The world faces “strong inflationary pressure” in the short term, and it may persist, warns the world’s richest man.

In a debate about inflation, some of the best-known names in Bitcoin (BTC) voiced unanimous doubts about the state of global monetary policy.

Future of inflation great unknown, says Musk

As even the United States Federal Reserve admits that inflation may be here to stay, the topic has become especially pertinent for Bitcoiners, given the cryptocurrency’s intrinsically deflationary characteristics.

For Elon Musk, who remains cool when it comes to Bitcoin as a “magic pill” for fiat currency’s ills, inflation is no less of an issue. With over $250 billion in net assets as of this week, potential exposure to devaluating currencies is more of a potential problem than ever.

“I don’t know about long-term, but short-term we are seeing strong inflationary pressure,” he said in a Twitter debate with Ark Invest CEO Cathie Wood and MicroStrategy CEO Michael Saylor.

All were commenting on a previous tweet from Twitter CEO Jack Dorsey, who described inflation as “happening” and apt to “change everything.”

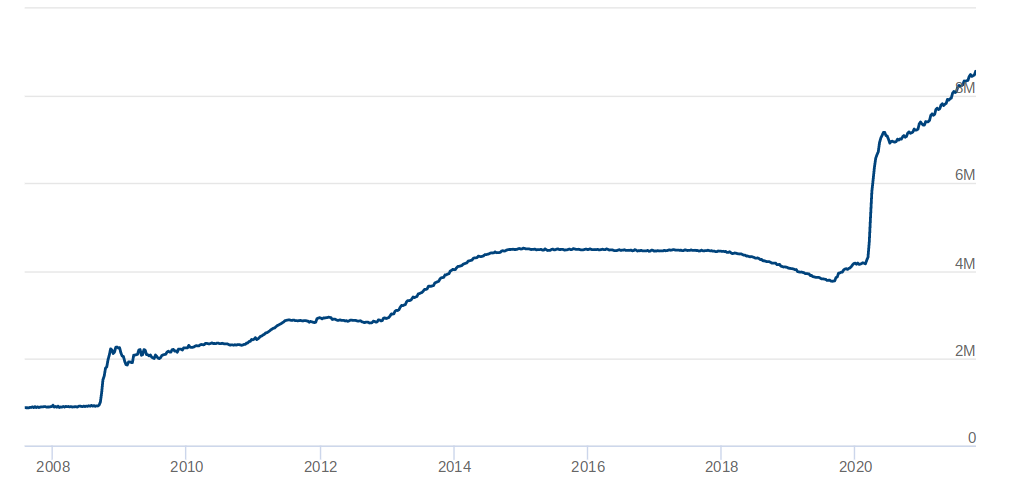

Wood, also a firm BTC supporter, noted that monetary velocity, on the contrary, had been slowing since the 2008 global financial crisis, disguising some of the devaluation impact.

Regardless, when all types of products are taken into account, the true cost of dollar printing far outstrips government claims about how inconsequential inflation really is.

“Inflation is a vector, and it is clearly evident in an array of products, services, & assets not currently measured by CPI or PCE,” Saylor wrote.

“Bitcoin is the most practical solution for a consumer, investor, or corporation seeking inflation protection over the long term.”

Federal Reserve balance sheet chart. Source: Federal Reserve

Bitcoin may yet return to Tesla

Musk’s Tesla passed $1,000 per share for the first time this week, helping spur a dramatic increase in his net worth.

In a filing with the U.S. Securities and Exchange Commission, meanwhile, the company left the door open to accepting Bitcoin for its products in the future.

“During the nine months ended September 30, 2021, we purchased an aggregate of $1.50 billion in bitcoin. In addition, during the three months ended March 31, 2021, we accepted bitcoin as a payment for sales of certain of our products in specified regions, subject to applicable laws, and suspended this practice in May 2021,” the 10-Q document reads.

“We may in the future restart the practice of transacting in cryptocurrencies (‘digital assets’) for our products and services.”

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Grayscale files S-3 form for Digital Large Cap ETF comprising Bitcoin, Ethereum, XRP, Solana, and Cardano

Grayscale, a leading digital asset manager operating the GBTC ETF, has filed the S-3 form with the United States (US) Securities and Exchange Commission (SEC) in favor of a Digital Large Cap ETF.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH, and XRP brace for volatility amid Trump’s ‘Liberation Day’

Bitcoin price faces a slight rejection around its $85,000 resistance level on Wednesday after recovering 3.16% the previous day. Ripple follows BTC as it falls below its critical level, indicating weakness and a correction on the horizon.

Top crypto news: VanEck hints at BNB ETF, Circle files S-1 application for IPO

Asset manager VanEck registered a BNB Trust in Delaware on Tuesday, marking its intention to register for an ETF product with the Securities & Exchange Commission (SEC).

Solana Price Forecast for April 2025: SOL traders risk $120 reversal as FTX begins $800M repayments on May 30

Solana price consolidated below $130 on Tuesday, facing mounting headwinds in April as investors grow wary of looming FTX sell-offs.

Bitcoin: BTC remains calm before a storm

Bitcoin's price has been consolidating between $85,000 and $88,000 this week. A K33 report explains how the markets are relatively calm and shaping up for volatility as traders absorb the tariff announcements. PlanB’s S2F model shows that Bitcoin looks extremely undervalued compared to Gold and the housing market.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.