- Elon Musk takes on Open AI and Sam Altman in a new lawsuit, calling out the executive for allegedly defrauding him into investing in the firm.

- AI tokens rallied on Monday despite market-wide bloodbath, top 10 AI tokens post between 2% and 6% gains.

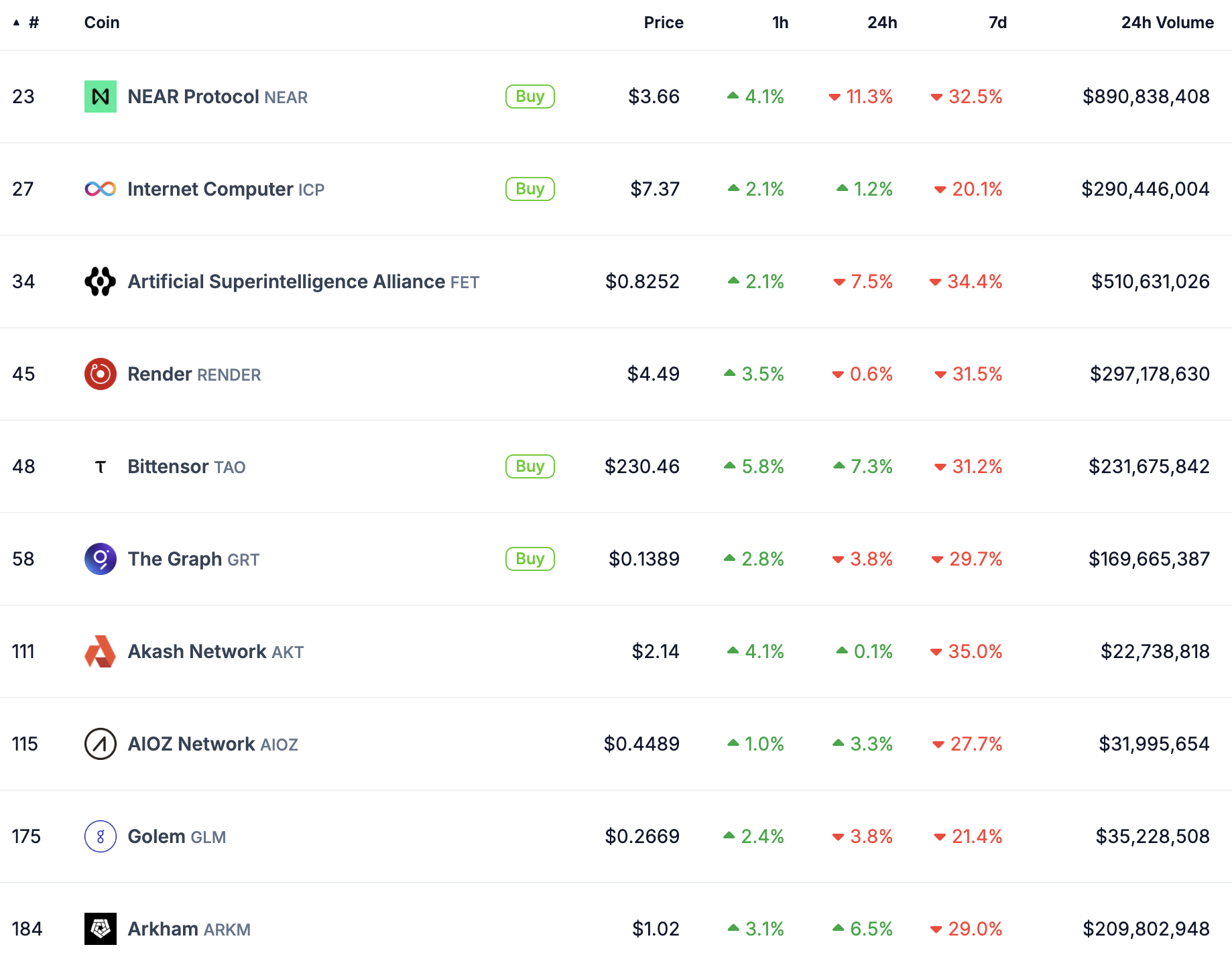

- Bittensor, AIOZ Network and Arkham rally up to 7% in the past 24 hours, per CoinGecko data.

