Elon Musk’s post sparks Dogefather crypto surge, tokens skyrocket

Elon Musk’s latest post on X triggered a surge in Dogefather-themed tokens, causing prices to spike as investors reacted to his influence in the crypto market.

Elon Musk’s latest post on X has ignited a massive surge in Dogefather-themed tokens, with some experiencing rapid price spikes. Known for his influence in the crypto world, Musk’s social media activity often causes waves, and this time was no different.

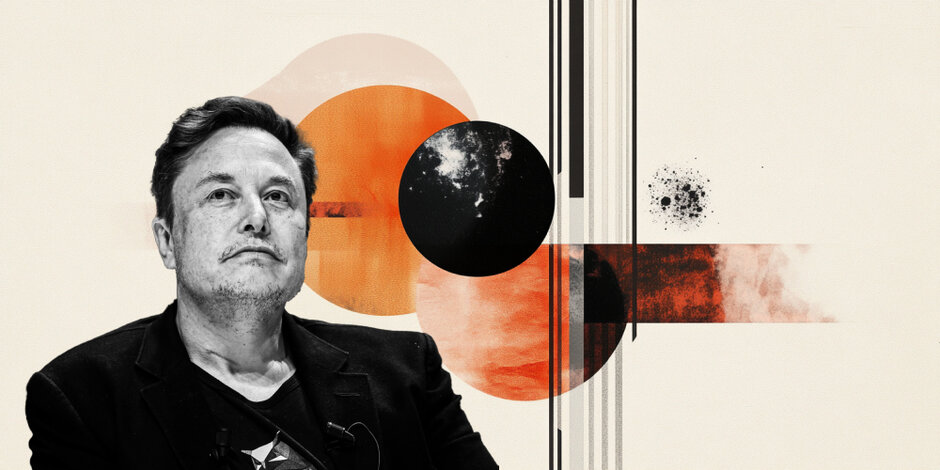

Musk shared an edited image of himself holding a chainsaw with the words “The Dogefather” displayed in the background. The caption read, “This is a real picture,” a statement that quickly grabbed attention across social media.

The term “Dogefather” is a widely recognized nickname for Musk, tied to his long-standing support for Dogecoin. It first gained popularity when he referred to himself this way during a Saturday Night Live (SNL) appearance in 2021. Following his recent post, several tokens carrying the Dogefather name saw a sharp rise in value. One of these tokens reached its highest price since late January, while another more than doubled in value.

In response to the hype, developers launched entirely new Dogefather-branded tokens, many of which skyrocketed in value within hours. This trend follows previous instances where Musk’s online activity has triggered market rallies. When he changed his username to “Kekius Maximus” and “Harry Bōlz,” tokens inspired by these names saw explosive growth. Similarly, in late January, Dogecoin saw a major increase after the U.S. Department of Government Efficiency featured the coin’s logo on its official website.

However, the image Musk shared was not authentic. The original photo was taken at the Conservative Political Action Conference (CPAC), where Musk made an appearance. Reports confirm that the real event featured Argentine President Javier Milei presenting Musk with a chainsaw as a symbolic gift.

“This is the chainsaw for bureaucracy,” Musk stated.

This gesture is believed to represent Musk’s work with the Department of Government Efficiency, a role he holds under the Donald Trump administration. His efforts focus on cutting government spending and reducing the federal workforce. In Argentina, President Milei has also frequently used a chainsaw in public as a symbol of his commitment to reducing government expenditures.

While Musk’s latest post fueled a frenzy in the crypto market, the reaction once again highlights how his words and actions hold significant sway over digital assets. Whether these Dogefather-themed tokens will sustain their gains remains uncertain, but one thing is clear—Musk’s influence over meme coins is stronger than ever.

Author

Jacob Lazurek

Coinpaprika

In the dynamic world of technology and cryptocurrencies, my career trajectory has been deeply rooted in continuous exploration and effective communication.