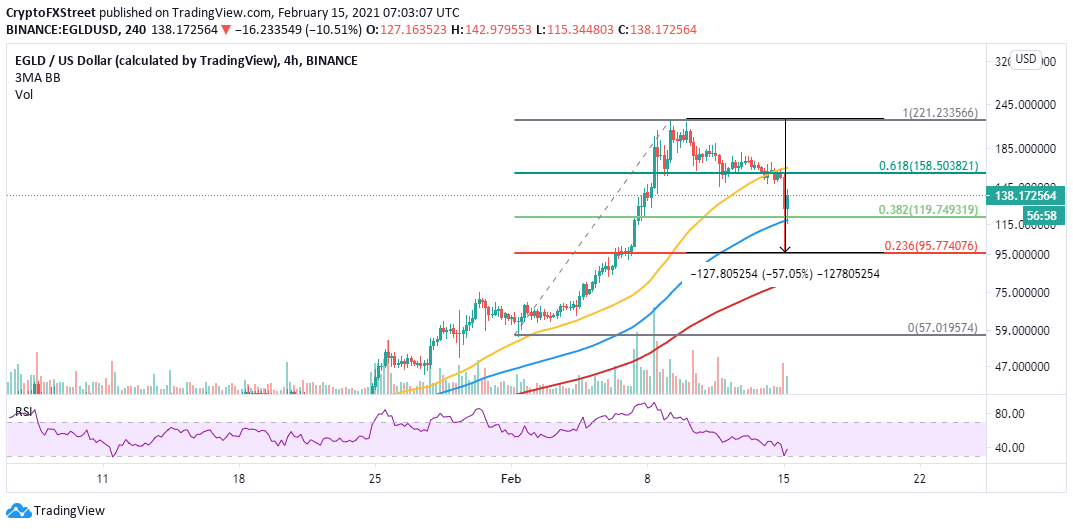

The breakdown from the all-time high failed to secure support at the 61.8% Fibonacci retracement level, taken between the last swing high at $225 to a swing of $96.2. The bearish leg progressed under $100 before Elrond bounced off the 23.6% Fibo.

At the time of writing, EGLD is dancing at $140 after reclaiming the lost ground above the 100 Simple Moving Average (SMA) on the 4-hour chart. Elrond must close the day above this key moving average to sustain the ongoing recovery. Notably, massive buy orders will be triggered if the token steps above either the 61.8% Fibo or the 50 SMA.

The Relative Strength Index (RSI) on the 4-hour chart has validated the rebound after bouncing off the oversold area. A continued movement toward the midline will cement the bulls’ influence over the price.

EGLD/USD 4-hour chart

Looking at the other side of the picture

Elrond is not out of the woods yet, and therefore, it is essential to tread with caution. If the uptrend cannot be sustained above the 100 SMA on the 4-hour chart, another retracement will take precedence. The support at the 23.6% Fibo near $95 would also be retested. A break under this zone may open the Pandora box as bears rush to push for losses toward the 200 SMA.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren