Dogecoin (DOGE), the meme-based cryptocurrency that is a pet favorite of Elon Musk, has a new date for its price diary — Musk’s appearance on Saturday Night Live.

In a tweet on Wednesday, Musk described himself as “The Dogefather” as he prepares to host the popular American television show on May 8.

Musk is well known for his PR stunts when it comes to Dogecoin, with social media posts often sparking price gains — something which has also benefited Bitcoin (BTC).

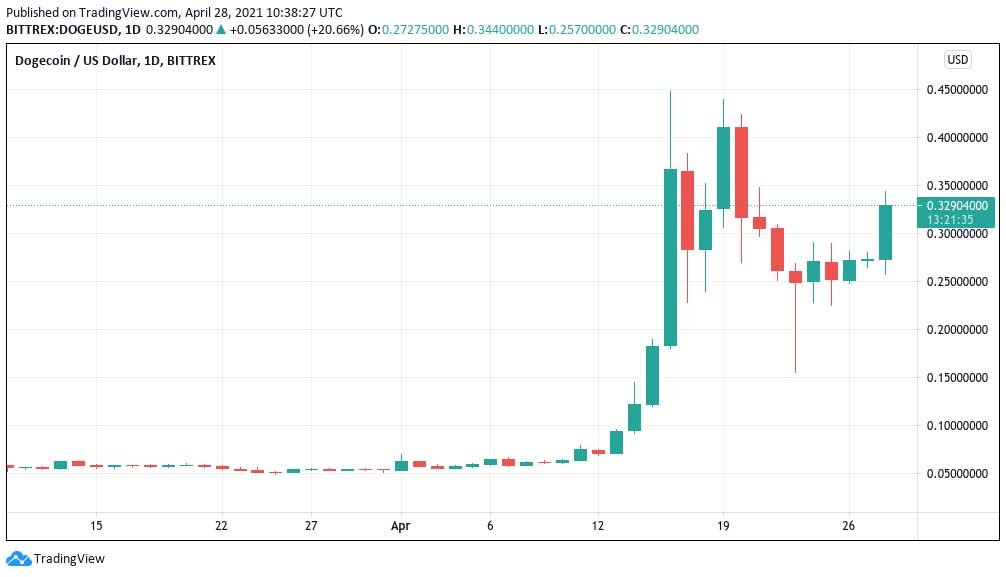

A familiar scenario for Dogecoin fans, Musk’s latest round of publicity immediately fuelled a rebound in DOGE/USD, which was up 20% in hours at the time of writing.

Bitcoin’s previous price dip had cost the altcoin sector dearly, with DOGE bottoming far below its recent record high of $0.47.

That peak had also been caused in part by Musk, who had promised to “put a literal Dogecoin on the literal moon” via the latest rocket launch of one of his companies, SpaceX.

Last week saw an improvised “holiday,” dubbed “Dogecoin Day,” attempt to run up the DOGE price to a stratospheric $4.20 in time for the launch, a move which ultimately fell far short of expectations.

DOGE/USD 1-day candle chart (Bittrex). Source: TradingView

Analyst eyes broad altcoin strength

The latest tweet nonetheless instantly placed DOGE in the top three daily movers with 20% gains to $0.32, beating Ether (ETH), which had itself just posted new all-time highs.

Bitcoin continued to range, meanwhile, failing to cement $55,000 support in a boon for those expecting a continuation of “alt season 2.0.”

