- Elon Musk has reached an agreement to acquire Twitter for approximately $44 billion, at $54.20 a share.

- Musk previously teased DOGE payments on Twitter, fueling a bullish sentiment among holders.

- Dogecoin price posted double-digit gains following the news of the acquisition.

There is no direct correlation between Elon Musk’s Twitter acquisition and Dogecoin price, but the tech entrepreneur has teased about introduction of DOGE payments on the social media platform. Proponents are bullish on the prospect of higher utility and adoption of DOGE, driving the meme coin’s price higher.

Dogecoin climbs 30% on news of Twitter acquisition

Tesla CEO Elon Musk acquired Twitter at approximately $44 billion, paying a 38% premium on the market price of the social media giant’s shares.

Jack Dorsey, CEO of Square, who owned a 2% stake in Twitter tweeted,

In principle, I don’t believe anyone should own or run Twitter. It wants to be a public good at a protocol level, not a company. Solving for the problem of it being a company however, Elon is the singular solution I trust. I trust his mission to extend the light of consciousness.

Interestingly, Elon Musk’s purchase of Twitter in an all-cash deal has garnered much attention from Dogecoin holders and the meme coin’s community. After joining the Twitter board, Musk proposed several changes to the Twitter Blue premium service, including DOGE payments, price reduction (of the subscription), and authentication checkmarks.

Therefore, market participants appear bullish on the prospect of enabling Dogecoin payments on Twitter’s premium service since Musk has repeatedly endorsed the meme coin.

Tesla already accepts DOGE payments on its online store, reaffirming investors’ belief that the meme coin could gain acceptance as a payment method for ads and subscriptions on the social media platform Twitter.

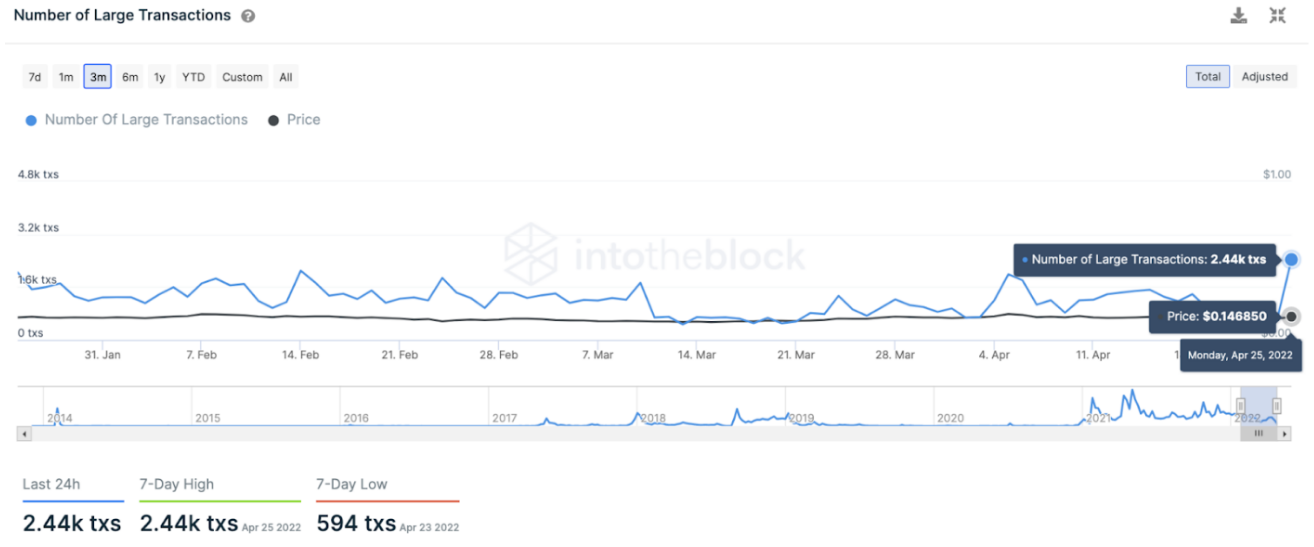

On-chain data shows a spike in large transactions with a value greater than $100,000 on the Dogecoin network, which coincides with the rising price action. Such market behavior is indicative of institutional players’ and whales’ activity. These individuals could be investing or positioning themselves for a big price move.

Crypto analysts CryptoFaibik believes Dogecoin price trend looks bullish. While DOGE continues to move inside the wedge, a breakout could mean a 2x upswing. The prominent trader has set the highest target for Dogecoin price in the ongoing price rally at $0.4484.

$DOGE Looks Pretty Bullish Here..!!

— Captain Faibik (@CryptoFaibik) April 25, 2022

Still Moving inside the Wedge & In Case of Breakout, 2x Bullish Wave Expected #Crypto #doge #dogecoin #dogearmy pic.twitter.com/hpNbKQMbLw

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.