El Salvador might put Western Union out of business by igniting Bitcoin mainstream adoption

- El Salvador's adoption of Bitcoin as a national currency poses a threat to money service providers Western Union and MoneyGram.

- Nearly 1.75 million Salvadorans receive remittance payments every year.

- The Salvadoran government rolled out "Chivo," a virtual wallet that powers cross-border payments and no-fee transactions.

Mario Gomes Lozada, a former Merrill Lynch and Credit Suisse banker, estimates that the combined loss in revenue for MoneyGram and Western Union will be close to $1 billion.

"Chivo" set to increase Salvadoran population’s wealth

In 2020, Salvadorans received close to $6 billion in remittances from friends and family abroad. Nearly 70% of El Salvador's citizens receive cross-border payments and pay up to $440 million in fees to payments giants.

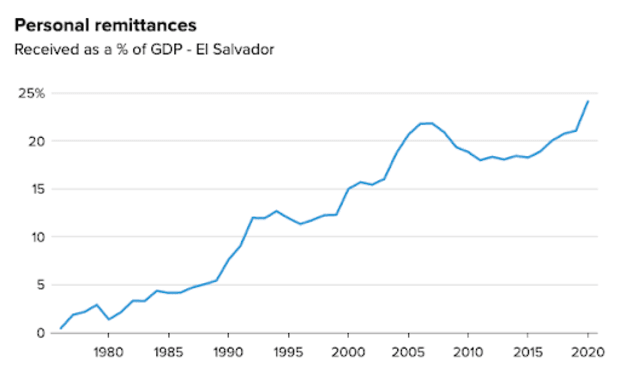

Personal remittances received as a percentage of GDP

One of the leading factors in the adoption of Bitcoin as legal tender was the prospect of reducing the cost of accepting cross-border payments and increasing the overall wealth of the Salvadoran diaspora.

Matt Hougan, Chief Investment Officer of Bitwise, commented on the utility of BTC for remittances,

Remittances are one area where the status quo in our legacy financial system is terrible, with extraordinarily high fees leveled at populations that can ill afford them.

The government introduced a virtual wallet, "Chivo," that offers commission-free borderless payments. Proponents consider that the implementation of Bitcoin in the country will not be easy; however, it remains to be seen how Salvadorans tackle the challenges of adopting new-age money.

If payment giants wish to remain relevant and compete with "Chivo," they will need to lower their commission. Despite initial glitches and roadblocks, El Salvador's virtual wallet is now the number one finance app on the play store as the masses continue to embrace Bitcoin.

Experts have cautioned Salvadorans in embracing the new virtual wallet, stating that the wallet is nearly as centralized as a bank, and the government can freeze it at any time. Bitcoin represents decentralization, and storing it in a centralized wallet downplays its purpose.

Crypto traders and influencers are urging people to move their funds from "Chivo" once they receive it. This is likely to limit centralized control on user's BTC holdings.

Dennis Porter, host of Bitcoin show "Smart People Shit," identifies El Salvador's Bitcoin adoption as a positive feedback loop set to increase people's wealth.

Bitcoin will save El Salvador’s economy $400 million per year which will increase their GDP and help Salvadorians buy even more bitcoin which will increase their savings and capital investment which will once again increase GDP and bitcoin holdings.

— Dennis Porter (@Dennis_Porter_) September 9, 2021

I positive feedback loops.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.