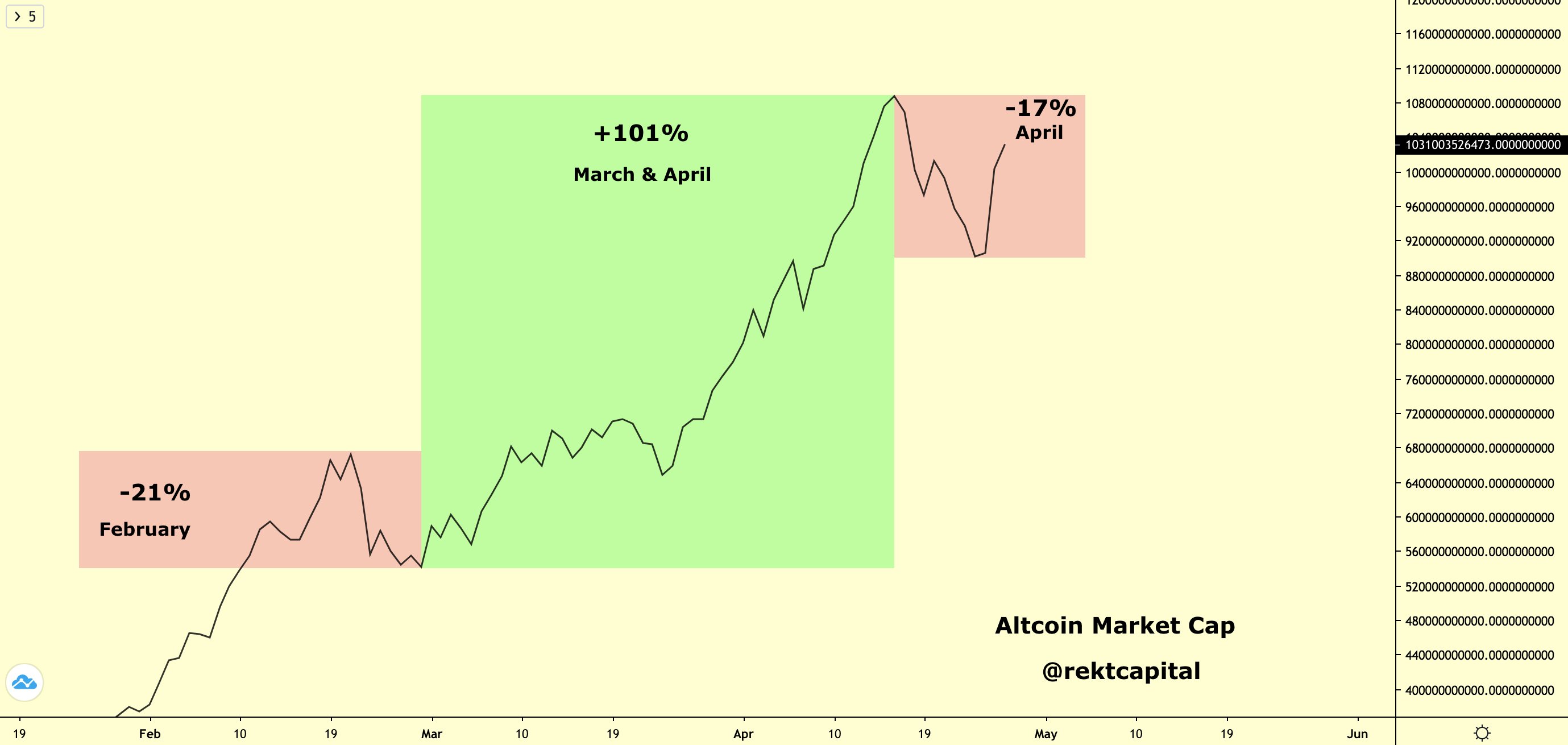

“This recent recovery in Altcoin Market Cap is much sharper than the post-retrace recovery in February,” popular Twitter account Rekt Capital commented on Tuesday, comparing different retracements in 2021.

“Even the actual -17% April retrace itself is shallower than the one back in February. These are all signs that point to a strong interest towards Altcoins in general.”

Altcoin market cap movements chart. Source: Rekt Capital/ Twitter

Unsubstantiated rumors that Facebook would announce a BTC allocation in its quarterly earnings due later on the day provided some bullish counterpoint to the mood.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.