Elon Musk takes Sam Altman and Open AI to court over getting him to invest in the artificial intelligence (AI) firm “fraudulently.” Monday's filing shows that the $44 million investment was based on the premise that the firm will remain a “nonprofit” focused on development of AI.

Musk has sued the AI firm and its CEO previously. Musk dropped his previous lawsuit that alleged the creators of ChatGPT have breached their initial mission to develop AI for the “benefit of humanity.”

Musk withdrew his lawsuit in June without proper explanation.

AI tokens rallied despite the recent bloodbath in crypto, gaining relevance among traders, even as market participants shed their “risk asset” holdings.

Musk’s lawsuit against OpenAI and Sam Altman

In the Monday filing, Musk claims that OpenAI executive Altman planned to convert the firm to a “for-profit” after the research churned out valuable technology. Musk says the plan changed and the executives “improperly profited” from their deals with Microsoft and other entities.

Musk accuses the executives of fraud, breach of contract, unfair competition and false advertising, among other allegations. Musk’s lawsuit holds several Open-AI related entities responsible for turning the firm into a “for profit” and defrauding him.

AI tokens gain despite crypto bloodbath

AI tokens, specifically the top 10 in the category ranked by market capitalization, started their recovery on Monday. Even as Bitcoin and other cryptocurrencies slipped under key support and over $1.06 billion was flushed out of the market in liquidations during a 24-hour time frame. AI tokens sustained their recent gains, specifically Internet Computer (ICP), Bittensor (TAO), Akash Network (AKT), AIOZ Network (AIOZ) and Arkham (ARKM). CoinGecko data shows these assets held onto their gains from the past 24 hours and recovered despite the market-wide correction.

AI token price from CoinGecko

Despite the controversies in the AI sector, the 24-hour trade volume exceeds $3.14 billion.

The AI firm recently released advanced voice mode in ChatGPT, adding to the utility of the Large Language Model (LLM), the major development in the sector.

Sam Altman’s Worldcoin (WLD) loses nearly 3% on Monday, trading at $1.598 at the time of writing.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 gainers Supra, Cosmos Hub, EOS: Supra leads recovery after Trump’s tariffs announcement

Supra’s 25% surge on Friday calls attention to lesser-known cryptocurrencies as Bitcoin, Ethereum and XRP struggle. Cosmos Hub remains range-bound while bulls focus on a potential inverse head-and-shoulders pattern breakout.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin price remains under selling pressure around $82,000 on Friday after failing to close above key resistance earlier this week. Donald Trump’s tariff announcement on Wednesday swept $200 billion from total crypto market capitalization and triggered a wave of liquidations.

Can Maker break $1,450 hurdle as whales launch buying spree?

Maker is back above $1,300 on Friday after extending its lower leg to $1,231 the previous day. MKR’s rebound has erased the drawdown that followed United States President Donald Trump’s ‘Liberaton Day’ tariffs on Wednesday, which targeted 100 countries.

Gold shines in Q1 while Bitcoin stumbles

Gold gains nearly 20%, reaching a peak of $3,167, while Bitcoin nosedives nearly 12%, reaching a low of $76,606, in Q1 2025. In Q1, the World Gold ETF's net inflows totalled 155 tonnes, while the Bitcoin spot ETF showed a net inflow of near $1 billion.

Bitcoin Weekly Forecast: Tariff ‘Liberation Day’ sparks liquidation in crypto market

Bitcoin (BTC) price remains under selling pressure and trades near $84,000 when writing on Friday after a rejection from a key resistance level earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.