- Elrond Network integrates a prediction market via Polkamarkets.

- Users can monetize their predictions on events such as smart contract outcomes or asset prices.

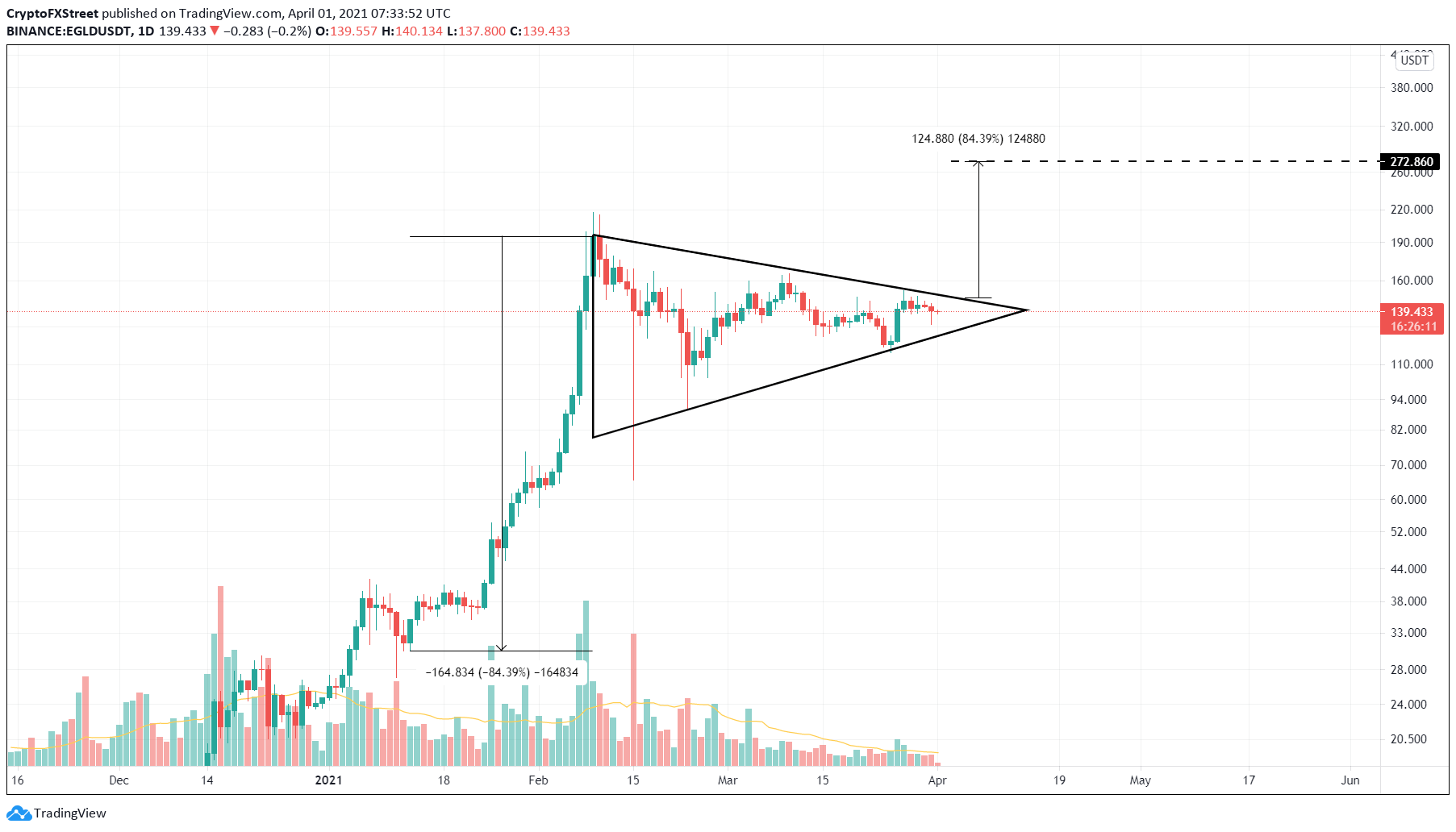

- EGLD price prepares for an 85% liftoff as it nears the end of a bullish pennant pattern.

Elrond Network’s latest development is significant, especially considering the hype around prediction markets. Mirroring the bullishness of the recent integration, the EGLD price prepares for a massive bull run as it nears the end of consolidation.

Prediction markets meet internet-scale blockchain, Elrond

Elrond, the internet-scale blockchain, announced integration with Polkamarkets. This latest development among a barrage of other significant updates seen on the EGLD blockchain is crucial since it brings the prediction market to its platform.

Users can now monetize predictions via the Elrond blockchain on various events like the amount of eGold staked on a certain date, smart contract outcomes, prices and so on.

Beniamin Mincu, the CEO of Elrond stated:

Blockchain technology is the missing piece enabling us to productively use the collective wisdom of the internet. The collaboration with Polkamarkets enables owners of use-cases deployed on the Elrond Network to introduce intelligent triggers into their decision making.

With the help of blockchain technology, predictions can be completely decentralized and reliable. It is estimated that prediction markets’ volume involving the US presidential elections is on average about 50% of the campaign budgets. This metric paints a picture of the prediction market landscape.

While this collaboration is just the start, Elrond aims for a deeper integration that might involve issuing a portion of the $POLK circulating supply as Elrond ESDT tokens.

EGLD price aims for another bull run

The Elrond price is trading in a symmetrical triangle-like pattern known as a pennant. The 540% price spike that precedes this consolidation is known as the flag pole. Together, the technical formation is a continuation pattern called a bullish pennant.

This setup forecasts an 85% upswing, determined by measuring the flag pole’s height and adding it to the breakout point at $147.98. If achieved, this target places EGLD at $272.86.

EGLD is getting squeezed as it approaches the end of the pennant. If the buyers manage a decisive candlestick close above $147.98, it will mark the start of a bull run. In order for the bull rally to continue, this breakout needs to have a substantial volume backing it.

EGLD/USDT 1-day chart

While the bullish scenario seems likely, a breakdown of the pennant’s lower trend line at $129.85 will signal bears’ presence. However, a breakdown of the critical support at $114.42 will not only invalidate the bullish scenario but also catalyze sellers to go on a spree.

This move could result in an 18% drop to $93.82.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto trading volume declines further, signaling waning trader enthusiasm and market momentum

The total crypto market capitalization lost $1.01 trillion since January, while Santiment data shows that crypto-wide trading volume has dropped since February’s peak. For a healthier and more sustainable recovery, bulls look for rising prices accompanied by increasing volumes; until trading activity picks up, cautious market sentiment is likely to prevail.

BNB price tops $570 as Binance receives $2 billion investment from Dubai

BNB price rose as high as $574 on Thursday as markets reacted to news that Binance received major investments from an Abu Dhabi based firm. Derivative markets analysis shows how BNB traders are repositioning amid the latest swings in market sentiment.

PEPE price outperforming DOGE and SHIB as US CPI boosts Crypto markets

PEPE price crossed the $0.00007 for the first time this week as markets reacted to positive macro market signals. Early insights show crypto traders are displaying high risk appetite at the onset of the current market rally. Could this sustain PEPE price uptrend along with the rest of the memecoin market.

XRP records slight gains as Ripple's battle with SEC nears end

Ripple's XRP recorded a 2% gain on Wednesday following rumors of the company nearing an agreement with the Securities & Exchange Commission (SEC) to end their four-year legal battle.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.